CK Asset: How I would play a recovery of China / Hongkong

Quality assets, diversification abroad for Chinese valuation, and low leverage.

Especially among value investors it is popular to invest in unpopular themes. One theme that is clearly unpopular: China. Within this theme real estate is even less popular in the investment community.

Given that other investors which do great research look into China I wanted to dive a little deeper and challenge my own conclusion. If you have any feedback, please let me know.

Currently I’m not investing in this theme, but I might when prices get even lower, or the situation improves. A good way to invest in Chinese real estate in my opinion would be through CK Asset.

CK Asset has a combination of:

International diversification that is priced at a Chinese valuation

Low leverage

Good real estate positions

Great development experience

Conservative management that managed to avoid the worst of the Chinese housing bubble

My idea is if I can buy CK assets for the value of its international assets I get upside in China/Hongkong for free. In addition, this means the company has more means to sit out the downturn and enough dry firepower to benefit from a recovery.

Overview

1. CK asset international assets

All these assets look stable and predictable to me. This is a nice anchor for CK Asset. Given the volatility and risk in China and Hongkong.

Greene King:

Pub operation bought for 2.7B GBP in 2019 (plus 1.9B GBP in debt). 1B HKD profit in 2023. My valuation 12x profit = 12B HKD (significant haircut vs acquisition price)

Reliance Home Comfort:

building equipment service provider. 75% ownership bought for 2.8B CAD in 2017. 1.5B profit in 2023. My valuation 15x profit = 22.5B HKD

DUET Group:

Energy infrastructure. Bought for $7.4B AUD in 2017, 40% ownership. 1.4B profit in 2023. My valuation 12x profit =16.8B HKD

Ista:

Energy management services provider in Europe. Bought for 4.5B euros in 2017, 65% ownership. 1.3B profit in 2023. My valuation 15x profit = 19.5B HKD

UK Power Networks:

Power distributor for London and southeast England. Bought for 5.5B GBP in 2010. Almost sold for 15.5B GBP in 2022, 20% ownership. 2.0B profit in 2023. My valuation 12x profit = 24B HKD (sale price would have been 31B HKD).

Northumbrian Water:

regulated water and sewage company in England. Bought for 2.4B GBP in 2011. Currently 27% ownership. Sold 25% to KKR in 2022 for 8.1B HKD. Profit contribution 672M in 2023. My valuation 12x profit = 8.1B HKD

Wales & West Utilities:

A gas distributor that serves southwest England. Bought in 2012 for 645M GBP, 27% ownership. 621M profit in 2023. My valuation 10x profit = 6.2B HKD

Dutch Enviro Energy (AVR):

waste incineration plant. Bought in 2013 for 944M euros, 24% ownership. Profit contribution 129M. Company suffered from fire, impact for me is difficult to assess. If anyone has a good guess. Please let me know. My valuation 15x profit = 1.9B HKD

UK Rails:

train leasing company. Bought for 1.1B GBP in 2015, 20% ownership. 19M profit in 2023. My valuation 0. Too small to be significant.

Other:

160M profit contribution (20% ownership of Park ‘N Fly a Canadian car park provider & 11% of Australian gas networks). Nice bonus.

total contribution: 7.8B HKD for a value of 111B HKD (14x earnings).

Total market cap of CK Asset = 107B HKD.

This means that you get all the upside (and all the risk) of the primary property segment basically for free.

2. Low leverage

12.4B HKD of net debt. This is 3.2% of shareholders’ funds. S&P gives CK Asset an A(stable) rating.

3. Good real estate positions

Investment property

Has grown quite aggressively over the years. Currently 22M sq.ft of space, while end of 2019 it was 16M sq.ft. Growth has come from China (1.9 to 4.6) and overseas (2.3 to 4.3). Space in Hongkong has been stable (13.0 to 13.1).

Noteworthy acquisition: Civitas Social housing was bought for 485M GBP in 2023.

Rental market has clearly been softening. Profit contribution in 2023 was 4.6B HKD, while in 2019 CK Asset earned 6.9B HKD.

Especially office and retail have been hit hard. Declining from 3.4B for retail and 2.9B for office to the current levels of 2.1B and 1.9B.

The forecasts are that oversupply will push down rental prices further. It is likely that most rental contracts especially office is currently above market rent. This makes it difficult to assess underlying value. 8x profit contribution does sounds fairly reasonable or should I go even more conservative?

8x 4.6 = 36.8B HKD

This is why in general I like more focused real estate businesses. Coming up with a reasonable valuation here is just so difficult. Wait it will get more difficult.

Hotels & Serviced suites

Serviced suites performed well during Covid and is a surprisingly good business. Hotels are volatile and saw great improvement in 2023. Results are now above the level of 2019 (1.3B), but still below 2018 (1.9B). Total of 9M sq.ft of space.

Assets in Hongkong seem to be higher quality and delivering decent returns while assets on the mainland are loss making and have been since 2019. Good thing is that the current rents here are by nature of the product always market price

The real estate is probably worth more than my conservative valuation. 8x profit contribution leads to 12.2B HKD.

Property management

359M HKD in profit contribution (362M in 2022). My valuation 8.5x profit = 3.1B HKD.

REITs

Hui Xian REIT

34% ownership 11.8M sq.ft under management 55M profit share in 2023 (178M in 2022) and 151M distribution. Total market cap 4.4B CNY (has declined 79% since start Covid). 1.6B HKD valuation.

