CK Infrastructure listing in London: valuation & comparison

CK Infrastructure is listing in the UK. A good time for a valuation of a complicated beast + my view on UK water companies.

CK Infrastructure is preparing to list in London. This is something that makes sense given that the business gets the largest part (40%) of its profits directly from the UK (more through Power Assets). The higher valuations prevalent in England compared to Hongkong are probably an additional reason.

Given my previous coverage on CK Hutchison & CK Asset I thought covering CK Infrastructure would be nice given that this would give a more complete insight into the CK business empire.

The stock has run up 34% YTD mostly in anticipation of the UK listing and has a 147B HKD market cap. The company trades at a p/e of 18. This does not look cheap.

Taking a longer time frame however is becomes clear that the stock is just back to its pre covid levels and still significantly below its 79 HKD high in 2016.

Complicated structure

CK Infrastructure has a complicated structure with a lot of stakes in different utility companies. Most of them jointly controlled together with Power Assets in which CK Infrastructure holds a 36.01% share.

Power assets has a 112.3B HKD market cap. Leading to a 40.4B HKD value for CK Infrastructure. It holds stakes in mostly the same companies and trades at a similar valuation.

The disclosure of CK Infrastructure is quite minimal on their underlying assets. They report on a country basis and have separate disclosure on their most important holdings. Which are CK Williams & UK Power Networks. For more information on the individual assets my article on CK Asset might be helpful. Still disclosure on the cash flow of individual investments is non-existent. This might improve with the listing in London, but at this moment is definitely something I miss.

Segment analysis

Naturally important, but if you are in a rush you can go directly to the segment analysis conclusion. The company is focused on the distribution of mainly electricity & gas. The more cyclical generation assets are a relatively small part of the pie.

UK contribution

The UK delivered 40% of the profit contribution in H1 2024 at 1.9B HKD. Full year 2023 was 3.1B HKD.

UK Power Networks:

Most important asset in the UK. Power distributor for London and southeast England. Bought for 5.5B GBP in 2010. Almost sold for 15.5B GBP in 2022. 40% ownership (another 40% by Power Assets & 20% by CK Asset). 5.8B HKD profit (2.3B HKD for CK I).

Other assets:

Northumbrian Water:

Regulated water and sewage company in England. Bought for 2.4B GBP in 2011. Currently 39% ownership. Sold 25% to KKR in 2022 for 8.1B HKD.

Northern Gas Networks:

One of 8 regulated gas network in northern England. Bought for 1.4B GBP in 2005. Ownership: 47.1% (another 41.3% held by Power Assets).

Wales & West Utilities:

A gas distributor that serves southwest England. Bought in 2012 for 645M GBP, 46% ownership (another 36% for Power Assets).

Seabank power:

Owns and operates Seabank Power Station near Bristol. The electricity is sold under a long-term contract to a single customer. Ownership 25% (another 25% held by Power Assets). Note a power generator (a more cyclical asset).

UK Rails:

Train leasing company. Bought for 1.1B GBP in 2015, 65% ownership. 62M profit in 2023.

Recently CK Infrastructure also invested in the largest gas distribution company of Northern Ireland (Phoenix Energy). This acquisition will be discussed later.

Australian contribution:

Australia delivered 18% of the profit in H1 2024 at 900M HKD. Full year 2023 profit was 1.9B HKD.

The largest asset in Australia is CK William of which CK Infrastructure owns 40%. Net assets of CK William is 25B HKD and CK Infrastructure share is 10B HKD. Profit in 2023 declined from 1B HKD to 600M HKD.

CK William owns the following things:

Energy Developments Pty Limited owns and operates an energy generation business mainly in Australia.

Multinet Group Holdings Pty Limited. A electricity distribution company in the state of Victoria

DBNGP Holdings Pty Limited operates natural gas distribution and transmission businesses in Western Australia.

66 per cent interests in United Energy Distribution Holdings Pty Limited, which operates an energy distribution business in Australia.

This was the entity that bought Phoenix Energy in Northern Ireland.

Other important Australian operations are:

SA Power Networks. Power distribution in South Australia in which CK Infrastructure owns 23%. Bought for 3.5B AUD in 2000 (100%).

Victoria Power Networks. Power distribution in the state of Victoria Australia in which CK Infrastructure owns 23% as well. Combination of Powercor acquired in 2000 for 2.3B AUD (100%) & CitiPower bought in 2002 for 1.5B AUD (100%).

Continental Europe

9% profit contribution to the portfolio. H1 2024 at 419M hkd profit. Full year 2023 535M profit. A fire at an AVR plant caused profits in 2023 to be lower. Insurance recoveries likely in my opinion.

