Airports, fly over country cement & Carlos Slim premium All Mexican stocks P7

The interesting case for investing in Mexican airports. A great way to invest in the US cement sector, micro lending & a valuation of Grupo Carso.

In part 7 of the all Mexican stock series I will cover:

Grupo Aeroportuario del Pacífico (GAP) (ADR:PAC)

Corporativo GBM (GBM)

Grupo Carso (GCARSO)

GCC Sab (GCC)

Gentera Sab (Gentera)

Grupo Aeroportuario del Pacífico (GAP) (ADR:PAC)

Market cap 148B pesos.

Operates, maintains and develops approximately 10 international airports in the Pacific and Central regions of Mexico, and an international airport in Jamaica.

The company trades at 16 times earnings (9.3B pesos) and a 6% dividend yield. The growth prospects of air travel in Mexico are good. Given the distances cheap flights are likely to gain share from buses. This fits well within the richer Mexicans theme.

There are three listed Mexican airport companies:

Grupo Aeroportuario del Sureste (ASUR): Covered in part 3

Grupo Aeroportuario Centro Norte (OMAB): Still to be covered

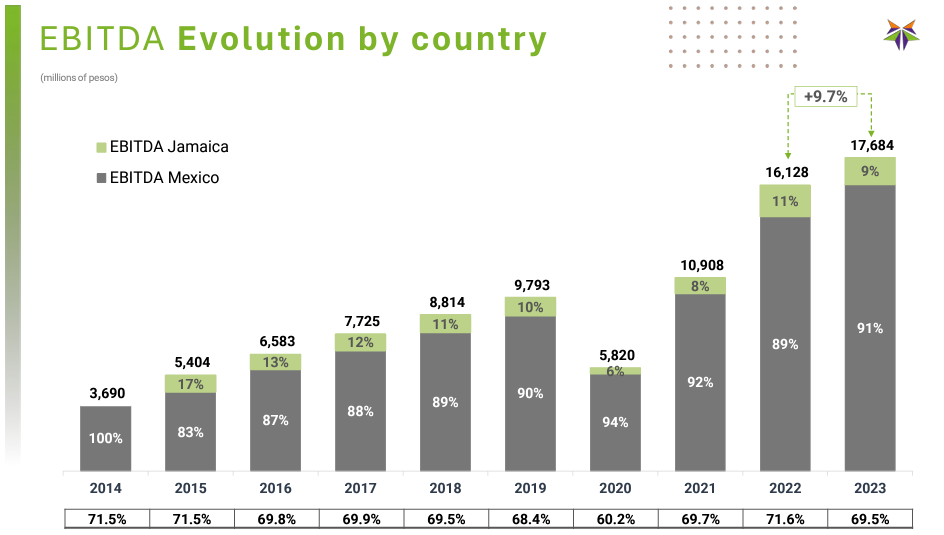

My problem with the Mexican airports is their excessive profitability in a regulated sector. Grupo Aeroportuario del Pacífico has 30.5B of net debt & 20.9B of equity. A profit of 9.3B on 20.9B of is really high for a company in a regulated industry. There have been some small regulatory changes in 2023 pushing EBITDA margins back from 71.6% to 69.5%.

In addition, the company has to invest significantly more in capex. This is probably fine given that demand for air travel will increase as well. So far no real issues.

