Real estate at 0.12x book & interesting financial companies. Mexico part 9.

In Mexican stocks there is incredible value at the surface. If you look under the hood you find surprises. Good, bad & strange.

In part 9 of my series covering all Mexican stocks I found many stocks trading at low valuations. Gicsa is a real estate company trading at 12% of its equity value.

Financial companies trade at low earnings multiples and reasonable price-to-book ratios. The market is scared about Mexican politics. The funny thing is that the market is quite volatile in this regard. I’m not an expert on Mexican politics but I think a richer Mexican population is more likely to defend things like property rights, freedom of expression & democracy.

The recent negative sentiment around elected judges is somewhat overdone in my opinion. I do not think elected judges is a great idea but do think that it is manageable. Judges are still elected for a 12-year period, a considerable time which will give them considerable independence.

Grupo Financiero Banorte

Market cap 410B pesos. Total assets 2,275B pesos, net income of 52.4B pesos & 249B in shareholders equity. Banorte is the second largest bank in Mexico behind BBVA with a 14% share in deposits & 15% in loans. The bank is a universal bank with an asset management & insurance arm as well. ROE is 23.3%, a cet1 ratio is 14.1% & a BBB credit rating by S&P (Baa2 by Moodys). Coverage ratio is good as well with 181%.

The company has significant exposure to government, mortgages & cars. All segments that are more commoditized than commercial loans. This leads to a NIM of 4.8% created with a good efficiency of 35.5%. Still this compares unfavorably to the 6.9% NIM 33.7% efficiency ratio Banco del Bajio realizes. in Q2 24. Personally, I liked the more focused exposure of Banco del Bajio plus the lower valuation. More on Banco del Bajio & BBVA here.

Conclusion Banorte

Banks in Mexico are clearly earning great money at the moment. This will probably get less in the future, when interest rates decline. Even then returns should be satisfactory. Paying 1.65 times book & 7.5 times earnings for a well-positioned quality bank that earns 23.3% of equity is a fair deal. NIM will probably decline leading to a lower return on equity of 18-15%. This still leads to satisfactory returns.

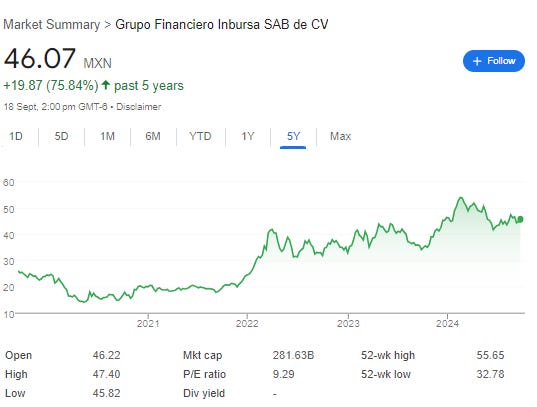

Grupo Financiero Inbursa

Market cap 273B pesos. Total assets 758B pesos, net income 31B pesos (2023) & shareholders’ equity 240B pesos. Book value looks attractive but intangible assets are 56B pesos. No price to tangible book value is 1.48 times.

Banco Inbursa is focused on commercial loans with a balance of 343B pesos on a total loan balance of 446B pesos. What I don’t like is the 80% acquisition of Cetelem on 31 March 2024. This company that is specialized in car financing was acquired for 9.0B pesos & 1.44 times book (57B pesos of loans). This greatly increased the exposure to cars at a rather peculiar time in the cycle.

Inbursa is an atypical bank. The company is controlled by Carlos Slim. The bank has a great operational track record growing and creating value.

Banking is still the dominant business of the company, but the Inbursa is more than just lending money. Inbursa has a strong asset management component in addition to being the number one in assets in custody with a 27.5% share in Mexico. I like this part of the business because it is not negatively affected by lower interest rates

I was not surprised to find an investment portfolio within Inbursa. The total value is 18B of which 10B pesos is related to infrastructure.

The balance sheet is extremely strong. Tier 1 captial is 22.3% & equity is 31.9% of assets. The coverage ratio is not very high at 142.1% but given the capital position not of great concern.

Conclusion Inbursa

Inbursa is mixing strong operational performance at the bank level with overcapitalization & as investment portfolio. This is an interesting mix especially in the hands of an able capital allocator as Carlos Slim. The strong position in asset management is a nice bonus. That being said I’m not a big fan of their latest acquisition which strongly grew their position in car financing. This is clearly a company I will keep following. Might be an interesting company that is able to benefit from a downturn in financial markets.

Grupo Gicsa

Market cap 3.4B pesos. Total assets 77B pesos, 27.5B pesos in net debt & 27.8B in equity. On an asset basis Gicsa looks very attractive. Grupo GICSA SA de CV engages in the operation, construction and management of real estate properties. The firm focuses on the operation of shopping centers, corporate offices and industrial warehouses.