AVR

CK Infrastructure owns 46%. AVR is the largest energy-from-waste player in the Netherlands, AVR, which operates five waste treatment plants in Rozenburg and Duiven; as well as four transfer stations. Bought in 2013 for 944M euros (100%).

Ista

CK Infrastructure owns 35%. Insta is a leading international provider of sub-metering and related services with strong market positions in European countries such as Germany, France, Denmark and the Netherlands. Bought in 2017 for 4.5B euros (100%).

Canada

6% profit contribution to the portfolio. H1 2024 profit at 301M HKD. Full year 2023 648M HKD.

Canadian Power Holdings

Natural gas power plant. CK Infrastructure owns 50%.

Acquired 75% in 2011 for 718M HKD. Note a power generator (a more cyclical asset).

Park n Fly

Parking spots at airports in Canada. CK Infrastructure owns 65%.

Acquired 100% in 2014 for $366M USD.

Husky midstream

Critical oil & gas infrastructure for Cenovus Energy.

CK Infrastructure owns 16%. 65% acquired in 2016 for 1.7B CAD.

Reliance Home Comfort Canada

Active in the home and commercial services sector providing the sale and rental of water heaters, HVAC equipment, water purification, plumbing, electrical, comfort protection plans and other services to homeowners primarily in Ontario, Canada.

CK Infrastructure owns 25%. 100% acquired in 2017 for 2.1B USD.

New Zealand

2% profit contribution. H1 2024 profit at 80M HKD. Full year 2023 profit 168M HKD.

Wellington Electricity

Electricity grid around the capital of New Zealand. CK Infrastructure owns 50%. Acquired for 785M NZD (4.8B HKD for 100%).

Enviro NZ

Waste collection around Wellington. CK Infrastructure owns 100%. Acquired for 410M HKD in 2013.

Hongkong & China

Contribution of Hongkong & China has been decreasing. Naturally the cement & construction materials plants are not helped by the strong downturn in Chinese real estate.

Segment analysis conclusion

Nearly all revenues come from strong developed countries and stable dependable revenue streams. Some income stream like Ista (smart metering in Europe), Park n Fly (parking) & Reliance Home Comfort (leasing water heaters/HVAC in Canada) are not regulated but have good stable prospects going forward in my opinion. Overall, I would say CK Infrastructure has a nice diverse mix that can deliver stable earnings going forward.

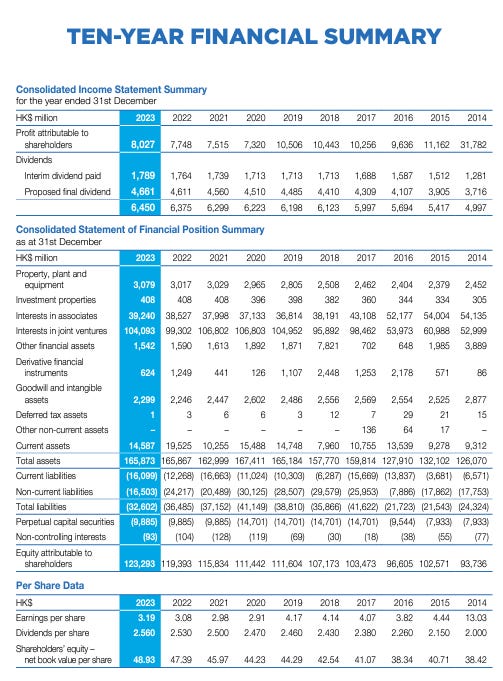

Historical results

CK Infrastructure has generated stable returns and has delivered a growing dividend to shareholders. The earnings have been disappointing. The main reason is that:

Regulators lowered returns when interest rates went down.

Most regulators used a top up rate on top of government bonds. Given the historic low rates this caused the return for CK Infrastructure to decline.

The most important question is:

Will regulators increase returns now that interest rates are up again?

It is politically a lot less popular to increase the returns for owners again. In the long term though this is necessary to attract the required investments. If and when this will be done remains a question, I’m not able to answer. This risk is very significant given the return profile. Anyone good insights?

Another question that might come up is:

Why did CK Infrastructure keep investing in assets with lower future returns?

There have been some divestments, but in the end the sale of UK Power Networks did not go through. This means that investors have gotten disappointing, but not catastrophic returns.

Do we trust CK Infrastructure to buy good assets and great prices? Not sure

Communication of CK Infrastructure is usually quite limited. The latest

Northern Ireland seems decent, but not clear what the multiple is. CK Infrastructure gets:

765M of TRV (regulatory assets) for 757M is not a very sweet deal given the returns you get on UK regulatory assets. That being said it is a discount to how CK Infrastructure & its competitors are trading.