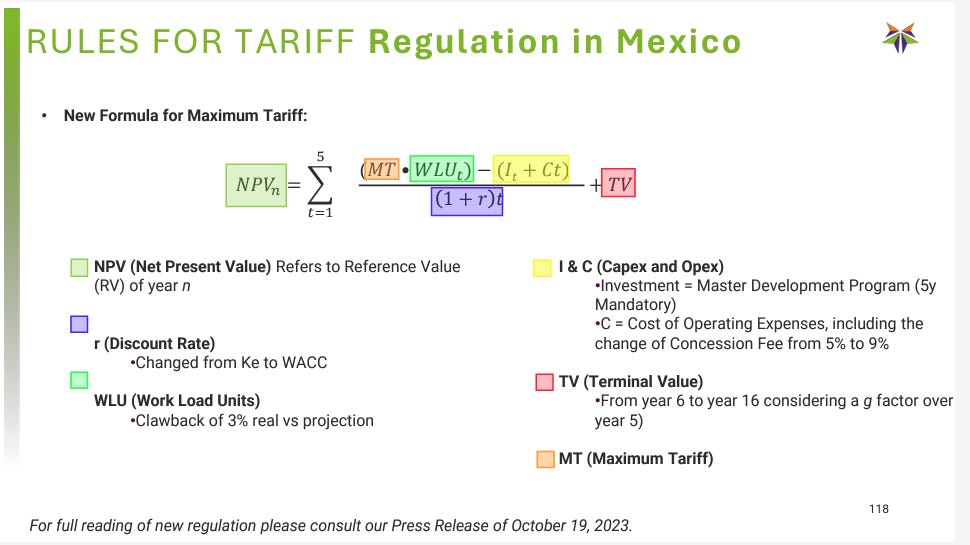

Grupo Aeroportuario del Pacífico is doing a great job explaining the tariff regulation. The current regulation is quite lenient in my opinion, allowing for good returns. I see a significant risk for the returns on Mexican airports in the future. This risk is the discount rate.

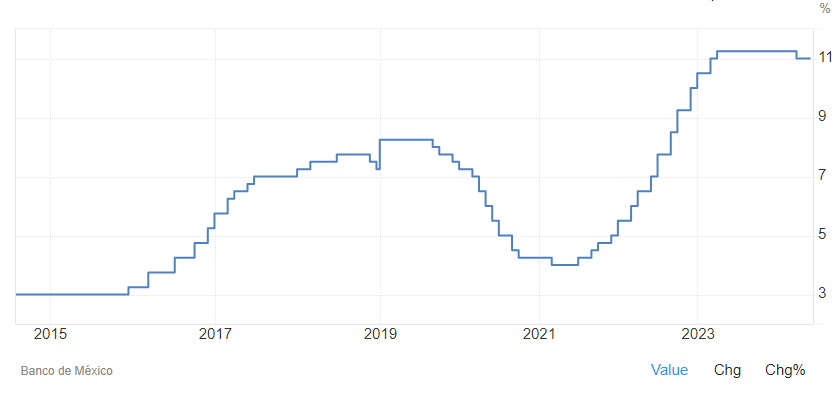

The discount rate is always calculated from the Risk Free Rate. In this case the interest on Mexican government bonds (UMS Bonds).

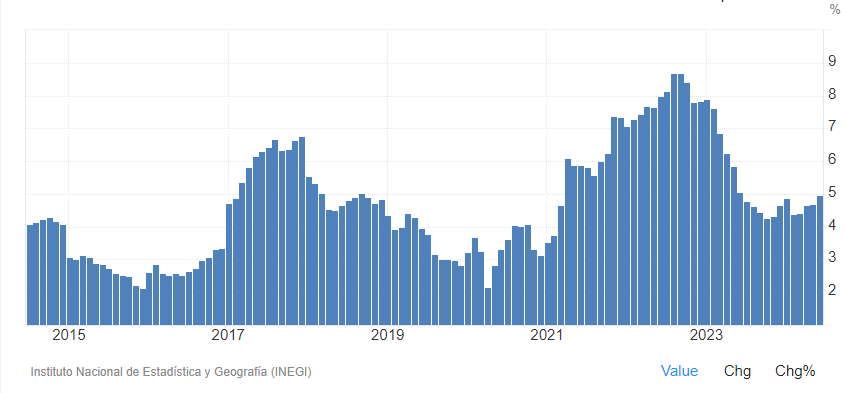

Currently the interest rate in Mexico is fairly high & the inflation under control.

This means that this is currently the perfect time to get high rewards with this regulatory framework.

If real interest rates drop significantly in Mexico so will the returns for shareholders of Mexican airports. I find this scenario likely and fitting in my thesis of Mexico becoming a more advanced economy.

I like companies with high returns on capital and good growth prospects. Combining this with high levels of regulation makes me somewhat nervous. This is why I currently stay away. A 6% dividend yield with some growth (capex + inflation - lower returns through regulation) is still probably a decent investment. Look for a steep drop after some regulation scare to amplify your returns if that’s your thing.

Corporativo GBM (Grupo Bursatil Mexicano)

Market cap 21.6B pesos

Focused on providing services and financial products to several businesses composed of large corporations and mid-cap companies, institutional investors, and Mexican and foreign individuals. Profitability is erratic. 2023 was a good year with 426M in profits. Tangible book value is 9.9B pesos. Not interested.

Grupo Carso

Market cap: 270.5B pesos.

Grupo Carso is a holding company controlled by Carlos Slim. Grupo Carso’s segments include:

Retail 20% of operating income (Sears :), not specialized & not valued highly by me)

Industrial 22% of operating income (cables, car parts, steel pipes (not valued highly))

Infrastructure & Construction 27 of operating income (like the infrastructure, the construction not so much).

