Mexican bottler magic & retail gem. All Mexican stocks P6.

Cheap bottler Cultiba vs FEMSA. investing in micro lending, cash advance services or a normal bank? Quick look at retail gem Farmacias Guadalajara.

Continuing on my mission to cover all Mexican stocks. In part 6 we have some very interesting companies. I will discuss bottlers more in detail with a very interesting opportunity. To finish of part 6, I will discuss a retail gem with great historic results and a reasonable valuation.

Cultiba:

Market cap 8.5B pesos

Cultiba owns 40% Grupo Gepp, the exclusive PepsiCo bottler in Mexico. In Mexico there are 3 main bottlers: Arca Continental (discussed in part 1 of my series), Coca-Cola Femsa (stock 3 of this article), and Grupo Gepp. EBITDA 2023 for Grupo Gepp was $8.4B pesos ($3.3B pesos for the 40% of Cultiba).

Valuation

This directly got my attention, given that a stable bottler is trading at slightly above 2.5 times EBITDA and a price to earnings ratio of 8.

The balance sheet is not a problem in my view. Grupo Gepp has $6.0B pesos of net debt, but this is less than 1 times EBITDA. Cultiba itself actually has $2.3B pesos of net cash with no debt.

Grupo Gepp like the other 2 Mexican bottlers is consistently profitable and gets decent and increasing returns on capital. This is partly related to the $4B investment in the Mexican market in 2019 by PepsiCo and its bottler.

The Mexican market is dominated though by Coca-Cola 47.7% soft drinks market share vs 15.1% for PepsiCo in 2010. US market is 46.3% Coca-Cola vs 24.7% for PepsiCo in 2022.

Given the consistently increasing results of the bottling operation and the nature of the industry I see little risk of this operation suddenly losing its profitable position.Capital allocation: Good & bad

Bad: buying a stake in a tuna farm. This sounds familiar to Coca-Cola buying Colombia pictures in 1982. Cost: $40 ($710M pesos). Given the lack of clarity & disclosure I value the tuna farm at $0. This partly covers the bad capital allocation.

Bad: No consistent capital return policy. Gepp is consistently paying a dividend, but this dividend does not consistently reach the pockets of Cultiba shareholders. Cultiba did pay a good dividend in 2019 & 2020. At the last annual meeting the company decided to a dividend payment of USD$20M, equivalent to MXN$340M or around 0.5 per share, payable by July 31 2024. Plus, an agreement to repurchase up to MXN$300M worth of stock in 2024. This means that the problem of no consistent shareholder returns might be subsiding

Good: During 2023 & Q1 2024 Cultiba bought back 2.6% of the shares outstanding. Plus more share buybacks to come. Given the prices and valuation of the company I think this is a great use of capital.

Why undervalued?

What are potential reasons for Cultiba to be so lowly valued compared to its main competitors.

No control: only holds a 40% share. As a small shareholder, I’m used to this. Still this structure makes the company less of an ideal investment. It also increases the risk of strange investments like the tuna farm.

Strange financial structure: Cultiba has a lot of cash, while Grupo Gepp has a net debt of 1 times EBITDA. This is not ideal. In addition, Grupo Gepp has too much short-term debt. Not a real concern given the level of leverage, but still strange.

Lower market cap: With a market cap of only 8.5B pesos the company is a lot smaller than giant Coca-Cola Femsa with 305B & Arca with 316B. This much lower valuation makes it easier to be overlooked by investors.

Low liquidity: 30% free float & 66% of the company is controlled by CEO Juan Ignacio Gallardo Thurlow.

Mis qualified: Cultiba is qualified as a financial holding. Which are usually valued at a discount to assets. Also means the stock is not easily found when looking at bottler stocks. Could be a reason for a lower valuation.

Lower quality: This could be. Coca-Cola is the dominant soft drink in Mexico. Higher sales density leads to a more effective sales network.

