More gems from Mexico

6 Mexican stocks covered including 3 with a price-earnings ratio below 7. One high potential gem named Medica Sur.

In my quest to cover all Mexican stocks here is the next group in the series.

The cheapest ones in my opinion are El Puerto de Liverpool, Medica Sur & Megacable. Give special attention to Medica Sur. This company has a lot of things going for it and a cheap valuation is only one of them.

1. Grupo Lamosa

Producer of wall & floor tiles. Stock had a strong performance due to covid-19. Apparently, there was strong demand for home renovations in Mexico as well during this period.

Results for the 9 months in 2024 are not great with earnings down 95% to 132M Ps.

Top earnings in 2022 was 4.2B Ps. This is not enough to get me interested. The company is cyclical and has too much debt.

2. Sitios Latinoamerica SAB

Sitios is a tower company. I do know this type of business quite well having analyzed American Tower and having invested in Cellnex pre-covid.

The stock returns for Sitios are quite disappointing. It looks like the stock was in some sort of bubble valuation. I Like the business but at a more reasonable price.

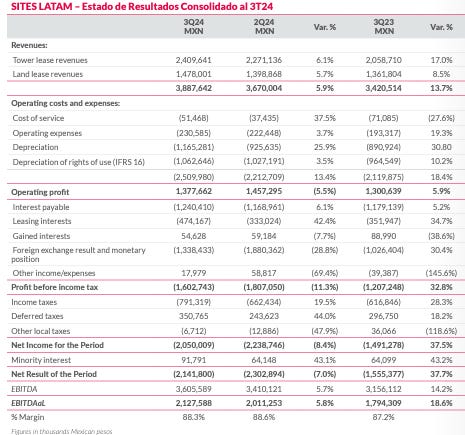

Sitios is printing too much red ink for me. I know that depreciation can be misleading for tower companies but these losses are too big for me. 56B Ps. in net debt is too much for my liking. Icing on the cake is that the business is too dependent on America Movil. Pass. If you like tower companies China Tower Corp might be of interest to you.

3. El Puerto de Liverpool

El Puerto de Liverpool is a large retail company. Liverpool in the last 12 months had 207B Ps. in Revenue & 22.1B Ps. in net profit. The company managed to be profitable in 2020 which is an achievement for a retail company. Profits have been increasing but difficult for me to say if they keep this upward trajectory. Net tangible equity is a healthy 142.6B Ps. Almost in line with the market cap of 147.4B Ps.

The company does not only get revenue from the shops but also as an owner of real estate and through credit cards. That being said I think it is fair to judge the company as a retailer.

Not sure how well Liverpool fits with the richer Mexicans theme. Since richer Mexicans means also higher wages for Liverpool employees.

Personally, it is difficult to judge the competitive position of El Puerto de Liverpool. 6.4 times net income is an attractive valuation, but I have difficulty assessing the future profitability of a company in such a competitive industry. The company is also investing significantly in growth in I’m not sure what kind of returns the company aims for and what kind of returns I think are realistic. Personally, I’m more comfortable with retail companies that have a more specific niche. Even if that niche is as broad as a supermarket.

Given the difficulty to assess the sustainability of profits going forward I pass on El Puerto de Liverpool.

4. Medica Sur

Médica Sur Tlalpan is a highly specialized private hospital. Arguably the best in Mexico. To me it looks like a clear gem if you can get comfortable with owning a Mexican hospital and can evaluate the durability of their profits.

The company has good capital allocation selling their laboratories at a good time. The company has also been rewarding shareholders with special dividends in the past.

Gabriel Tamez had a good writeup on Medica Sur September 2023. The company has performed well since then, but the share price has gone down (7.5 times earnings has become 6.7 times earnings).

With a valuation of 3.7B Ps. Medica Sur is trading at 6.7 times earnings. This looks very attractive.

Richer Mexicans means more demand for better healthcare services. In addition, Medica Sur is well positioned to benefit from growing medical tourism.

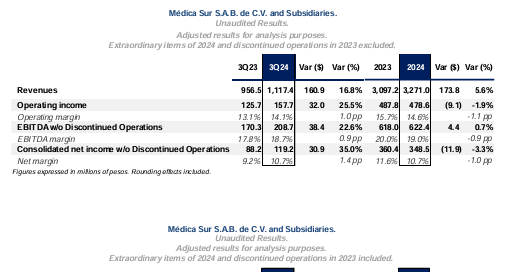

The most recent Q3 results look good but YTD profits show signs of stagnation. If you exclude the extraordinary items of 2024 and discontinued operations of 2023.

Including them gives a different picture from a percentage change perspective. Just looking at the raw 9-month number the result is quite similar with 347.5M Ps. and 326.5M Ps. I think most of the corrections are fair given the major divestment that Medica Sur did.

The balance sheet has become rock solid due to the increasing cash balances. The company is now operating without any leverage and with significant real estate.

Politics might be an issue. Claudia Sheinbaum is a clear outspoken in favor of better public care. If this has negative consequences for private hospitals like Medica Sur is unknown at this point. I have not found any direct negative comments on private hospital care but better public care might become a better alternative to care delivered through Medica Sur. This risk seems somewhat manageable to me.

Conclusion on Medica Sur

Very interesting company that fits well with the richer Mexico theme. Will have to do some more research on the Medical sector in Mexico and private hospitals in particular. Valuation is attractive, management seems good and the balance sheet is strong. Very interesting.

5. Megacable Holdings

Megacable is a Mexican broadband company. It is a clear number two behind América Móvil which I analyzed here. While América Móvil is the dominant player in Mexico I like Megacable more. There are two reasons for this:

Megacable is more focused on providing broadband. This is a better business given that customers have usually fewer options and are locked into one provider of fiber (when there is overbuilding this ruins the party for everyone).

