More hidden gems in Mexico P5

An even better way to play a construction boom in Mexico & an in depth analysis of Tequila manufacturer Jose Cuervo. Anyone interested in Chemical stocks? please comment.

Part 5 in a series covering all Mexican stocks. Uncovered some interesting companies. Enjoy a writeup on 7 new companies. Including a very profitable cement company, a chemical company with strong growth and the world’s leading tequila manufacturer.

Cementos Moctezuma: Mexican cement company. Market cap 66.4B pesos, 7B pesos net cash. 10.3 times earnings. Pure play exposure to Mexico with a nice shareholder yield. Dividend of 6.7% plus share repurchases.

Great company that benefits from more construction in Mexico. Like it more than Cemex due to its balance sheet strength. Downside is no aggregates exposure.

Returns on capital are great with net profit of 6.2B pesos on 17B pesos of total assets. Given the cash balance return on invested capital is 59%.

Company is controlled by Buzzi Unicem & Cementos Molins (an Italian & Spanish cement company). I have done some research on Buzzi Unicem and like their management. Explains also the significant distributions of dividends and lack of empire building at Moctezuma.

More details on Cementos Moctezuma can be found in this great article of Dola Capital. Agree with most of his points. Better transportation is a double-edged sword though. Given that it allows increased competition between cement factories.

Biggest question that remains is how demand & supply for cement in Mexico will develop? Is the current profitability sustainable. If construction increases even more (not unlikely) this will be a nice tailwind for Cementos Moctezuma. So far most of the foreign investments have focused on industrial real estate. If residential real estate construction increases Cementos is well positioned to benefit.

Does someone have a more in-depth view on the Mexican construction market & the demand for Cement. I found some research reports online that forecast a 3+% annual growth rate for the next decade. Sounds pretty promising.

Another risk is for cement companies in general is the amount of Co2 released in its production. Heidelberg Cement for example already changed their name to Heidelberg Materials. A risk for cement companies is that the demand of cement might not follow the construction trend.

Interesting company. Not sure about the future margins on cement in Mexico. If someone has some inside into this, please let me know. If margins can stay at this elevated level or grow a bit this is a buy in my opinion.CMR SAB is a Mexico-based company primarily engaged in the management of restaurants. Market cap 902M pesos. Can only find the results of 2022. Restaurants are a difficult business. Do not like the diversity of brands (9). Focus is key in such a competitive industry. No knowledge that adds value: pass.

Convertidora Industrial SAB is a Mexico-based company engaged in the production, distribution and sale of plastic film for food packaging and articles used for party's decorations. Market cap: 156M pesos. Last profit in 2021. I don’t like this kind of commodity producers that have not generated a profit in the last two years. Pass

Axtel SAB is a telecommunications services provider. Market cap 4B pesos. Significant net debt of 10B pesos. Net income was 314M pesos. Building out fibre is not cheap. Returns on these investments are not clear enough for me. The combination of these kind of investments and an emerging economy are not an attractive combination. Not even when the World Bank loans them money. Debts in USD is an additional risk that will bite them now the exchange rate dropped.