Grupo Gicsa is more of a real estate owner than a developer. This is a good thing (less risky). 1.7B of net profit in 2023 looks great. 2.0B of that is due to higher valuation of the properties. Not sure how realistic this is. High interest cost eats up a lot of the rent. Could be that growth in rent is the cause for higher valuation.

Grupo Gicsa has one of the most depressing stock price charts ever. So the market clearly does not see value being generated here. Do not like that the company is dependent on higher real estate valuations for a profit. Pass.

Grupo Industrial Saltillo SAB de CV

Total assets 20B pesos, equity 9.6B, market cap 6B & 2.6B of net debt. Loss making in last 12 months. No big profits since 2020.

GIS is a company with presence in Mexico, Europe and Asia, we are oriented to design, comfort and security solutions for our customers in the world.

We manufacture and market products for the industries of:

Auto parts, iron and aluminum castings, machining for brake, engine, transmission, and suspension systems.

Housewares, A wide range of kitchenware, tableware and counter top kitchen appliances

Company is active in very competitive industries. Do not see their competitive advantage. High capital investments needed to stay competitive. Auto parts is very cyclical and 2024 does not look good. Dividend does not look sustainable to me. Divested their ceramic tile business in 2022 to lower debt. Hard pass.

Grupo Nacional Provincal

Total assets 214.3B pesos, equity 16.8B pesos, market cap 31.3B pesos. Net income 4.7B pesos in 2023. GNP is a leading insurer in Mexico. It is number 1 with 12.5% market share in premiums. Looking at profitability it is number 3.

The company is using 16,900 agents to deliver their insurance products. In addition to this it has partnerships with other organizations like banks. Going forward I’m inclined to think that these middlemen will be replaced by technology. The most successful insurers in the developed markets are quite often direct insurers like Admiral & Progressive. How GNP will manage to transform itself is unclear to me. That GNP is a leader in premiums but not in profitability is not great. that its market share of profits & premiums is decreasing is not great either.

4.7B pesos in profits on a 31.3B pesos market cap is not bad. I do think that GNP with its massive insurance premium does benefit somewhat from the high-interest rate environment. GNP is controlled by Grupo Bal. That being said I would feel more comfortable with an integrated bank like Banorte or Inbursa. With insurance it is paramount to know a bit more about their underwriting culture and this is difficult for me to get comfortable with. Pass.

Grupo Palacio de Hierro

Total assets 55.7B pesos, equity 22.6B pesos, market cap 16.6B pesos & net debt 2B pesos. Company is consistently profitable except for 2020 (-1B pesos). Result for 2023 was 2.6B pesos.

This looks all pretty good. The loss in 2020 might have already given it away though. This is a department store business. Departments stores are a difficult business. In more developed markets they have suffered from competition from online & more focused retailers. Company clearly needs to invest a lot to keep its stores in great condition to attract high end brands and customers.

The company is controlled by Grupo Bal which is owned by Alejandro Baillères Gual & family. They also control Grupo Nacional Provincal. Alejandro Baillères Gual is also vice chairman Industrias Peñoles, known for its silver mines.

Property is valuable but repurposing is difficult. Not an industry I’m attracted to but the valuations are probably enticing to certain value investors. The dividend is decent with a 7.2% yield, but that is lower than you get on Mexican government bills. Pass.

Grupo Profuturo SAB

Total assets 124B pesos, net tangible equity 7.7B, market cap 27.4B pesos & net debt 1B pesos. Net income 3B pesos.

Profuturo’s businesses are structured into four areas:

Profuturo GNP Afore, which specializes in the management of retirement pension plans.

Profuturo GNP Pensiones, which focuses on the operation of individual capitalization accounts and annuity plans.

Profuturo GNP Fondos, active in the investment and collection of its clients’ contributions

Profuturo GNP Prestamos, involved in the provision of personal loans.

The Company is a member of Grupo Bal SA de CV. Difficult for me to get comfortable with the grouping of businesses around Grupo Bal. Asset management can be a great business but the dependence on GNP is unclear to me. The company does pay an attractive dividend but the prospects are not clear to me. Pass.

Conclusion

In Mexico, it is easy to find discounted stocks. The trick if getting comfortable with the reasons for undervaluation. Not all controlling shareholders are equally capable. Certain structures make significantly more sense than others. Some real estate looks incredibly cheap but is not generating any cash flow.

Banks in Mexico are an attractive place to be, I think. Mexican banks have growth opportunities that banks in the developed world can only dream of. This allows for good growth combined with high returns & dividends. The question is do you think those good times will last and change in the future?

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Some of these companies are incredible, although a few will surely value traps. GICSA looks ridiculous, if only you could convince them to liquidate.