The biggest loser in my portfolio is CK Hutchison.

CK Hutchison has been in my portfolio for over 6 years and has delivered disappointing results. The dividend yield has been nice. Apart from the dividend, the only good thing is that I have led the position to decline in relevance in my portfolio. By good performance of other stocks and new money not being invested in CK Hutchison.

Given these poor results, why am I still holding on?

The answer is quite simple. I still like the assets and management (my views have not changed much since 2018). While I tend to stick to easier investment theses for newer investments, I have a decent track record with sum-of-the-parts investments (thanks to Berkshire Hathaway, Bollore, and Investor AB).

In the case of CK Hutchison the sum of the parts still looks very attractive.

Sum of the parts overview:

I would recommend to look at the annual report and come up with your own estimation. The branches of the tree are easily distinguishable at CK Hutchison. You have Utilities, retail, ports, telecom, and a significant holding in Cenovus (a Canadian oil company). Below is a summary and my valuation. Others like Emerging Value and Asian Century Stocks have made different analyses but come to a similar conclusion.

utilities: 76% of listed CK Infrastructure (fairly valued and under-leveraged, cheaper than European or Australian listed competitors) 88B HKD. CK Hutchison also has some direct investments in utilities. Most significant is a 27.5% stake in Australian gas networks. Acquired in 2014 (100% for 2.37B AUD). I consider this stake and 5 others a nice bonus or a discount to the market valuation of CK Infrastructure.

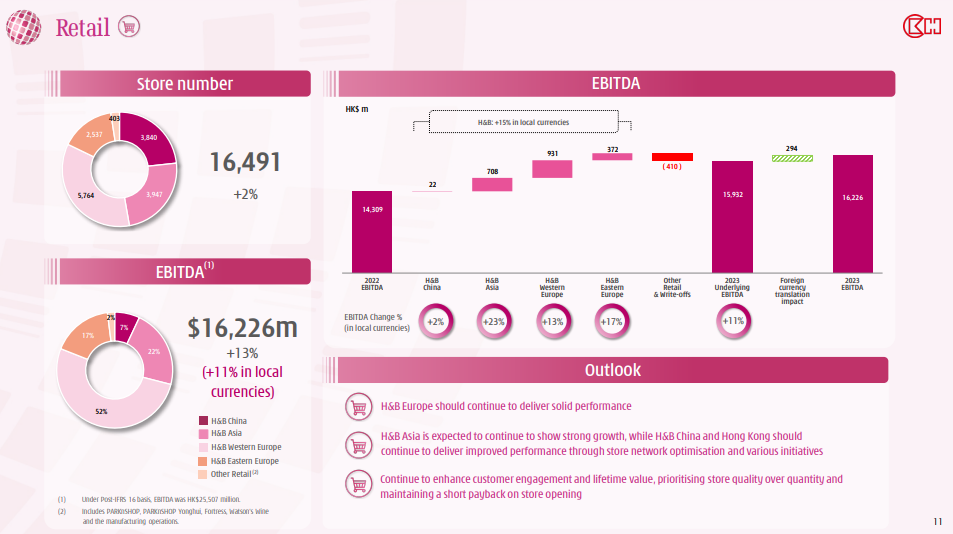

retail: CK Hutchison owns 75% of Watson, the global leading health and beauty retail company (69% of revenue out of Europe). Temasek (owns 25%) was in talks to sell 10% for $3B. Temasek bought the 25% for $5.6B in 2014 and since then Watson has grown, but potentially the Chinese part has become less valuable. At 8x (16.2B HKD) EBITDA Watson is worth 130B HKD ($16.6B) and the 75% of CK Hutchison is worth 97 HKD. If you think this is excessive look at the valuation of Douglas ag that went public recently (2.4B Euro and way too much debt). You can easily argue that the stake of CK Hutchison is worth 130B HKD ($16.6B), but I try to stay conservative.