In addition to a Coca-Cola franchise being favored compared to Pepsi. Looking at EBITDA margins Grupo Gepp has 13.6%, while Coca-Cola Femsa has 18.9% and Arca has 19.8%.

There might be another quality issue (partly captured by lower EBITDA margins). Grupo Gepp is a large seller of water. You might think bottled water is better than soft drinks. This is not the case. The share of bottled drinks as a percentage of Gepp sales has been growing while the jugs of water have been declining. Large 15l bottles have a lot lower margin. In addition, this business might deteriorate when the quality of the water infrastructure of Mexico improves over time. It might be better to buy a bottler without a large water jug business (12% of GEPP revenue).

Conclusion:

Giving the structure, lower market cap and the lower quality of the business compared to its main two bottler rivals a discount is understandable. A price earnings ratio that is 50% lower is excessive. A more reasonable valuation would be 12 times earnings, which would give Cultiba 50% upside. This in combination with a stable business, improving economics & a good fit with a richer Mexican consumer means I will think hard to give this company a position in my portfolio.Elektra:

Market cap: $233.8B pesos

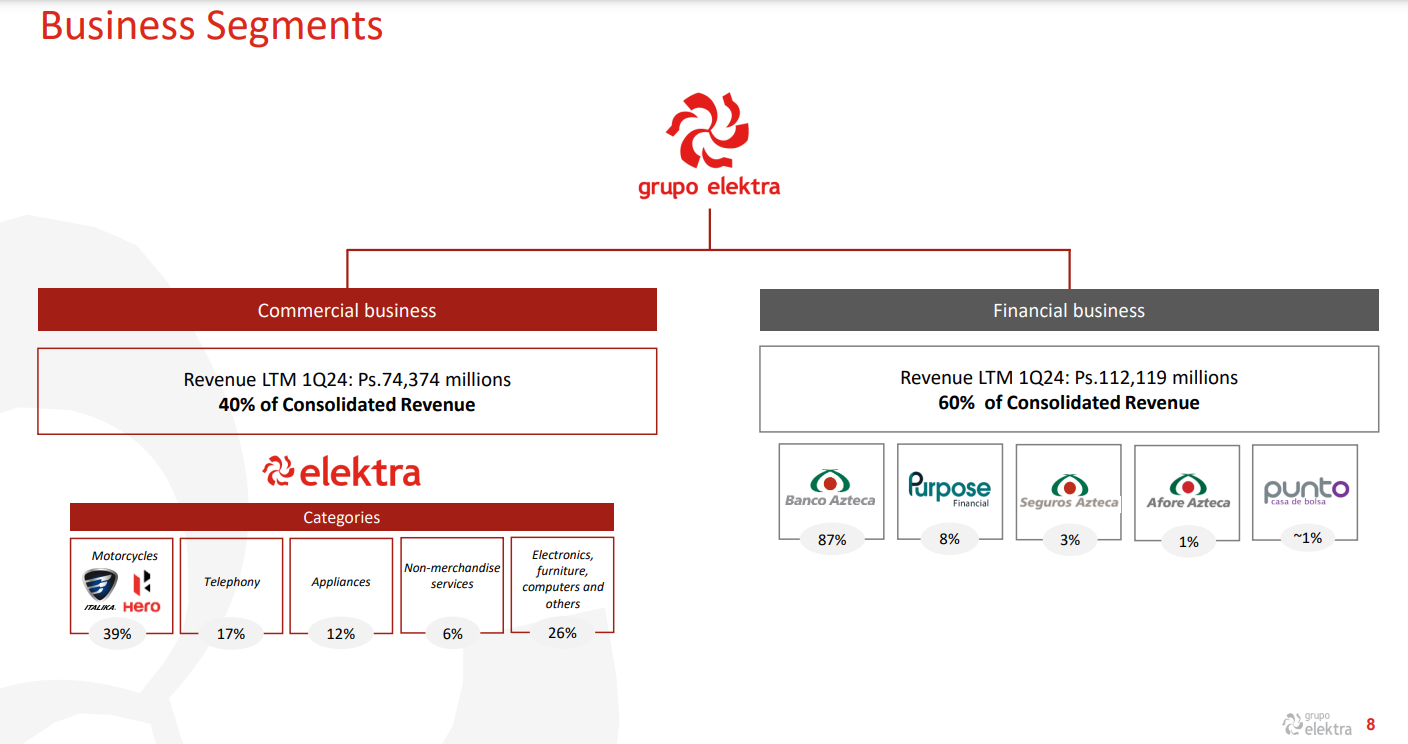

Grupo Elektra is a Mexican financial (60%) and retailing (40%) corporation The company has operations in Latin America and is the largest non-bank provider of cash advance services in the United States.

Valuation: The stock is trading 32 times earnings and has 91B pesos of common equity.