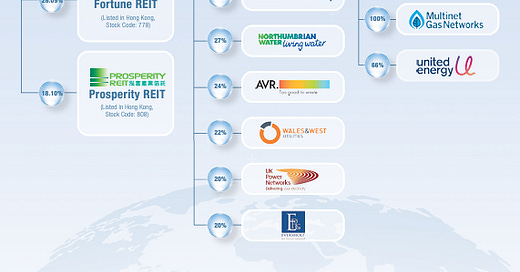

Fortune REIT & Prosperity REIT

Fortune REIT 26.2% ownership 3.0M sq.ft under management. 8.2B HKD total market cap (declined 57% since start Covid).

Prosperity REIT 18.2% ownership 1.3M sq.ft under management. 2.1B HKD total market cap (declined 53% since Covid). Combined 270M in distribution (273M in 2022) for a valuation of 2.5B HKD.

Landbank & property development

Now we get to the real difficult part. CK asset has 74M sq.ft of properties under development. Still 4.5B in profit contribution in 2023 (10.4B in 2022, 18.1B in 2021, 19.1B in 2020 & 21.4B in 2019). Valuation?? no idea. How would anyone approach this? Might be that a significant part of these historic earnings never come back.

Jan-April 2024 there was another 30% drop in property sales. It is hard to catch a falling knife like this. I’m not sure where the bottom is.

In addition to this it might be the case that CK Asset has already committed to a lot of projects that in hindsight don’t make economic sense. This is the dangerous part of property development.

2023 was a relatively light year in the development schedule. 2024 however is quite busy with significantly more projects scheduled for completion (10,025k sq.ft vs 913k sq.ft with 484k sq.ft in London).

Margins so far have been great for CK Assets property development division. This is great, but the trend is clearly down. Given the big margins the chances of losses are luckily somewhat muted.

CK Asset always has been conservative and has not bought much in the most speculative phase of the China real estate boom. Still, I find a very wide range of outcomes when looking for a valuation of the property division.

Just because of the high optionality (returning to earning 18-21B a year between 2019-2021). I would value the landbank and property development business at 1x peak profit 19-21 = 19.5B. This includes potential losses on current developments and the believe that a return of the golden times in Chinese real estate development might lay quite far into the future.

Investing in bubbles

You can make a lot of money investing before a bubble start and lose a lot of money by riding it down. Valuations might look reasonable or even cheap all the way down. The business environment just continues to decline below the assets. Trends can go longer in both ways than you imagine.

The bear market in Japan equities took 30 years after a massive bubble and this was with near zero interest rates the whole time. Brazil is still clearly below its peak in 2011 and Mexico just recently crossed its high watermark of 2013. Compared to those markets the peak in 2021 of the China ETF is still relatively recent.

China has probably the biggest real estate bubble in history on its hands. This is my opinion, based on the percentage of the world cement China is using (51% in 2022 & 57% in 2020) 25% would be more normal in my opinion. It could definitely go lower as well after years of overconsumption. It will take time to flush the oversupply out of the market.

The problem with a bubble is that a lot of the effects feed on themselves like a spiral. In this case lower home sales lead and prices to:

Less construction jobs

Higher unemployment

less consumption/social unrest

Lower government income (especially for lower governments)

Higher debt or higher taxes elsewhere

More risk in the system or less consumption/investment due to higher taxes

More bankruptcies of construction companies

Lower profitability of banks / less trust in financial system

Less willingness to take risk

This is happening in a country that is strongly controlled by the government. This is seen as a benefit, but I would argue that it is also the primary reason why the bubble got so big.

Government policies and believe that the government can realize whatever it wants. Government gave very little options for people to invest and save outside of real estate. In addition, rising prices combined with leverage made people believe that home prices would only go up and you had to join quickly to not lose out.

There might be plenty of time to make money in the market after the worst has passed.

To benefit you first need to survive

The great thing is that CK Asset has good international assets than keep delivering. This gives investors a decent return, while investors wait for this great profit engine of real estate development to restart. When the real estate market recovers in China/Hongkong it is likely that CK Asset is in a good position to prosper.

Paid to wait

Shareholders of CK Asset are paid to wait. The company pays a 6.9% dividend yield and bought back of 2B HKD in 2023 and wants to continue this policy going forward (another 2% yield).

Adding it up

111B in international assets

36.8B in rental property

12.2B in serviced suites & hotels

3.1B in property management

4.1B in REITS

19.5B in landbank & property development

-12.4B in net debt

Total value of 174.3B vs market cap of 107B.

Conclusion

Even when taking some drastic assumptions, I find that CK asset is clearly undervalued. What I like is that the international assets cover the entire valuation. In addition, investors are paid to wait with a good dividend yield.

Even after this severe haircut however I’m not confident that this is the moment to invest in Chinese real estate yet. Given the long time it takes to develop property and the use of significant leverage in the system the cycles do take quite a long time to play out.

For the moment I stick with my investment in CK Hutchison which allows me to invest in Western assets at a Chinese price without the real estate exposure.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Thanks for the great write up. I’m not sure if I’m interpreting it wrongly, but it seems like based on the history of acquisitions they’ve only made money on one or two deals, with the valuations of the rest being significantly lower than the original purchase price? While certainly cheap based on SOTP, it does give one slight concern regarding their capital allocation ability.

Hey, nice write-up. I have a question here: "Total value of 174.3B vs market cap of 107B." Is it a mistake? Shouldn't the market cap be around 140B HKD?