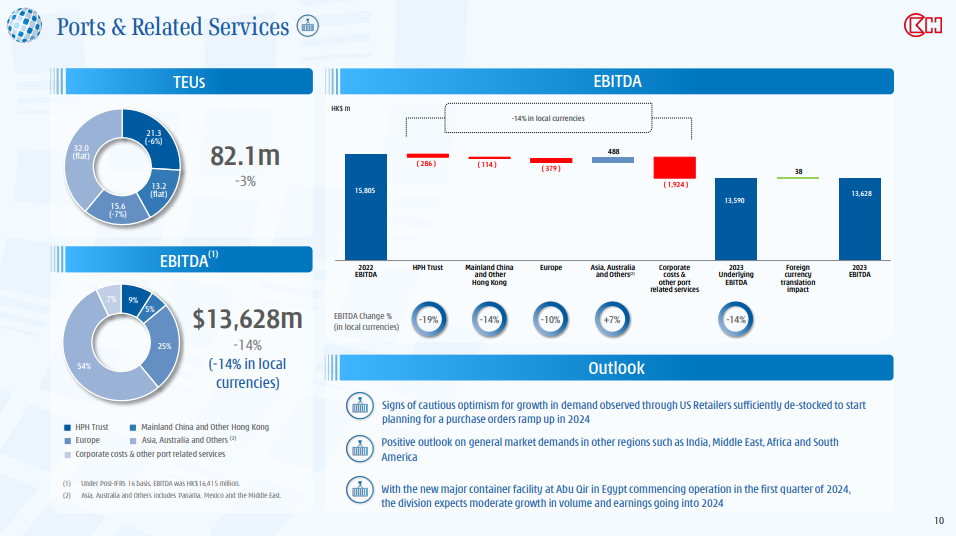

ports: Leading port business in the world. After an amazing 2022 results normalized a bit in 2023. Still, 13.6B HKD in EBITDA for such a well-positioned international business should fetch at least 8x EBITDA leading to a 109B HKD valuation.

Telecom: Most difficult to come up with a good valuation. Given the value of infrastructure, retail, and ports are also not necessary for a good valuation. Value is there. Leading position in Italy with Vodafone Italy (similar size) being sold for 8B euro (67B HKD). Using a 50% discount is still 34B HKD.

I think the merger with Vodafone in England will likely go through. This would create significant value. I doubt the merged company is worth the $18.5B (144B HKD) mentioned in the press though. An additional 50% discount would still mean a 36B HKD valuation.

Then we still have the assets in Sweden, Denmark, Austria, and Ireland. With an EBITDA of 1,860*60%+746*60%+2914+1,317 = 5.8B HKD

EBIT of 660*60%+(6)*60%+1,499+183= 2.1B HKD

For a combined value of 17B HKD.

Merger in Indonesia led to CK Hutchison owning 50% of 65.6% of PT Indosat Tbk which is currently worth 90.5 Trillion Indonesian Rupiah (43.5B HKD). Share of CK Hutchison worth 14.3B HKD. EBITDA for all Asian telecom activities (Indonesia, Vietnam, and Sri Lanka) amounted to 4.0B HKD. Given the somewhat high valuation of the Indonesian assets, I value the Vietnamese and Sri Lankan assets at 0.

The total valuation of the telecom assets is 101B HKD using these valuations.Cenovus Energy: I like the position in this cheap Canadian oil & gas company. 16.9% share = 39B HKD

Other holdings:

HutchMed: 38.2% of 26B HKD = 10B HKD

Cellnex: 3.44% = 6.3B HKD

Rest: Bonus

Total: 88+97+109+101+39+10+6= 450B HKD versus a market cap of 147B HKD and net debt 132B HKD. Now I know you can find other very cheap assets in China. These assets are predominantly in Western countries and should therefore be valued accordingly.

Management

While most people probably blame management for an inconsistent dividend policy and an insignificant buyback program I am more forgiving. While I would have liked a more consistent dividend policy, like they have implemented at CK Infrastructure, I don’t mind the lumpy payouts on average the yield has been good. The minimal share buyback has been a bit frustrating, especially given the perceived discount, but even Warren Buffett has not been aggressive enough with his buyback program.

Given the continued decline in the share price. Not committing to a significant share buyback program was the right decision.

Management has no influence on the economic environment they face. Their decisions are something to be judged though. The capital allocation decisions have been sound. Selling the telecom towers to Cellnex was a decent deal and the consolidating mergers within telecom have created much stronger positions in the countries that CK Hutchison is active. This is particularly true for Italy and Indonesia, while the UK merger is still in the works. Preliminary talks have been had with Telenor for the assets in Denmark and Sweden. A lot of progress on this front, but not the deals CK Hutchison hoped for when they made those investments.

What went wrong:

Given that the thesis did not change, why did the stock perform poorly?

First: the sectors CK Hutchison has exposure to have all performed poorly.

Infrastructure has been hammered by lower regulated returns. The focus of governments has been on minimizing costs for consumers. Not increasing rates have been on top of mind for regulators and given the lower interest rates, they saw an opportunity to lower the returns for owners. Given that interest rates increased again and the current problems in the UK with over-leveraged utilities that cannot fund necessary investments, it might be that some of those declines reverse.

Being more negative you might think that Great Britain will nationalize all utilities, I think this is an unlikely scenario. Even in this scenario, CK Hutchison will probably not lose much money given the valuation.