Not a great fan of their diversified retail operations. The financial side focuses on the under-banked and cash transfers from the US. When Mexicans become more wealthy normal banking products become more available to them.

Money transfers will in my view also become more digital with the benefit of physical stores diminishing. I am surprised this company is so expensive. Potentially their super app is a real gem. Not convinced. Pass.Coca-Cola Femsa SAB de CV:

Market cap: 304.9B pesos

Largest Coca-Cola bottler in the world. Talked about Cultiba above & Arca in my first article on Mexican stocks. I’m ready to talk about Femsa, but since it’s holding structure. I find it helpful to start first with the largest listed position.

Leading positions in Mexico, Brazil. & other South American countries.

Valuation: 16.1 times earnings 34B pesos of net debt. 0.8 debt to EBITDA.

A 3.8% dividend with stable growth. Devaluation of the Brazilian real is not good for Coca-Cola Femsa, but the business has the ability to increase prices with inflation.

I like the Mexican exposure the most. Given how well it fits with the theme of the rising Mexican consumer. Not as optimistic on the rise of the Brazilian consumer. US assets of Arca are also more attractive to me. Given the defensive characteristics, a price-earnings ratio of 12 would (-25%) might get me interested.Femsa:

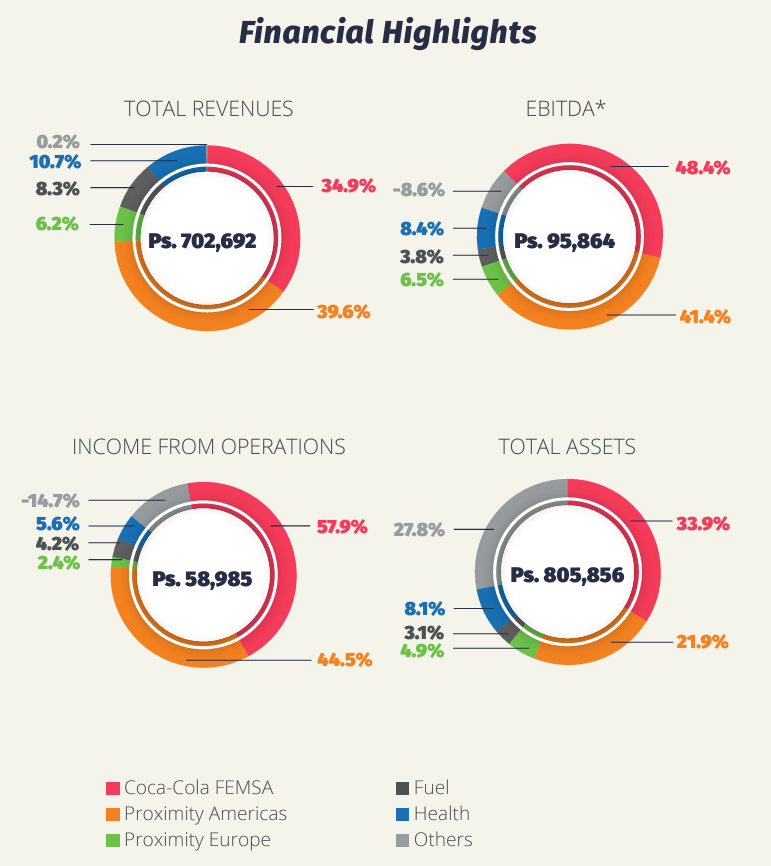

Market cap $665B pesos. The company has 304B pesos of equity, 70.7B of net cash (excluding lease liabilities) & 33.4B of net income from continuing operations.