Valuation. Megacable is trading at a price earnings ratio of 6.8. This looks attractive and is combined with a 7.6% dividend yield. Looking at the numbers of the company the net profit in the last 2 months was 2.5B Ps. Still attractive but not a P/E ratio of 6.8. Price to book ratio is roughly 1 with equity of 35.2B Ps. Goodwill and intangibles are manageable 5.3B Ps.

I like the valuation and my first thought is that the risk of overbuilding fiber is probably lower in emerging markets given the higher cost of capital. Looking more closely at the providers I’m not 100% confident this is the case. There are 4 big providers in Mexico which all had expansion plans. This might have created significant overbuilding. There are other risks with companies like Megacable though. These in my mind are:

Dependency on other income than broadband. For example, from declining video subscribers or poor DSL quality internet subscribers. It is a good sign that Megacable increased the percentage of internet subscribers using fiber from 59% in Q3 2023 to 73% in Q3 2024. Internet subscribers increased by 13% in a year this is quite good in my opinion.

Debt. The company has invested heavily in building out its fiber network. This in combination with the dividend means that the net debt has increased substantially from 4.5B Ps. end of 2021 to 22B Ps. end of Q3 2024. This is a huge increase. Net debt is still manageable at 1.54 times EBITDA. So far, the market has not liked these investments, and the value of the share price has halved in 5 years. The good thing is that the peak of their expansion project has passed.

Increasing debt means that cash flow has not been great. High investments are the cause. Capex of 33.5% of revenue is still very high. In addition, because of all the growth the results will increase in the future when new growth projects mature. For 2025 capex will be steady but dropping to slightly below 30% of revenues. In 2027 the expansion project is completed and this should lead to sustained higher profitability.

Patches AKF does a good job in this article to show you the potential final state and corresponding valuation for Megacable. The worry that I have is that competition from the other providers (primarily expansion by America Movil & Total Play) will prevent Megacable from achieving and keeping this higher level of profitability.

Total valuation of the Megacable business including net debt is $2.8B. This does not look too much for a growing 5M+ internet subscriber base and 17M homes passed. This is $165 per home passed and $560 per internet subscriber. Getting 3.9M video subscribers, 4.6M mobile subscribers and the corporate business with 4.2B Ps. in revenue in 9M 2024 for free.

The valuation for Megacable compares very favorable to Charter Communications that has an enterprise value of $151B for 58M homes passed ($2,603 per home passed) and 30.3M broadband customers ($5,033 per broadband customer).

Naturally broadband connections are more valuable in the US but the difference is quite extreme in my opinion. A slight worry is that the number of clients per connection at Megacable is quite low at 29.4% compared to the 52.2% of Charter Communications. Megacable has more room to grow but competition to overbuilding of broadband fiber is a potential risk.

Conclusion on Megacable

Megacable is an interesting company that primarily provides broadband connection. The company has been investing in a major expansion but has managed to keep a decent balance sheet.

When the expansion is complete free cash flow should increase substantially. 2027 is still quite far away though and additional competition might result in a less favorable situation than planned. The share price looks low both from a profit and an asset perspective. The company does fit well with the richer Mexican consumer theme. Lower interest rates would also be helpful. Given the amount of competition and the amount of overbuilding I have some doubt about the future profitability of the Mexican market.

Given my limited knowledge about the Mexican market I will not initiate a position but do like Megacable a lot better than America Movil or Sitios Latinoamerica.

6. Minera Frisco

Minera Frisco is a Mexican mining company. Since 2020 the company was only profitable in 2022 with a profit of 975M Ps. Net debt is 17.5B Ps.

Minera Frisco focuses on Copper 31%, gold 27%, zinc 21%, and sliver 17%.

Minera Frisco is producing too much red ink. Losing 783M Ps in 2023. Profitable in 2022 but bigger losses in 2021 (1.8B Ps.) & 2020 (5.2B Ps.).

The combination of losses and a high net debt of 17.5B Ps. make Minera Frisco not attractive to me. If interested in mining in Mexico I would look at Grupo Mexico the controlling shareholder of Southern Copper.

Conclusion

Continuing on my journey of studying all Mexican listed companies I learned quite a bit again. I was especially surprised with the competitiveness of fiber in Mexico. Luckily the study uncovered also a company that looks like a true gem. Megacable clearly has potential but I’m not fully convinced.

It is Medica Sur that combines a strong balance sheet, low valuation and good future prospects. A bonus is that medical companies are less cyclical. Medica Sur might at some point be added to the portfolio. If anyone has more knowledge about private hospital care or the healthcare situation in Mexico please contact me.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Thank you for the write-up. I came across your substack by searching for some insights regarding Sitio Latinamerica. I am new to the tower business, so appreciate your insights! I like the leverage of the bet, an increase in EV equals a 10x increase in marketCap. Interest payments don’t seem of any concern in the near future. Seems that there is a lot of selling pressure from the spin-off. But I have difficulties valuing the assets. My rough estimate is between 4.9B and 6.9B EV. + I am missing a catalyst. Looking at its previous Spin-Off Telesites (SITES - Operadora de Sites Mexicanos SAB), which is the Mexican equivalent to SITIO Latinamerica, there hasn’t been any appreciation for the assets so far…

Medicar Sur seems very interesting at current valuation and private hospital servics are big through central and south america. Wil likely do some more research.

Thanks again Wubbe, I hadn't come across Medica Sur but it looks too cheap at a glance. I have followed Megacable for some time and like the set-up there. My experience with these Latam telecoms has been mostly very frustrating, but I can see it doing very well over the long-term.