All Mexican stocks part 3: Bigger is better? First new position found

I discuss the valuation of some of Mexico's largest companies, like America Movil, the largest bank of Mexico, airports, and a new addition to my portfolio.

In part 3 we see some of the more well-known companies of Mexico. America Movil, controlled by Carlos Slim, the richest man in Latin America and 11th in the world with $105B (was the richest man in the world from 2010 till 2013). We will dive deeper into telecom. Furthermore, I will take a serious look at Mexican banking.

The most interesting companies of part 2 were Consorcio Ara and Alsea. Apparently not too much interest in Consorcio Ara. I find the stock interesting, given the low valuation. It is an interesting play. Might be that value investors are not looking closely at Mexico, while growth investors are not interested in a construction company that owns land and shopping malls.

Without further delay I will now discuss the following companies on the Mexican stock exchange.

America Movil

Grupo Aeroportuario del Sureste

Compania Minera Autlan

Axtel

Banco del Bajio

BBVA

1. America Movil (AMX) Market cap 1.02T pesos

America Movil is the seventh largest telecom company in the world and the second largest company on the Mexican exchange behind WalMex (Wal-Mart Mexico). The company dominates the local market with its Telcel brand (78% market share). In addition America Movil is very active in other Latin American markets with its Claro brand. Most important is Brazil where it is second behind Telefonica Brasil with its Vivo brand at 33.3% market share in mobile (here a nice, 3 year old write up from the strongly recommended Superfluous Value Substack).

Claro is the leader in fixed access in Brazil with 26.1% market share. Claro also has a strong position in Colombia with 55% market share. In addition to positions in all other Latin American countries, America Movil holds a 59% share in A1, the leading telecom company in Austria.

The primary problem is that all telecom companies have been struggling as of late (discussed this as well when I talked about CK Hutchison recently). This problem is less bad at clear market leaders like America Movil, but still recent results are not great.

Wireless customers increased 3.6% to 312M and broadband increased 4.8% to 32.5M. Growth in customers did not lead to revenue growth (-2.7%). EBIT declined 7.6%. Net income declined 55% in Q1 due to non recuring foreign exchange gain last year.

Company has been doing the right things, but this industry is just to damn competitive. Only in a market you totally dominate you make sufficient returns (like Mexico), but then there is always the risk that your monopoly is broken up by regulators.

Net debt not high, but also not insignificant at 411B pesos.

The current Price to earnings ratio of 17.3. This is too high for me given the alternatives, high capital intensity, and strong competitive pressures in the industry.

2. Grupo Aeroportuario del Sureste (ASUR) Market cap 176.7B pesos

ASUR is one of three listed Mexican airport companies. The others being Grupo Aeroportuario del Pacífico (GAP) and Grupo Aeroportuario Centro Norte (OMA), which will be discussed in due time.

I have been following airports for a long time and sold GAP just before Covid-19 at a good price (stock has recovered those highs). Expert when it comes to Mexican airports is Ian Bezek.

ASUR has spread outside Mexico with the acquisition of Puerto Rico (2013) and Colombia (2017). Still the most important airport by far is Cancún with 33M passengers in 2023.