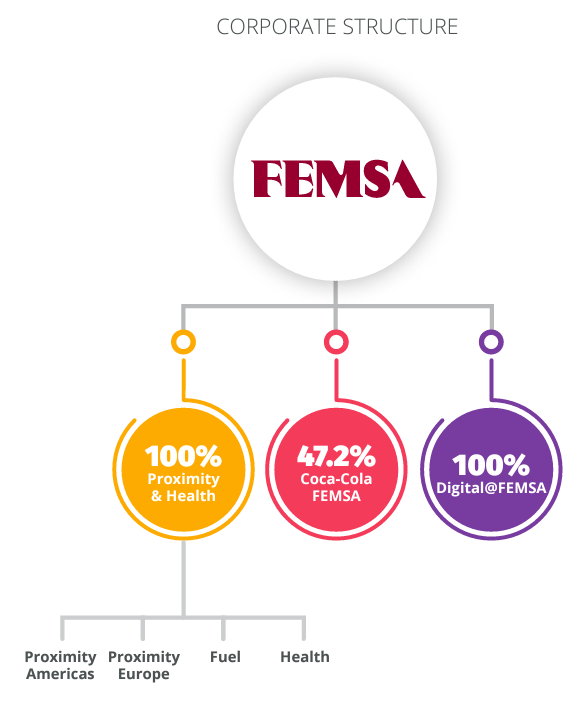

One of the most well-known Mexican companies. After divesting their stake in Heineken, the company basically has two main pillars. 1: its stake 47.2% in Coca-Cola Femsa, which I discussed above. 2: it’s retail operations. Digital is still small and has an immaterial value in my view (some losses & some potential).OXXO & Coca-Cola FEMSA are also the most important when you look at revenue & profits.

Coca-Cola FEMSA is already covered.

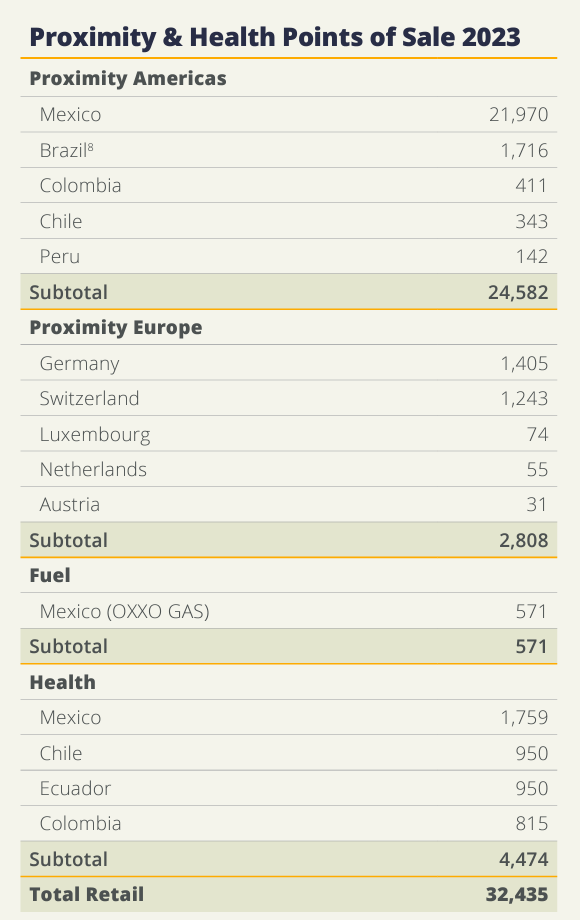

Proximity Americas is the OXXO format of convenience stores. Those delivered 11.6% growth in income from operations to reach 26.2B pesos & a 9.4% operating margin. This business has been growing at an attractive rate and has been expanding in other Latin American countries and been opening over 1,000 net stores a year. This is an attractive & growing business, still retail. Value 314.4B pesos.