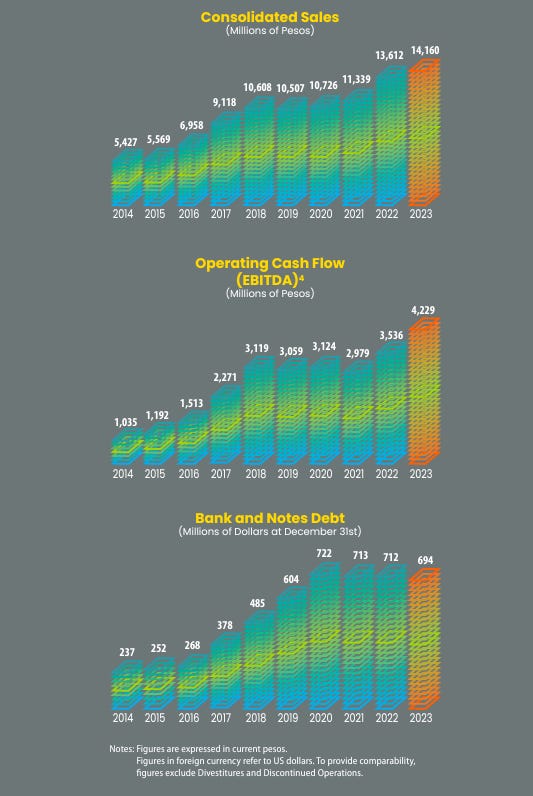

Becle SAB (Cuervo). Beverage producer known for the Jose Cuervo Tequila. Market cap 116B pesos. Net debt 17.5B pesos. Spirits has historically been an attractive industry with good returns. Tequila has been a strong growing category in the industry. Sounds attractive? It is. You have to pay 25.4 times earnings for it. This is more than spirit market leader Diageo at 18.3 times earnings, Pernod Ricard 16.3 times earnings and even Brown-Forman (Jack Daniels) at 19.5 times earnings. Looking at their own presentation I see them not realizing great EBITDA growth.

In general, the whole spirit industry seems to be in a bit of a downturn (at least their stocks). The same problem is not prevalent in beer producers. Does anyone have more knowledge about this? My only hunch is that investing in whisky became somewhat popular and that this bubble is deflating. See article Forbes & Financial Times. Personally, I always found the investing in spirits as an investment quite bizarre.

Another reason might be that people during Covid-19 drank more spirits and are now reverting back to their normal (declining) consumption of alcohol.It might also be the same reason other branded goods are struggling. It is just easier to create new brands, which undermine the value of existing brands. Interesting though that the current share price declines are specific to spirit companies.

Anyway, I’m not willing to pay 25 times earnings for a company that is not growing its bottom line. I am interested in better explanations of the strong decline in spirit stocks though.Cydsa SAB is active in Chemicals. The production and distribution of refined edible salts, industrial salts, caustic soda, chlorine and refrigerant gasses. Market cap 10.7B pesos. Net debt of 9.8B pesos.

The historic results have been surprisingly consistent and profitable.

The valuation is not expensive with 5.3 times earnings. The company is investing in expanding the production capacity as well and pays a 3.1% dividend.

The stable historic growth of EBITDA might mislead investors somewhat. This is still a chemical company. Q1 2024 showed a drop in net income from 475M pesos to 260M pesos. Given the cyclicality of the business and my lack of understanding of the situation in Mexico I stay away.

I do think the chemical sector might be an interesting sector to look into though. The sector has been harshly beaten. Pretty sure some great investments are given away.

Anyone any gems to share? I might have to do some more research into Solvay (Einhorn idea).Dine SAB de CV focuses on the construction and promotion of residential and touristic properties, as well as development of large-scale commercial spaces. Market cap 17.9B pesos. Equity only 2.9B pesos and profitability is not consistent. Not a fan of large construction projects. Pass.

Conclusion

Covering Mexican stocks I’m a little more critical than normal on certain aspects of the business. I’m taking some country risk and have clearly less knowledge of the place. This means I’m less willing to invest in very cyclical stocks, because it is more difficult to judge the cycle (I’m still comfortable with buying a Mexican bank, which might surprise you, but I think Mexico currently a low risk of a credit crisis). In addition, I can find cheap cyclical stocks in markets I know better. This leads me ignore potential gems like Cydsa and to a lesser extend Cementos Moctezuma. A pure specialist in the Mexican market might find value in them (or not given that he sees risks I’m oblivious to).

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Looking a bit more into spirit manufacturers. It is not a pretty sight.

I guess all industries are cyclical to some degree. I learned once that industries with long lead times (think of putting whisky in a barrel for 20 years) are more cyclical than industries with short cycles. Demand is just a lot harder to predict 10 years out than 1 month. Misjudgments lead to a gap between demand and supply, which creates cycles.

Anyone an insight into how these cycles in the industry develop?

Or maybe a good book recommendation on this topic?

Spirits have been taking share from wine and beer. Plus historically returns on alcohol companies have been great. Tequila is one the fastest spirit categories, which sounds particularly interesting. In the end it is all about demand & supply though.

(look at the article for more details)

Good read