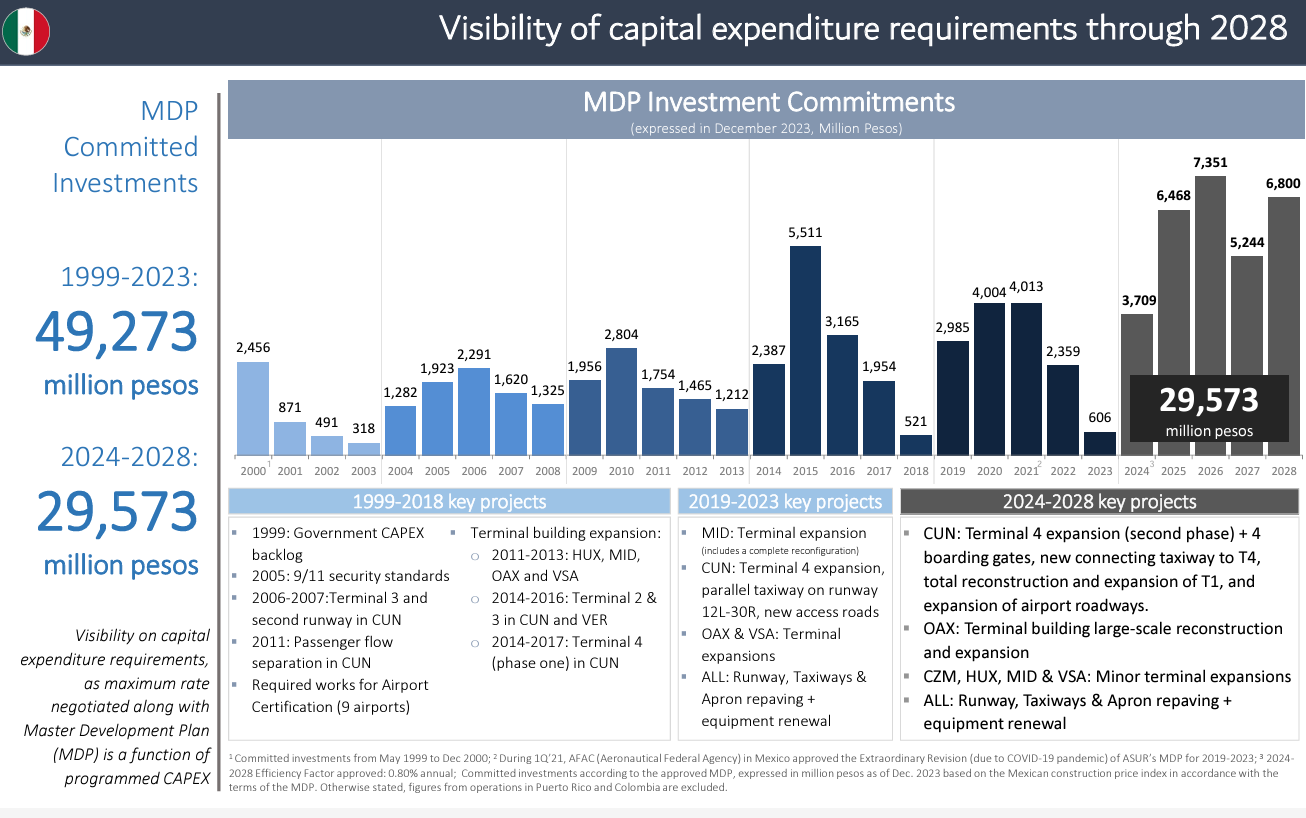

All Mexican airports started with a 50-year concession in 1998, which means that still 24 years on this concession are left. This concession can be extended by another 50 years.