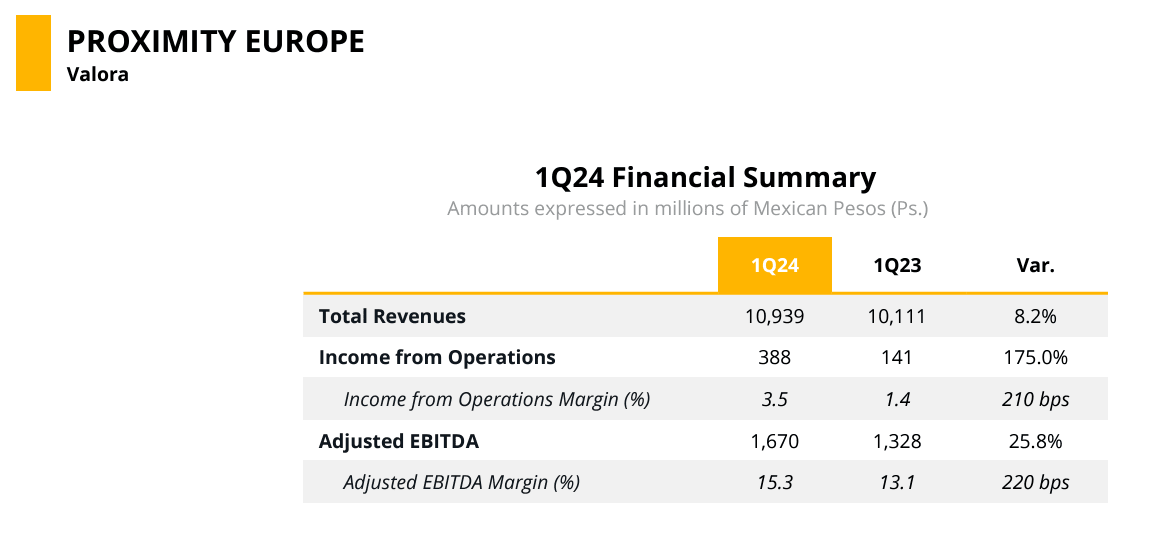

I’m a bit puzzled with their investment in Europe. They paid 1,139M CHF pls 222M CHF in debt and 9.4 times EBITDA in 2022 (26.8B pesos) of what was likely peak earnings. Income from operations in 2023 was 1.4B pesos (3.2% operating margin). They might get a lot of synergies going forward, but I would argue time of management is better spend at Proximity Americas.Q1 results of Europe was good. In addition, the business will benefit from the devaluation of the peso. I value the European operation at 13.4B pesos (50% haircut).

FEMSA Health had a difficult year with revenue (0.7%) growing slower than expenses leading to a 15.5% drop in profits to 3.3B pesos with operating margin declining from 5.3% to 4.4%. Value 26.4B pesos

Fuel increased revenue with 12.9% and income from operations with 11% to 2.5B pesos. Value 25B pesos

Valuation: market cap 665B pesos

47.2% stake in Coca-Cola Femsa = 143.9B + 70.7B net cash = 214.6B pesos.

retail = 314.4+13.4+26.4+25= 379.2Total value: 593.8B pesos.

This means the market is ascribing significant value to the digital assets, a higher multiple to the retail side or both. Here is a nice, but somewhat dated article on the digital potential of FEMSA. Personally, I think digital companies work better as a focused stand-alone business. Not interested in FEMSA at these price levels.Financiera Independencia:

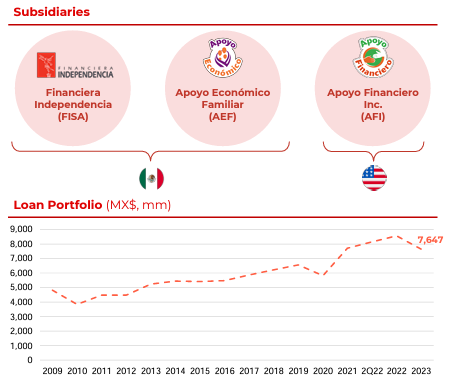

Market cap: $3.2B pesos, equity 5.3B pesos & net income 710M pesos.