Retail has not been popular for a long time. Watson might have had a good performance, but it is still difficult for people to pay up for a retail company. Covid has not been helpful either. I’m surprised though that US chains like Dollar General get considerable investor love, while the strength of Watson goes unnoticed.

Oil going negative. Cenovus Energy is a product of a merger between Husky and Cenovus. Since the merger, the returns have been great and the returns for CK Hutchison were even better thanks to warrants. Before the merger declining oil prices let to very dissapointing results. The position currently looks to be attractive to me.

Telecom has been an absolute disaster. All companies in this sector have had poor performance. Many companies have been unable to push higher costs onto customers leading to shrinking margins. Especially for companies with less dominant market positions. CK Hutchison has been active in consolidating. Buying out Veon in Italy for 2.45B euro looked like a great deal, but in hindsight has only been a decent deal. The merger in Indonesia with Oredoo looks good so far.

CK Hutchison has not been able to sell some of their assets for top dollar. The tower sale to Cellnex for 10B euro was a decent deal, but nothing like the sale of Hutchison Essar for $11.1B to Vodafone in 2007 or Orange to Mannesmann in 1999 for $33B.

Lowering debt. CK Hutchison lowered the debt levels. While I liked the deals that have been done I expected more. CK Hutchison did not blow their money on bad investments but did not do something transformative. CK Infrastructure is looking at investments. So we might hear of a new deal soon. Given the businesses CK Hutchison is underleveraged.

I do have the feeling though that CK Hutchison has been so conservative in part because of the real estate situation in China/Hong Kong. Though CK Hutchison has limited exposure CK Asset is primarily a Chinese real estate company.

China Risk

The most important reason for the poor performance in my opinion is the listing in Hong Kong and Chinese management. China has quickly lost popularity with investors. When I first bought the stock I thought a Price earnings ratio of 10 was too low. Currently, the PE is 6.4.

Chinese politics is another risk. The state is getting a stronger grip on the economy. Li Ka-Shing’s historical connections seem to have been lost. Given the limited direct exposure of CK Hutchison to China this risk might seem limited, but can become real very quickly.

Unpopular sectors

Retail, utilities, and telecom have all been unpopular. That being said I like the retail business and the port assets. This alone should be worth the current market cap while using a conservative valuation. The utilities should continue to deliver a regulated return. Telecom has had a tough time, but the assets have value. I hope more of this value can be crystallized. The low valuation for telecom companies doesn’t give much hope, but the deal for Vodafone’s assets in Italy shows there are still possibilities.

How CK Hutchison helped me avoid mistakes

While the share price performance of CK Hutchison has been disappointing. The position in CK Hutchison helped me avoid other mistakes.

The position in CK Hutchison made it much easier to sell my remaining telecom exposure in Liberty Global and Liberty Latin America. In addition, it made it much easier not to buy into the supposed value of other telecom assets.

Within infrastructure, I did not buy into Enagas, which currently looks attractive again (at much lower prices).

Within Energy it made me wait till after COVID-19 to buy into more energy. Good performance in that space (thanks Petrobras), but performance could have been way better if I bought stock of Tourmaline instead of Gazprom.

Conclusion

The total market cap of CK Hutchison is a very undemanding 17.6B euro (147B HKD). A clear path to value realization is missing. For some investors, this makes CK Hutchison uninvestible. I see multiple ways to win:

Green light for merging UK telecom assets with Vodafone.

Re-rating of utilities to European pears

Market realizing the value of retail or port assets.

Splitting up CK Hutchison and listing the assets separately might release value. This might seem very unlikely, but CK Hutchison was split in 2015. So it is something the family is familiar with.

None of these scenarios may play out. This is not a tragedy. Investors can still see CK Hutchison retain the majority of the earnings and still pay a 6.4% tax-free dividend.

CK Hutchison might be selling most of their port division to BlackRock for net cash proceeds of $19B. Roughly equal to the current market cap of CK Hutchison. Sounds like a great deal to me. I valued the ports business at $14B in the article.

https://doc.irasia.com/listco/hk/ckh/announcement/a308174-e_announcement(1).pdf

I still hold for several reasons:

-It has been hit by a perfect storm of down events but that is over now and the down turns are turning, in retail, infrastructure, oil, ports, even telecoms a bit.

-They will do some growth capex and acquisitions (infrastructure)

-Telecom is pretty much written off and in cash cow mode.

-Obviously the dividend.

-Sometimes, some stuff does not work out and it's part of having a portfolio. It will turn positive when some other stuff in my portfolio will hit a speed bump. so selling now would be an error in that sense.