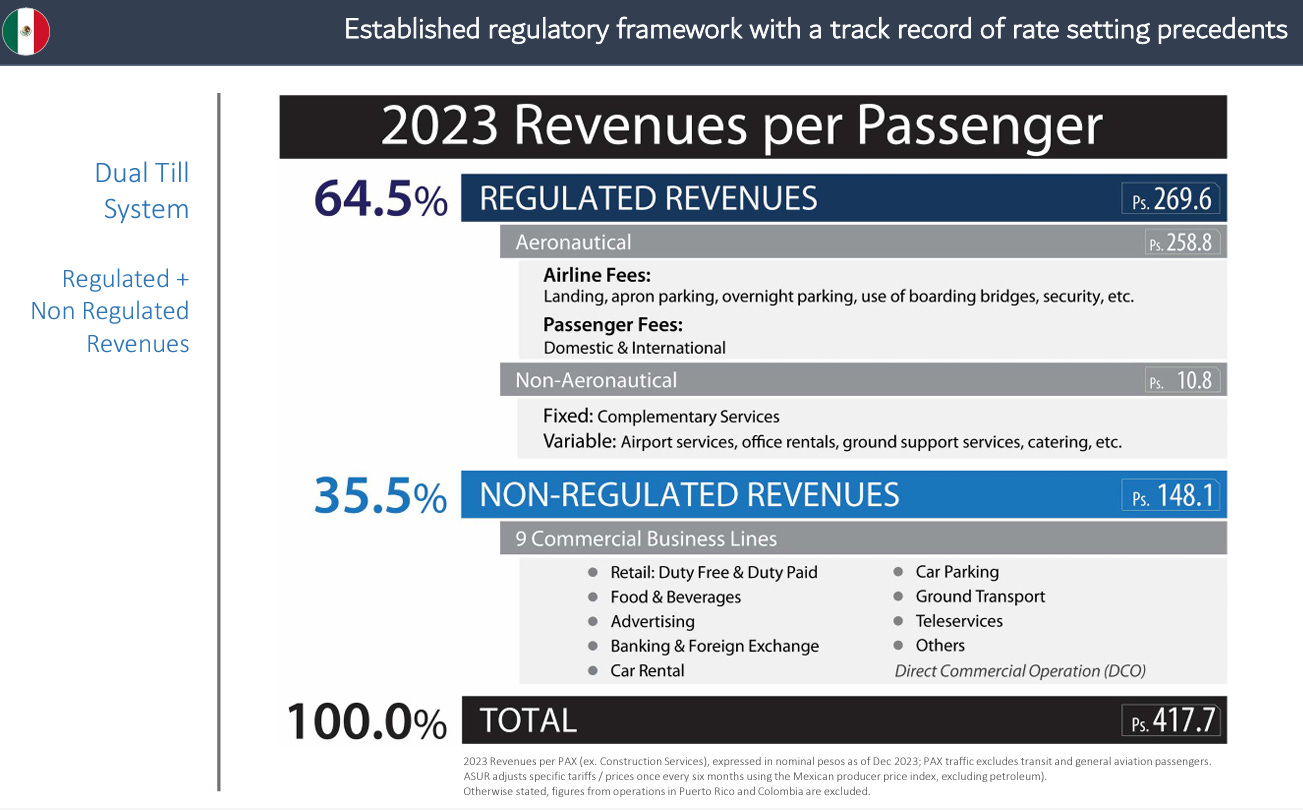

The concession naturally involves prices agreements with the government on regulated revenues and additional agreements on taxes.

The good thing is that air travel in Mexico is likely to continue to grow and non-regulated revenues might even increase more rapidly when passengers become wealthier.

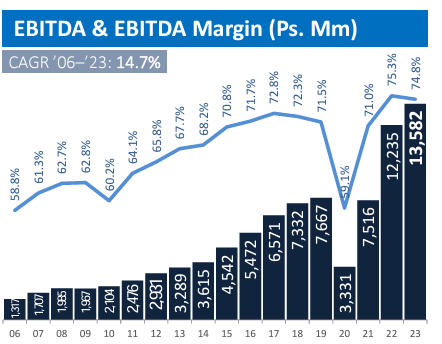

Historically airports in Mexico have been able to get a good return on invested capital and shareholders have benefited.

Given the current margin further expansion might not be warranted. The government recently put pressure on the airport companies to lower rates. The deal that was made was fair to the airports, but margins and pictures like the one above are an easy target for regulators in the future.

Going forward ASUR will have to invest more. This is not necessarily a problem though. Especially if this can enable the next leg of growth.

This is where I do like the other listed Mexican airports better. Cancún and thus ASUR is more heavily international tourist focused. This does not fit very well with my theme of nearshoring and the rising wages of the Mexican consumer. In addition Cancún might lose some of its shine to newer less overbuild tourist locations.

What I do like is the net cash position of 5B pesos. The international growth is something else I can appreciate. It still is early to tell how those investments will play out, but there is definitely potential there (especially Colombia might benefit from a wealthier, more expensive Mexico).