A non-bank entity specialized in personal loans, targeted to low-income population segments in Mexico and USA. These loans tend to be riskier in nature.

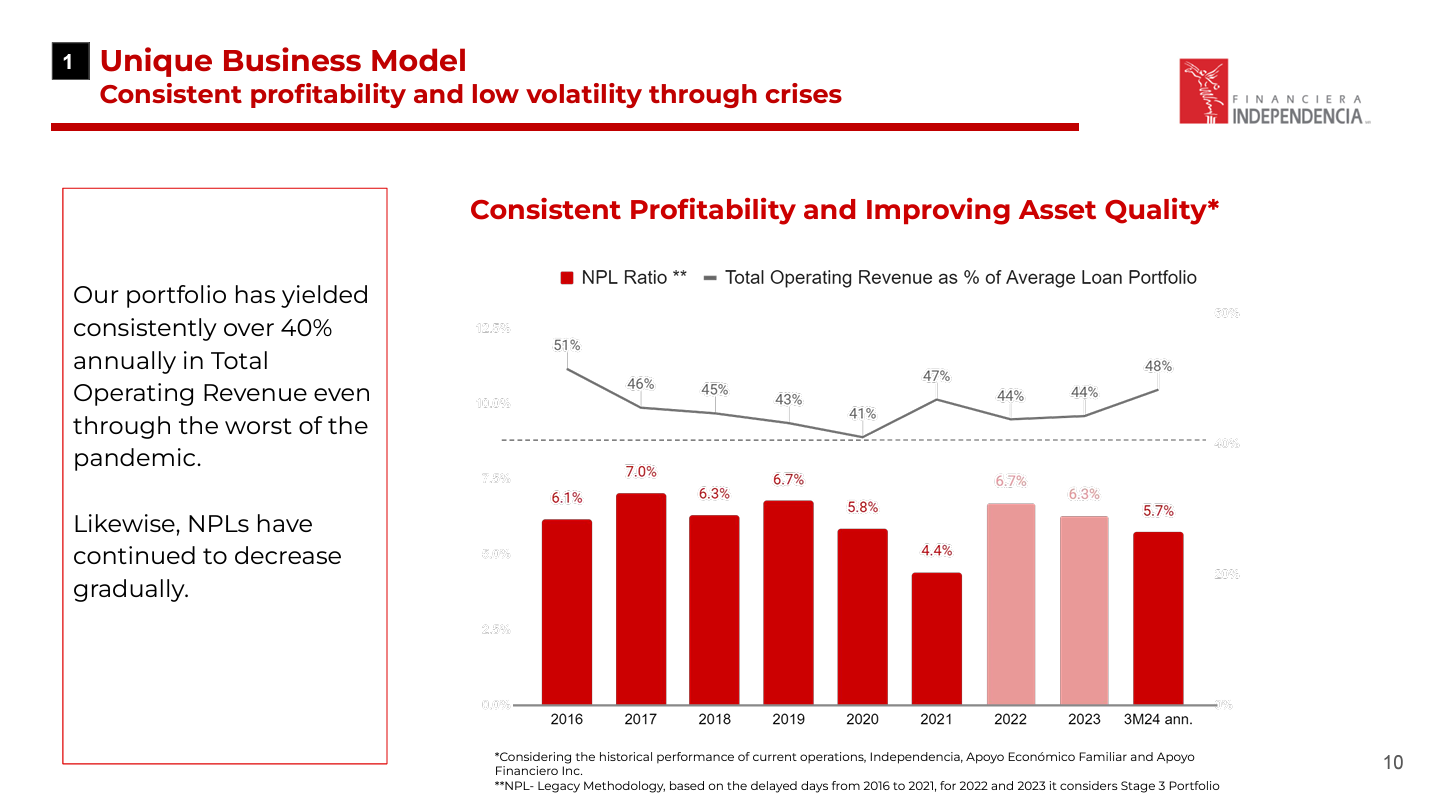

Loan growth has been decent, but not very fast 50% from 2009 to 2023. Last two years actually a decline in total assets. This is not a bad thing in my book. Fast growth means more risky loans (growth in US is somewhat worrisome).Financiera Independencia is active in the US with 35% of its loan book. They focus on Hispanics in the US. This makes sense given their Mexican