Solutions to the construction sector 14% (cement, roof tiles, etc, nothing special)

Carso Energy 11% of operating income (gas transmission & electricity generation, interesting).

Equity 144B pesos, net debt 30B pesos & net income of 16B pesos in 2023 (19.6 times earnings). I don’t see a clear conglomerate discount here. Some of the businesses like retail & industrial are not even worth 10 times earnings to me. This means the rest should hold a premium valuation. Better alternatives in Mexico. Not interested.

GCC (Grupo Cementos de Chihuahua)

Market cap: 50.8B pesos

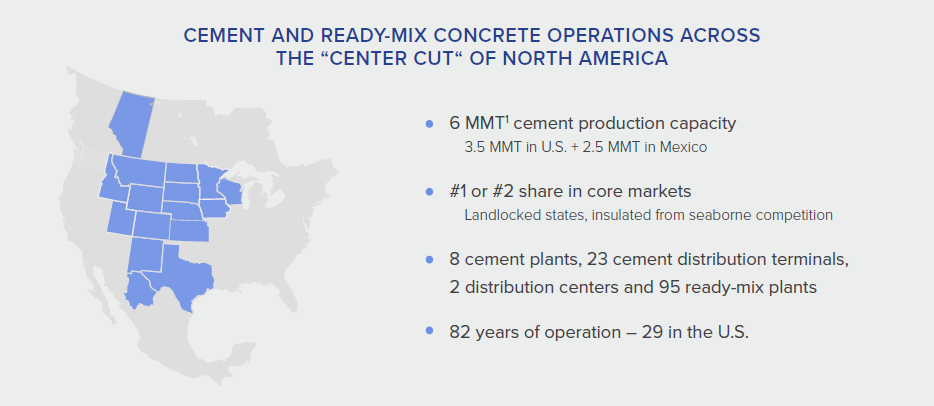

GCC a producer of cement, concrete, aggregates, coal and construction related services in the United States and Mexico, with an annual cement production capacity of 6 million metric tons.

Interesting fact: Majority of business is actually in the US with 3.5 MMT vs 2.5 MMT in Mexico. 69% of sales is the US as well. This is interesting, given the valuation of US competitors & prospects of the US market.

Downside: very small aggregates segment & even some coals exposure.

Positive: focus on landlocked states plus #1 or #2 position in each market.

Positive 2: focus on Northern Mexico which benefits most from nearshoring.

Net income in 2023 $295.3 USD (5.4B pesos). Only $140.3M in 2022 though.

Net income in H1 2024 up to $139M vs $115M in H1 2023.

51% of the shares in GCC owned by CAMCEM. 40.1% of CAMCEM is owned by CEMEX. Given this position of the largest Mexican cement company I’m confident that minority shareholders enjoy some protection from the most egregious forms of mismanagement & misappropriation of funds.

1.0% dividend yield. This is low. The company is focused on growing and sporadically buying back shares.

equity $1.8B (33.1B pesos)

$879M USD in cash & equivalents. $497 in debt. Net cash $382M (7.0B in pesos).

Company is looking for acquisition targets:

Cement companies & the aggregates sector. Not much is happening though in the last 5 years, which have seen net debt turn into a significant net cash position. This might be somewhat of a risk.

Comparing it to Cementos Moctezuma & Cemex

Cemex: Not a fan of the debt at Cemex plus I like the stronger US exposure of GCC

Cementos Moctezuma: Like the strong capital return program of Cementos Moctezuma. In addition, I like management more at Cementos Moctezuma as well. Large US exposure for GCC is a plus in my mind, due to the abnormally high margins on cement in Mexico. Grupo GCC is cheaper and has my preference, but it is fairly close.

Grupo GCC is similar to Monarch Cement (low pe, net cash & focused on flyover America). Monarch Cement recently has gotten fairly popular on financial blogs with recent coverage two I like:

Canadian Dividend Investing

Wintergems

Monarch Cement is smaller, US listed (better disclosure), fully US focused and has no acquisition plans. GCC is slightly cheaper (lower pe), has more net cash and, is more diversified.

I would argue that it is pretty difficult to choose between them. More research is necessary.

Cement is still cyclical. The margins have been expanding for the last decade. Worried this might revert to the mean.

Should have bought Monarch Cement in 2019 when it was covered by Focused Compounding on their great podcast or when OTC Adventures wrote about it afterwards. The best would have been to remember their coverage and buy in after covid-19 crashed the stock for no clear reason. Happy to watch from the sidelines currently.