Stock currently trades at a price earnings ratio of 16.4 and pays a 4.6% dividend. Definitely an interesting stock to watch.

3. Compania Minera Autlan (AUTLAN) market cap 3.1B pesos

Autlan is primarily engaged in the mining, exploitation, production and sale of manganese ore and manganese ferroalloys. Not a great fan of mining companies with not a strong low-cost position and something special.

Autlan presents its results in USD. EBITDA dropped in 2023 84% to $34.4M. Net debt increased to $137.1M. Debt to EBITDA is 4.0 and 2023 presented a net loss of $39M of which $29M due to currency losses. Q1 2024 saw another loss of $12M.

Autlan is dependent on commodity prices. Higher salaries for Mexican workers is not something that will help Autlan.

You can buy $274M of stockholders’ equity for $187M in market cap. Given current losses I am still not interested. Potentially new tariffs against Chinese dumping will help. Long term I’m not convinced this is an attractive investment that can consistently generate value.

4. Axtel market cap 4.8B pesos

Axtel provides data infrastructure for broadband Internet, pay television, telephony, and data centers. The main business is providing ftth broadband as a white label service to other broadband companies in 45 cities

Revenue increased 5% in 2023 to 11B pesos. EBITDA increased 14% to 3.4B pesos. Operating income exploded higher from 174M pesos in 2022 to 576M pesos in 2023. Net income in 2023 was 314M pesos. Net debt increased 5% in 2023 and currently sits at 2.9 times EBITDA.

Providing broadband infrastructure should be a relatively stable business. Given the significant leverage, the riskiness of the share price increased. The long-term share price performance of Axtel is poor.

Recently the stock price however has seen some light and increased over 150%. Using EBITDA of 3.4B the market cap of 4.8B plus net debt of 9.1B means the EV to EBITDA ratio is still a relatively undemanding 4.1. The company can also benefit from wealthier Mexican consumers who can afford more expensive broadband.

The risk with these kinds of assets is the depreciation charge and the longevity. Historically the company has not been able to deliver sufficient returns on investment. It might be cheap now, but I’m not sure the value will come to shareholders. Free cash flow has been limited and looking at net income the stock has only in 2023 shown some decent profits.

The company initiated a 100M share buyback program and is optimistic about the future. Axtel is benefitting from higher demands for data, which with the current hype around AI might have helped the stock as well.

Interesting company. Difficult to assess the quality of the business for me. Leverage is significant, but this can also amplify the results to the upside. Growth profile looks better than that of America Movil. If anyone has more information on Axtel please share. I might do a more in-depth analysis.

Banks

Banks are not popular investments for most investors. They find them hard to analyze and/or have been scarred by the Great Financial Crisis. Personally, I have a great track record with investing in banks. First with Bank of America on the tail coats of Buffett, more recently in Japan, and with Good European banks like ING and BNP Paribas. See here my article on ING and European banks.

So far I always stayed away from banks in emerging markets. Not that I was not interested, but I preferred the banks in developed markets. The low price to book ratio of banks in developed markets and the benefit they got from interest rates moving away from 0%.