origin. I like the Mexican part better, given that it fits with the theme of Mexicans becoming wealthier. If you get a significant pay rise you are more likely to pay back your loans.

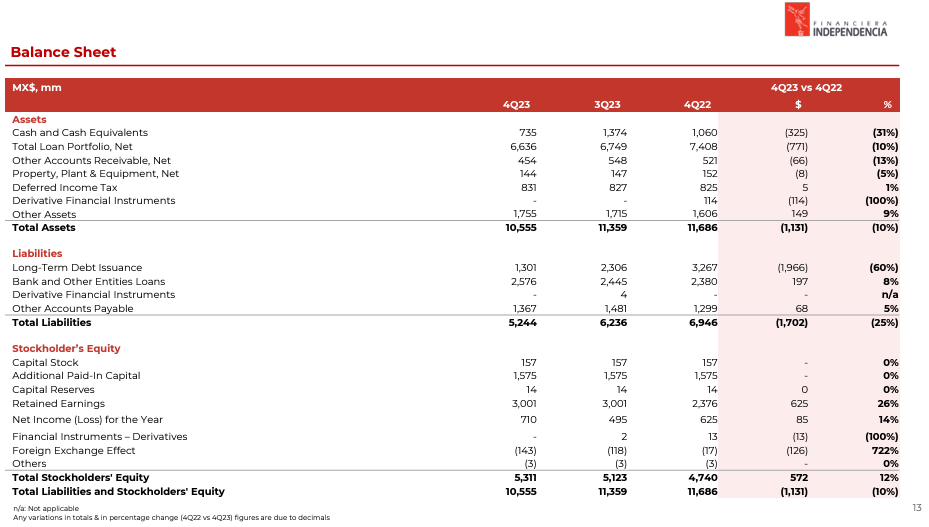

Balance sheet strength

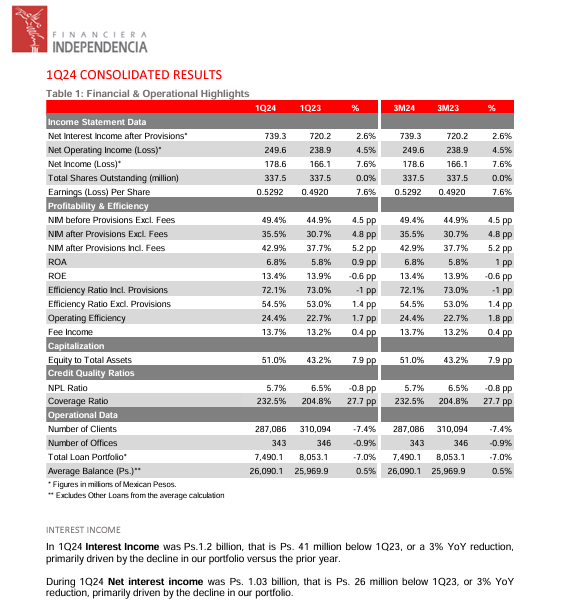

Surprised with the quality of their balance sheet. Normally banks are fairly leveraged. Given the loans they make and the lack of a good low-cost deposit base, I was kind of worried before I looked at the numbers. Equity being more than 50% of assets gives the company a nice cushion.

