Fonterra: Sleepy giant coming back to life

Fonterra shareholders benefit from shift in strategy and nitrogen problems in Europe. Rewards come from huge dividends, higher earnings and a potential rerating.

Disclaimer: These are my ideas and not personal investment advice. I don’t know your financial situation. Do your own research and do not blindly follow an article on the internet.

Explanation to an 11 year old:

Milk is a lindy industry. People have been consuming milk for 10,000 years.

Fonterra is a dominant player in the New Zealand milk industry, which is globally advantaged versus the competition.

Fonterra is changing its strategic course and is focusing more on return on investment and less on plain growth.

The current valuation is attractive on both an earnings and asset basis.

Before I go into detail about Fonterra I wanted to give some more understanding of the global milk industry and the NZ milk industry in particular. I do think company-specific reasons are more important, but I do think more general information is helpful to get a better understanding of the situation.

Milk is Lindy

Milk consumption started around 10,000 years ago and it took human genes around 5,000 years to become lactase persistent. Things that are done for a long time tend to stay around. This is called the lindy effect and milk is a lindy industry.

Overview of the milk industry

According to the OECD Milk consumption will grow by roughly 1.6% per annum.

India is the largest producer of milk and also one of the fastest growing. Pakistan is the clear leader in per capita consumption. While significant growth is expected from these markets they both play a marginal role in the in and export of milk.

The largest exporters of milk are the Eurozone, the US, and New Zealand. Accounting for 65% of the global export.

An interesting detail is that while NZ is particularly strong in butter and whole milk powder. The Eurozone specializes in Cheese. The US is more focused on exporting Skim milk powder while keeping the fat for the internal market. Growth in milk consumption in the developed world will primarily come from the consumption of Cheese. Which is not a good thing from an environmental standpoint.

The report says that most of the export growth will come from the US.

The strengths of this argument have gotten less strong in my opinion. For the following reasons:

Labor has gotten more expensive in The US.

The dollar has gotten more expensive.

Reasons for limits on New Zealand exports are no longer valid.

Environmental issues

Too many cows are not good for the environment. Looking at the graph you can see that milk products are way better than meat. Especially when you consider a kg of Cheese is a lot more dense than meat. Not surprisingly less dense products like cottage cheese are a lot better than normal cheese. Milk products like yogurt are significantly better than eggs, which is somewhat surprising to me. For more detailed information just read the report.

Methane rules NZ

The production of methane by cows was something the last left-leaning labour government in New Zealand wanted to tax from 2025 onwards. This government lost heavily in the recent election and the implementation of these rules will be extended to 2030 and most likely longer.

These heavy taxes are the reason that the OECD was not too optimistic about milk product exports from New Zealand. Given the importance of milk to New Zealand I would be surprised if NZ actually would significantly harm one of the few industries which is advantaged compared to competition from abroad. Due to the grass-fed model, New Zealand milk has 1/3 of the carbon footprint of the global average. In a world focused on the environment, the importance of this unique model is likely to grow in the future.

Nitrogen problems in Europe

Intensive farming methods in Europe have led to an oversupply of manure. This is bad for the environment. Most governments are quite reluctant to do something about this, but the pressure is building. This will put pressure on farmers to close, because of tighter regulation. In addition, building companies in the Netherlands are already buying up farmers for environmental impact rights. Actions like This might lead to lower milk production or at least put a break on the growth in milk production that is coming from Europe.

Nitrogen problems might become an issue in the US as well. Given the prevalence of intensive farming methods. New Zealand however is using a much less intensive method of farming given the abundance of farmland. New Zealand cows are on a grass-fed diet. This means that too much nitrogen is not a pressing problem for New Zealand farmers.

Importance of dairy to NZ

except for wood and tourism, no other real sources of external income (except maybe for people working abroad. However I’m not sure how much NZ wants to count on that. If they do that, then they become a proper third-world country).

Fonterra is responsible for 25% of the total exports of New Zealand and has a 79% market share in raw milk production.

This significance to the economy means that there are large internal incentives to keep the milk industry flourishing in New Zealand. Something that might be good for New Zealand is to focus more on higher-value products made from milk like cheese and protein powders. At the current moment, however, I would say that New Zealand cheese on average is not particularly good. However, investments in science by Fonterra might be beneficial to benefit from the growing use of protein powders.

The geographic location for the export of cheese is fairly favorable. New Zealand is relatively close to China and good position in South East Asia, which might become a strong importer of milk in the future. South East Asia currently has low consumption, but also poor climate and land availability for own production might the demand arise in the future.

Finally time for the ‘important stuff’

Fonterra is changing its business model

Historically Fonterra has been eager to grow abroad. They are investing in faraway countries like Brazil and the Netherlands. The results have been mediocre and the company is acknowledging this.

The new model is built on 3 pillars:

Focus on New Zealand milk

Be a leader in sustainability

Be a leader in dairy innovation and science

I think they mean the following with those 3 pillars:

The company is focusing on its core. This is the market where the company can make a difference. Expansion abroad is likely to lead to distraction. By focusing on New Zealand milk. Investor shareholders and Farming shareholders are also more aligned (more on this later). The company already reaped some nice profits by selling activities in Brazil. An IPO of the Australian business is an option and divestiture of the business in Chile is as well. This means additional one of profits might be on the horizon.

Given that New Zealand milk is already advantaged from a carbon footprint, it makes sense to invest to keep this leadership. Hopefully, not too much money is wasted and actual progress is realized. In my non-expert view most benefits can be realized by planting trees/hedges, more efficient production processes, and less methane-emitting cows.