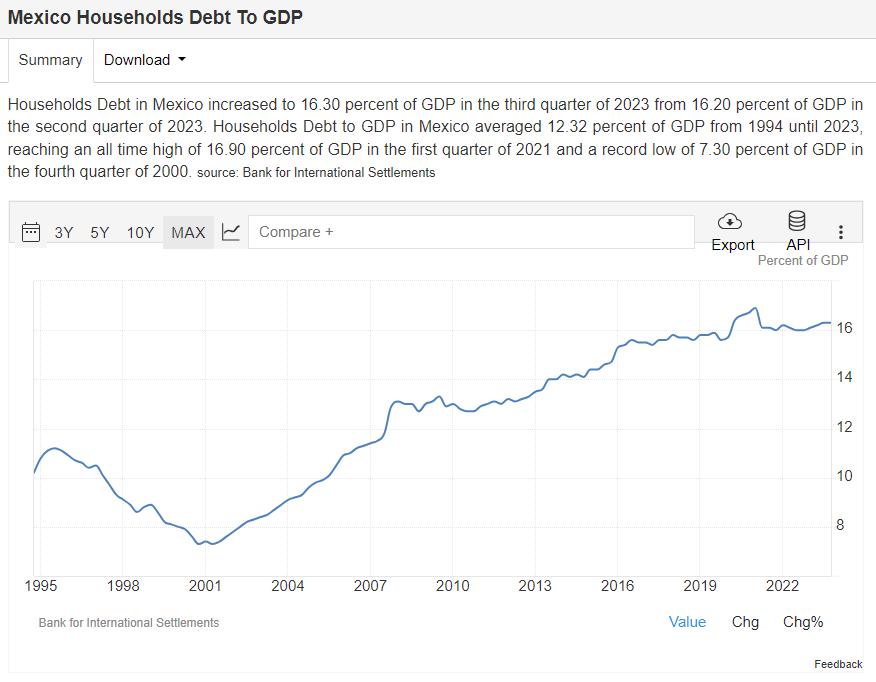

Emerging markets promise more growth. Especially markets with low debt show possibility for growth. Household debt in Mexico is still fairly low, which gives opportunities for banks to grow their business.

Growth is only valuable if there are sufficiently high returns on equity. Too many companies focus on growth, but actually destroy value in pursuing it. High return on equity will however attract competition and regulatory scrutiny (see FT article). Until now I never have been very interested in banks in emerging markets. Looking more closely at Mexico might change my opinion.

5. Banco del Bajio

Banco del Bajio can be described as a great bank. Return on assets employed is 25.9%, efficiency ratio is 34.0%, and the bank is showing continued growth. Price earnings ratio is low at 6.6, price to book is 1.6, and dividend yield is 7.1%.

Banco del Bajio is a commercial bank focused on Corporates and SME. This comprises a surprisingly high 84% of the loan book. 51% is related to working capital, 23% to fixed assets, 8% to commercial real estate, 6% to government infrastructure, 6% to financial institutions and 6% to housing real estate.

With 24% a surprisingly large part of the loans is to commerce, restaurants and hotels. This might be normal for emerging markets with a large tourist sector, but it surprised me somewhat. Not the safest sector to lend to, but not a dealbreaker. Compared to other banks Banco del Bajio has a focus on agriculture, but with 15% of loan book, compared to 5% I actually like this focus.

On the consumer side the company is focused on credit cards 39%, payroll loans 38%, and personal loans 18%. I like the fact that Banco del Bajio has very limited mortgage exposure.