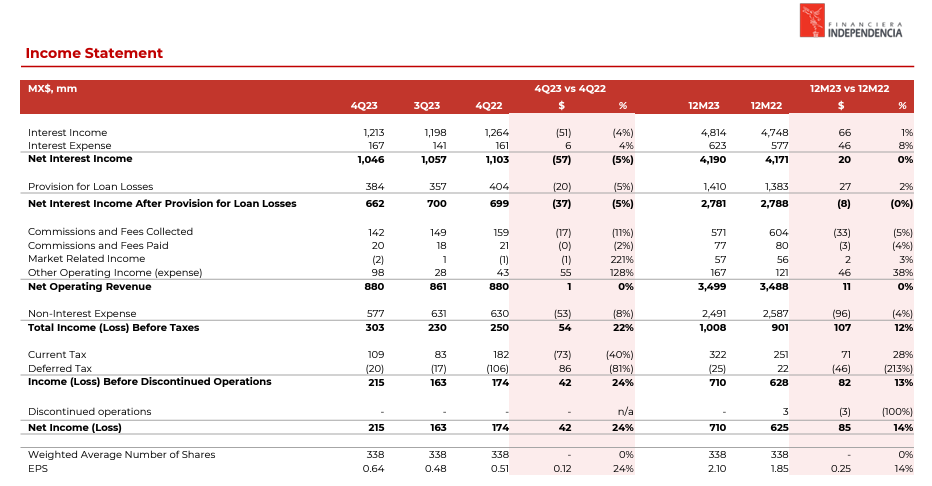

Financiera Independencia also saw an increase in its credit rating by Fitch to BB-Net income holding up well

Net income is holding up well given the lack of growth. Company has good cost control with non-interest expense down 4%. Be aware of the negative 25M pesos deferred tax. Still income before tax is up 12%

Good Q1 2024 result

Net income up 7.6%. NPL down to 5.7%. Declining loan portfolio -7%. Good results. It almost feels the company is in liquidation mode. Loans are declining fast. Is this because of better alternatives for clients? Liquidation is not bad given that equity is significantly above market cap.

High interest rates

Interest rates on the loans are very high and in the last quarter reached 48%. This makes me somewhat uncomfortable. I don’t know if I want to be part of such practices. Furthermore, it will probably attract competition and regulators.

Controlling shareholder: I cannot find sufficient information on the controlling shareholder. If someone can enlighten me, please do. Company has not paid a dividend since 2016.

Financiera Independencia is trading below book & 4.5 times earnings. Sounds interesting. The combination +40% interest rates, an unknown shareholder, small market cap & no capital return policy leads me to say no to this investment. Mexican banking is interesting though. I have a position in Banco del Bajio.

Farmacias Guadalajara: Market cap: $97.5B pesos

What a chart. The company has really good historical performance. Stock has doubled since Gabriel Tamez wrote his piece about the company. Highly recommended to read his piece.

Reason I did not invest is that it is retail. Retail can be quite fickle & very competitive. I have no real insight in the retail situation in Mexico.

Company has been consistently opening new stores & is controlled by the Arroyo family that holds 76% of the shares. Given what can happen to pharmacies when they lose their competitive position (just look at what happened to Walgreens Boots Alliance).Valuation is reasonable 19.5 times earnings & 4 times book given its growth trajectory, but not something I’m able to get comfortable with.

Conclusion

Turning over more rocks increases the chances of finding gems. If you see gems, you still have to pick them up. I missed investing in Farmacias Guadalajara & might miss it again by not investing now. Cultiba is a very interesting opportunity. I try to limit my total investing positions, but stocks like Cultiba make it attractive to run a slightly more diversified book with room for small companies like Cultiba.

Please let me know in the comments what you think is the optimal number of positions in a portfolio.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

What is a fair discount for Cultiba (Mexican Pepsi bottler) vs Coca-Cola Femsa?

A price earnings ratio of 8 vs 16 seems excessive to me (2.5 times EV/EBITDA is cheap).