Given its strong global position and collaborating position with dairy farmers, I think investing in science makes sense. This is hurting the bottom line but might deliver surprising results in the future. Will also help with goal number 2.

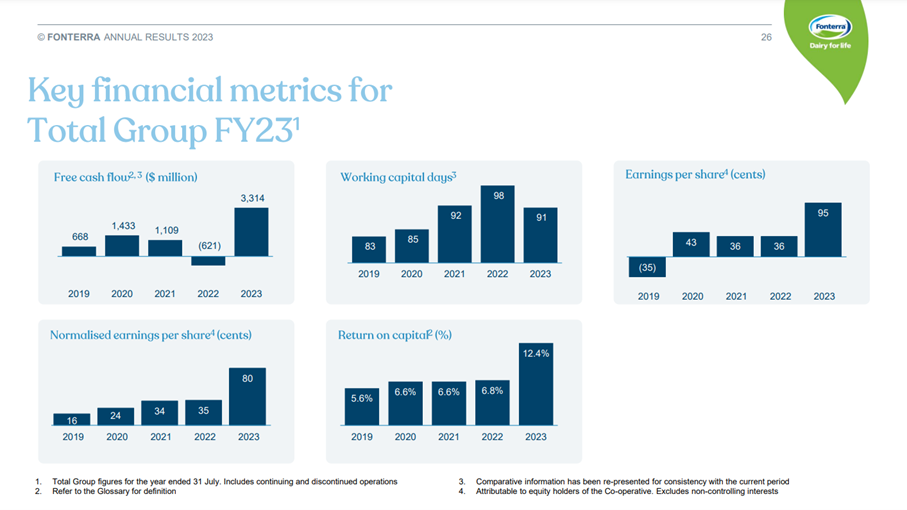

Next to those pillars, the company wants to increase return on assets to the 9-10% range. Historically this has been often in the 6-7% range. An increase to 9-10% is doable in my opinion and a major reason to be bullish about the company. How this is done is also directly related to focusing on the core and not investing too much outside the advantaged position.

Current valuation

Those nice inflections in the future are all nice and rosy. What is the current situation?

In a nutshell:

The share price of the fund at 3.06 NZD and shares for farmers at 2.37 NZD.

forecast of 50-65c profit in 2024.

Earnings in 2023 95c.

7.6B NZD in equity.

Using the fund price total value of all the shares in the company is 4.9B NZD.

Net debt of 2.4B NZD.

Dividend payout of 40-60%. To grow to the top end of the range.

Don’t get me wrong not everything is perfect about the milk business. This business is cyclical and capital-intensive. The company however has used a good operational performance and the proceeds of the sale of the Brazilian activities not only to reward shareholders. Shareholders got rewarded with a hefty 50c dividend. The balance sheet was not forgotten and got deleveraged strongly. This means that a larger share of future profits can go to shareholders and that the company is appropriately financed to withstand the cyclicality of the business.

Unfortunately, the company does not own significant land holdings at historic cost. However, it does own some land and a lot of critical infrastructure. Given that this infrastructure is essential for the advantaged New Zealand milk industry a decent return on this capital base going forward can be expected.

Management and dual share structure

The company is kind of bureaucratic. However, management is doing all the right things in my opinion. The focus is on the core and selling assets that are not essential to the company.

The great thing is that on this front there is a strong alignment between investors and farmers. Farmers do control the company and want higher milk prices from Fonterra and secondly more dividends.

By divesting assets that do not help New Zealand farmers, the company is going back to its roots. This leads to a leaner company that can more effectively operate.

The dual share structure means farmers have total control over the company. Given the ownership, they would have had total control regardless. Shares for farmers are currently cheaper. If you are a farmer buying more of those shares is even better. This might be a reason for some investors to not buy the shares.

I don’t mind if other people get a better deal. This happens all the time in the world and I’m just happy to get a good deal at all. Share prices might converge in the long run, but I’m not too worried about it. Given that I expect that good earnings reinvested and nice dividends are where my return will primarily come from. If the shares double due to a higher valuation at some point that is a bonus, but not necessary for a good return.

Longer term it could be that the incentives of farmers change again to focus primarily on the milk price received. However Given that this price is linked to global markets I think this risk is manageable, but is something that has to be watched closely.

Conclusion

My thinking is that an advantaged company should not trade at a discount to the historical costs of creating the business. A 9-10% return on capital is doable and has already been achieved last year. Using moderate leverage good returns on leverage can be achieved for the long term.

If you can buy the company at a clear discount to tangible book value I think you have an interesting opportunity at hand. Especially if shareholders are rewarded while waiting for a rerating of the Fonterra stock.

For what it’s worth, Fonterra is uninvestable for me. The co-operative structure is not in favour of investors. Since IPO, it’s been a very poor performing investment. They expanded overseas and overpaid for acquisitions. It’s common knowledge they have a bloated cost base (I personally knew people working there getting paid ridiculous sums for as they told me, not doing much). It may also pay to note Nz is going through a power crisis with a number of large companies shutting down this week alone with wholesale power prices up from $150Mw/hr a year ago to $800 at present. A lead story in the business news today is the impact it’s having on Fonterra.

For me, I’ve always avoided buying these units (they aren’t shares) and advising my clients in the past to do the same (our broking firm was involved in the IPO by the way)

Yes it looks cheap ish … but there are far better interment opportunities in Nz than this one. All the best.

More good news at Fonterra is not only looking at selling their underperforming consumer brands division. Fonterra also presented good results and increased the earnings guidance to 60-70c NZD (from 50-65c NZD range). Not bad for a stock trading at 4 NZD.