Credit rating

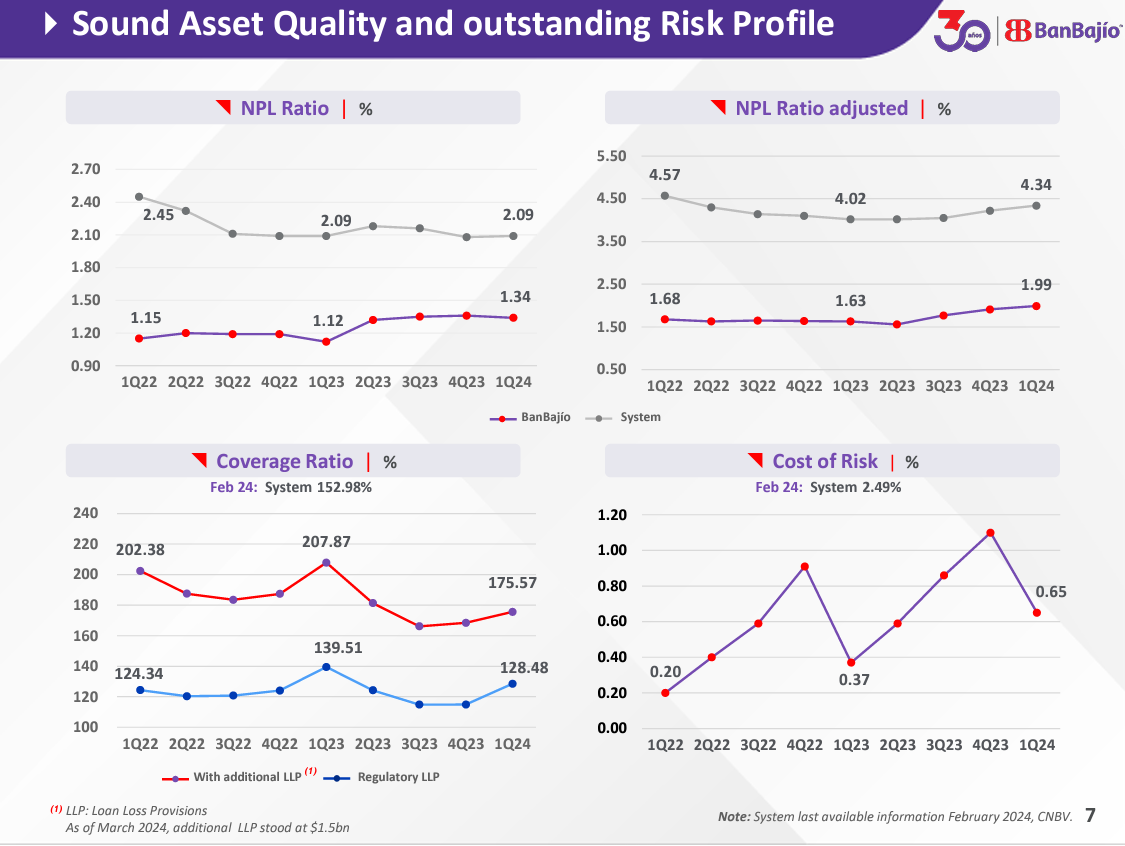

credit rating is good with AA+ .mx (Baa2 for Moody’s). The causes for its good rating are a good Nonperforming loans ratio at 1.34% and strong Cet1 capitalization at 16.9%

There is however one thing I don’t like about Banco del Bajio and that is that loans with 235B pesos are equal to deposits at 236B pesos. I prefer banks with a strong deposit franchise. This might be more common in emerging markets though. Having it in balance is also not that bad. A good thing is that deposits have been growing more quickly in Q1 with 13.4% vs loans at 8.7%. This means this downside will quickly become less meaningful.

Banco del Bajio what are sustainable returns

The current ROE of 25% is in my view not sustainable. The good thing is it does not have to be to make this a great investment. The great returns at Banco del Bajio are partly created by:

the high interest rate environment in Mexico

Low inflation

Benign credit environment with low levels of bankruptcies

Good performance of Banco del Bajio

The high interest rate environment might not last, but banks can make decent money in all kinds of different environments as long as interest rates are not negative. Given they operate on a spread basis. That being said a high and stable interest rate environment is favorable.

Especially if inflation is low. This makes saving products attractive and does not dilute the equity of shareholders.

Benign credit environment leads to low losses.

My greatest worry is about the competitive position of Banco del Bajio. It is the 8th largest bank in Mexico. This does not sound like a position that is great for making above average amounts of money.

Still the bank manages to make great returns while having a conservative balance sheet. Apparently, this is due to a good risk culture and good relationship banking. Hopefully someone can help me understand their performance and competitive position better.

Given that Banco del Bajio still managed to get an ROE of 10.3 in 2020 with Covid-19 hitting the economy and tourism I think a long-term average ROE of 15% would seem conservative after a couple years of normalization. The first couple years would potentially have even higher returns boosting total returns for shareholders.

Banco del Bajio compared to my bank investments

So far, I have made my money in banks by buying them below book and with the idea that ROE would increase again from 8% to 12%. At 12% the banks should at least trade at book value given the return profile. Profits came from all sides (better performance, higher valuation, dividends and retained earnings).