In recent years I do not see great investments in the CK Infrastructure universe. In addition, the payout ratio has been increasing. This means that going forward I expect CK infrastructure to be run like a run of the mill utility. This might decrease the risk of future acquisition mistakes. So, let’s compare CK Infrastructure to some counterparts.

Comparing CK Infrastructure

The most obvious company to compare CK Infrastructure to is National Grid. National Grid is the leading UK transmission company with also a strong electricity distribution business. National Grid divested their gas assets.

National Grid has a market cap of 48B GBP, 40B of net debt & 30B of net equity. The p/e ratio might look slightly lower, but last year was kind on typical of National Grid. Given its premier status in a single country I would expect National Grid to be slightly more expensive. Comparing equity to market cap we see a multiple of 1.6 for National Grid. Versus 1.18 for CK Infrastructure. There is some discount for CK Infrastructure.

APA Group: Australia based energy infrastructure company. A good predictable business. It is a good comparable to CK Infrastucture assets in Australia. In 2018 a CK consortium tried to buy APA Group for $13B AUD, but was blocked by the Australian government. Net debt is 13B AUD, Market cap 10B AUD & equity 3.2B AUD (not sure how equity is calculated in Australia). 13B of debt on 20B of assets seems like a lot.

APA is very candid about its operation. To me the Australian investments look more reasonable compared to cash flow than that of most European counterparts. In 2024 not much of the EBITDA growth hits the free cash flow. With free cash flow from operations declining 5.1%.

APA also sees a problem with its debt cost on the horizon.

Shareholders naturally did not like this. The declining share price is somewhat concerning for the value of CK Infrastructure assets in Australia.

SSE: Might look cheap, to some. Not only into distribution & transmission. Generation of electricity is much riskier. In 2023 the business reported a small loss after a really good 2022 with a 2.5B euro profit. Not a good comp. Might be interesting if you like a more general utility company in the UK. 27B GBP of assets, 20.5B Market Cap & 8.5B of equity.

UK Water companies

CK Infrastructure holds a stake in Northumbrian Water. Being somewhat interested in the mess that Thames Water has become I looked to UK listed water companies as well. I expected to see low valuations, but that was not what I found. There are some clear troubles brewing under the surface.

Surprised that only the stock of Pennon Group is going down.

Severn Trent (PE of 49) & United Utilities (PE of 54) have some clear risks as well, but the share price has not really declined.

Not sure who is holding the shares in this company. Probably pension funds who like the dependable dividends, connection to inflation and stable operations. They are not safe investments in my opinion.

Problems for UK water stocks are the following:

Stocks are trading on dividend yield

Cash flow after investments does not leave room for this dividend

Leverage is significant and cost of leverage will increase when debt matures.

By paying out the dividends the companies are decreasing the asset base

Current problems of underinvestment will likely get worse & lead to regulatory repercussions.

Comparison conclusion

Compared to other utility companies I find the relatively strong equity component a clear plus. In addition, I rate the quality of the smart metering business (Ista) & Reliance Home comfort above most utility assets. This compensates for some generation assets. I was expecting more of a discount. Recent strong performance has closed the gap for a large part. This is somewhat surprising to me given the governance structure (CK Infrastructure being 76% owned by CK Hutchison).

Solid financial position

The position of CK Infrastructure is decent:

The company is less leveraged than most, but clearly the investment portfolio holds considerable debt. This is not a surprise given how this kind of assets are financed and regulated. Just looking at the headline will misinform you though. The real debt at a look through basis is 47.8% of capital. This will probably not be beneficial for earnings going forward as debt will need refinancing.

Better ways to get exposure to CK Infrastructure:

Buying it through CK Hutchison & getting the port assets, telecom, Cenovus Energy & retail business for 52B HKD.

Buying CK Asset which co invested in most of CK Infrastructure businesses and has a market cap of 108B HKD. In addition, CK Asset has a strong HK property arm. Potentially CK Asset can benefit from the listing of CK Infrastructure by selling its assets to CK Infrastructure.

When does a higher valuation matter for the controlling shareholder?

When he wants to sell. I would not be surprised to see CK Hutchison sell a significant chunk of CK Infrastructure in the near future. This might help unlock value at this holding company. Another move which would not surprise me is that CK Infrastructure would start buying out the minority interests from CK Asset.

Conclusion

The current valuation does not make CK Infrastructure very attractive at this point on an absolute basis. On a relative basis it is somewhat interesting, but I would expect CK Infrastructure to keep trading at a discount. Personally, I keep my shares in CK Hutchison and hope the value realization at CK Infrastructure will help its largest shareholder.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

That's pretty wild that CKI has rallied that hard on a UK listing. So much for efficient markets!