Gentera

Market cap: 34.9B pesos

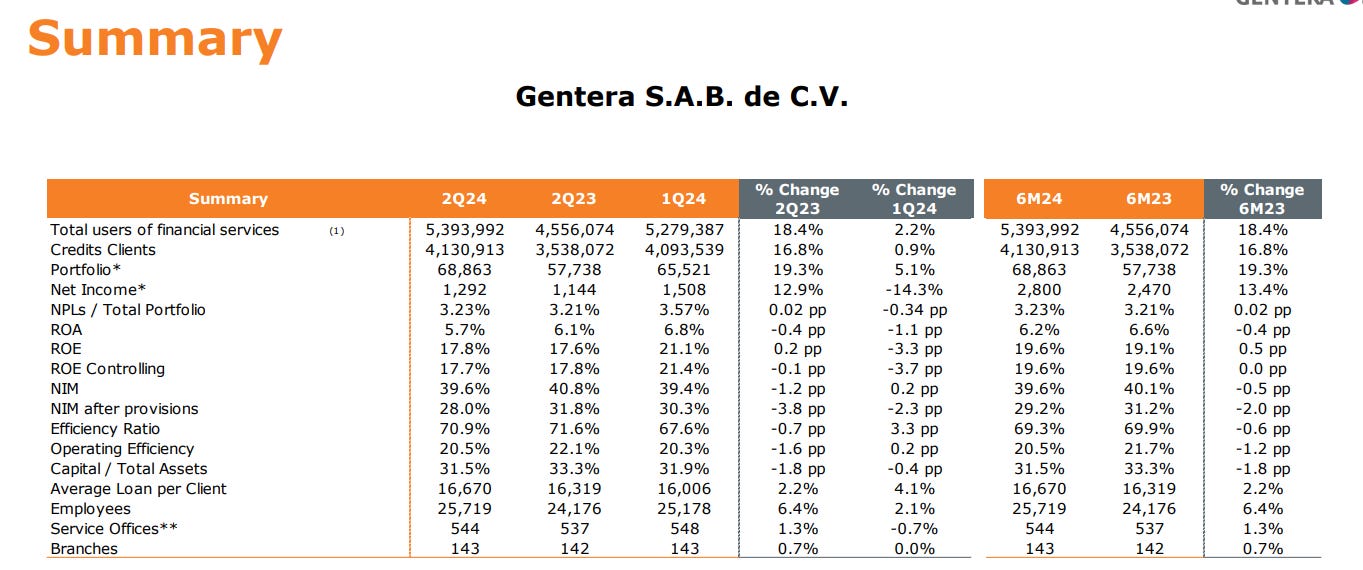

Bank with Mexican & Peru exposure. Historically founded as a NGO. Focus on helping clients develop by giving them opportunities. This is sounds all very noble. What are the results for shareholders?

Not/barely profitable in 2020 & 2021. This compares unfavourably to most other banks. Tangible equity is 19B pesos & company is trading at 5.5 times earnings.

Capital ratios are pretty good. Net interest margin is very high. Not sure what I think of these kinds of interest rates. Given the bank’s history, I’m slightly less worried about it. Still, not sure I want to be involved in micro lending.

I have very little knowledge about the banking market in Peru. This is 28.2% of loans (not very profitable). Given the exposure to Peru Gentera fits less well in the richer Mexico theme. In addition, I’m not a great fan of banks with a high-cost base. This makes losses in a downturn more likely as we saw with the results in 2020-2021.

I like other Mexican banks better.

Conclusion

This edition again showed some interesting companies. Airports are an interesting business with good growth potential. I have to do more research to get comfortable around stocks with a lot of regulation, high returns on capital & growth prospects. It just feels like something likely to be taken away.

Surprised, by what feels like a Carlos Slim premium at Grupo Carso. In Europe companies controlled by a family trade usually at a steep discount. Apparently investors in Mexico still think it is justified to pay up for a company with a well connected shareholder.

After looking at a better micro lending company I’m pretty sure this is not something I’m interested in. The net interest margins are great, but this is a double edged sword. The operational cost are very high. Not convinced this is a great business model. Its existence might be good for the world, but I’m not comfortable with lending at these kind of rates.

Some of the valuations and market caps are a bit off given the sell-off in the market. The focus is more on the business anyway and the valuations are still roughly right.

In the next part in the Mexican stock series, I will start with a look at interesting Mexican financial companies.

If you liked this article, you might like other articles in this all-Mexican stocks series:

An article with a focus: a Mexican airport with a great balance sheet.

Or this one: a well-run Mexican cement company that does return capital to shareholders.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

I agree with you on micro lending