This all lights on green approach is nice, but not necessarily the best method. Long term returns are coming mostly from the return on equity. I was using Graham’s cigar butt strategy. Buying decent businesses at a wonderful price and getting good returns this way. Banco del Bajio offers potentially a great business at a fair price, due to its high Return on equity.

To show the difference higher return on equity makes here a simple example.

Banco del Bajio 15% ROE: trades at 1.5 x book value, pays out 50% of profits as dividend, and has a return on equity of 15% (pe of 10). Return is 5% dividend plus 7.5% growth through retained earnings.

Banco del Bajio 12% ROE: trades at 1.0 x book value, pays out 50% of profits as dividend, and has a return on equity of 12% (pe of 8.33). Return is 6% dividend plus 6% growth through retained earnings.

Banco del Bajio everything stays great scenario. 24% ROE: trades at 1.6 x book value, pays out 50% of profits as dividend, and has a return on equity of 24% (pe of 6.67). Return is 7.5% plus 12% growth through retained earnings.

Even with compression of ROE to 15% and the price to book ratio total returns for shareholders might end up being higher in the long term for holders of banks with higher return on equity.

6. BBVA

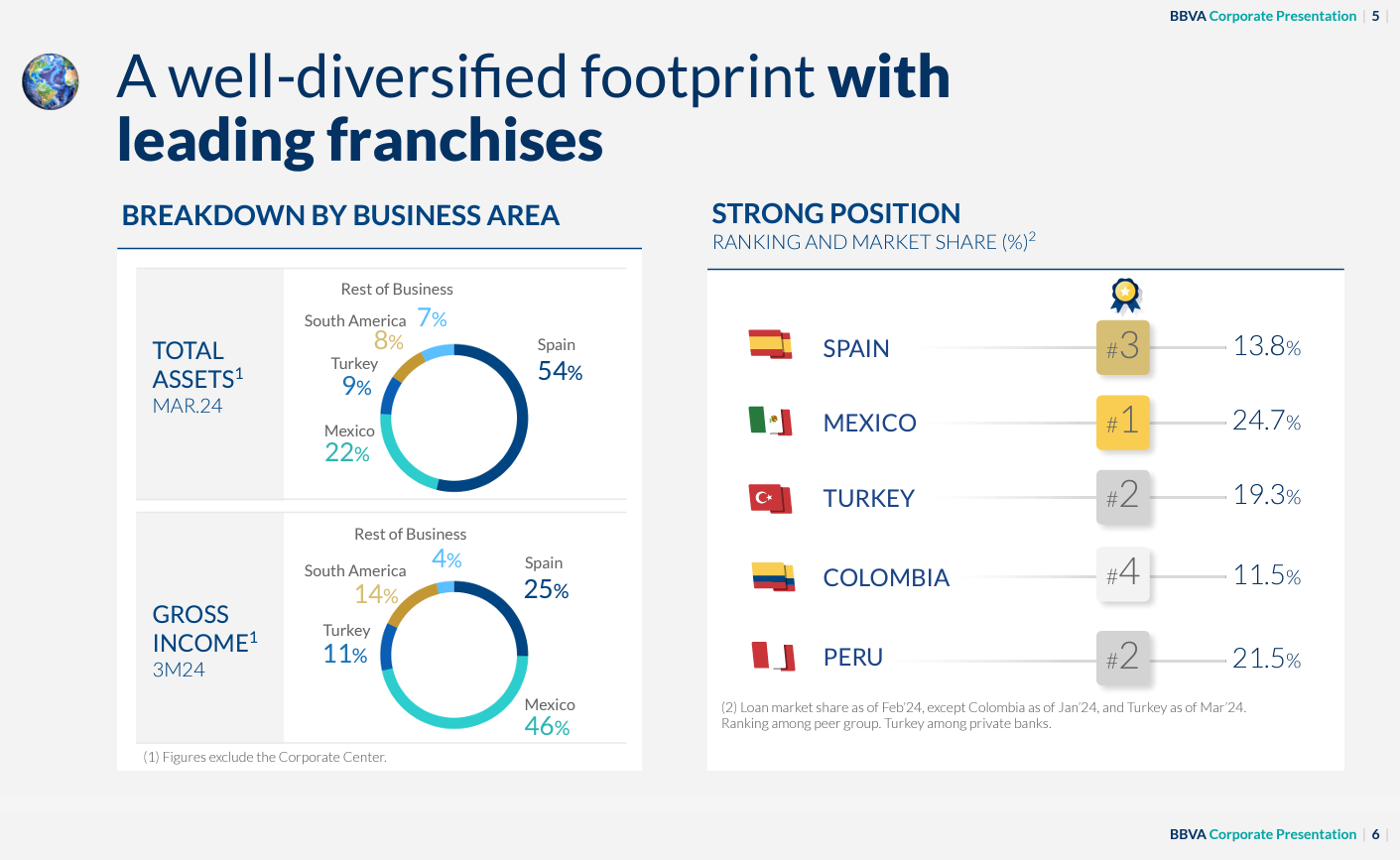

The largest bank in Mexico is BBVA. This is actually a Spanish bank, but also has a listing in Mexico. Given my interest in the previous bank it makes sense to analyze BBVA to compare it to Banco del Bajio. Returns on tangible equity is 17% for BBVA (ROE is 14.8%), price earnings ratio is 7.4, price to book is 1.1 and dividend yield is 5.5%.

Efficiency ratio in Mexico is a great 30.0% but returns in all other segments is less good. On average the efficiency ratio is still a decent 41.2%. The superiority of the Mexican franchise can be seen clearly from the slide below.

Cet1 capitalization is 12.8%. This is on the low side given the exposure to emerging markets. Credit rating is strong with A3 of Moody’s and A by S&P.

BBVA is proposing to merge with Sabadell. Another Spanish bank. This would create a stronger number 2 behind Santander (quite some mergers in Spain recently, but still quite some banks left, I like markets with high concentration.

I like the combination in Spain I don’t think they got a great price. In addition, Sabadell has exposure to the UK which is not very attractive (not a strong market position).

Another downside is they get a not insignificant part of their profits from markets with high inflation (Turkey, Colombia, and Argentina) this inflates the profitability of BBVA somewhat.

Overall BBVA is a decent bank. They are more of a generalist and have some exposure to markets I like less. They benefit from the heavy exposure to the Mexican market. I do not like themselves comparing to European banks and saying they outperform.

Another bank investors might want to consider is Grupo Financiero Banorte, which will be discussed in a following article.

Conclusion part 3

Telecom stays a very competitive business. Which means that it is uncertain if the benefits of investments will come back to investors or if all the benefits will go to the customers.

Banks however are still unpopular with investors but offer potentially great returns for shareholders.

The Mexican election result caused a drawdown in the Mexican stock exchange. After doing my research I decided this was a good time to buy some shares in Banco del Bajio.

Next article will not be in this series, but on a more well-known company that was my largest position in the portfolio by far (Berkshire Hathaway).

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Great article!

On Banco del Bajio´s competitive position,

I do not see a problem with the bank being the 8th largest one. The history of Mexico´s banking industry is very interesting, historically the government has significantly limited competition. In 1994 the banking industry was privatized, with Carlos Salinas de Gortari stating that new banking licenses would be very limited. Limited competition has made Mexico one of the most profitable markets for banks in the world. I recommend checking out margin.mx by Whitepaper, they do great deep dives on the banking industry.

I am curious to analyze how the industry's cost of funding has changed in recent years with the rise of fintechs. Most of these companies do not lend money, but they do take deposits, and offer very high returns. Recently, Nu Bank offered 14.75% interest rate on deposits. These companies have entered into a "price war" funded by VC capital and taking advantage of their lower cost structures.