CTP continues to deliver: Record result in 2024

Founder led real estate company is creating value quickly and is trading below NAV.

A year ago investors worried high interest rates might kill real estate companies. CTP showed in 2024 that great companies can still deliver in a tough environment.

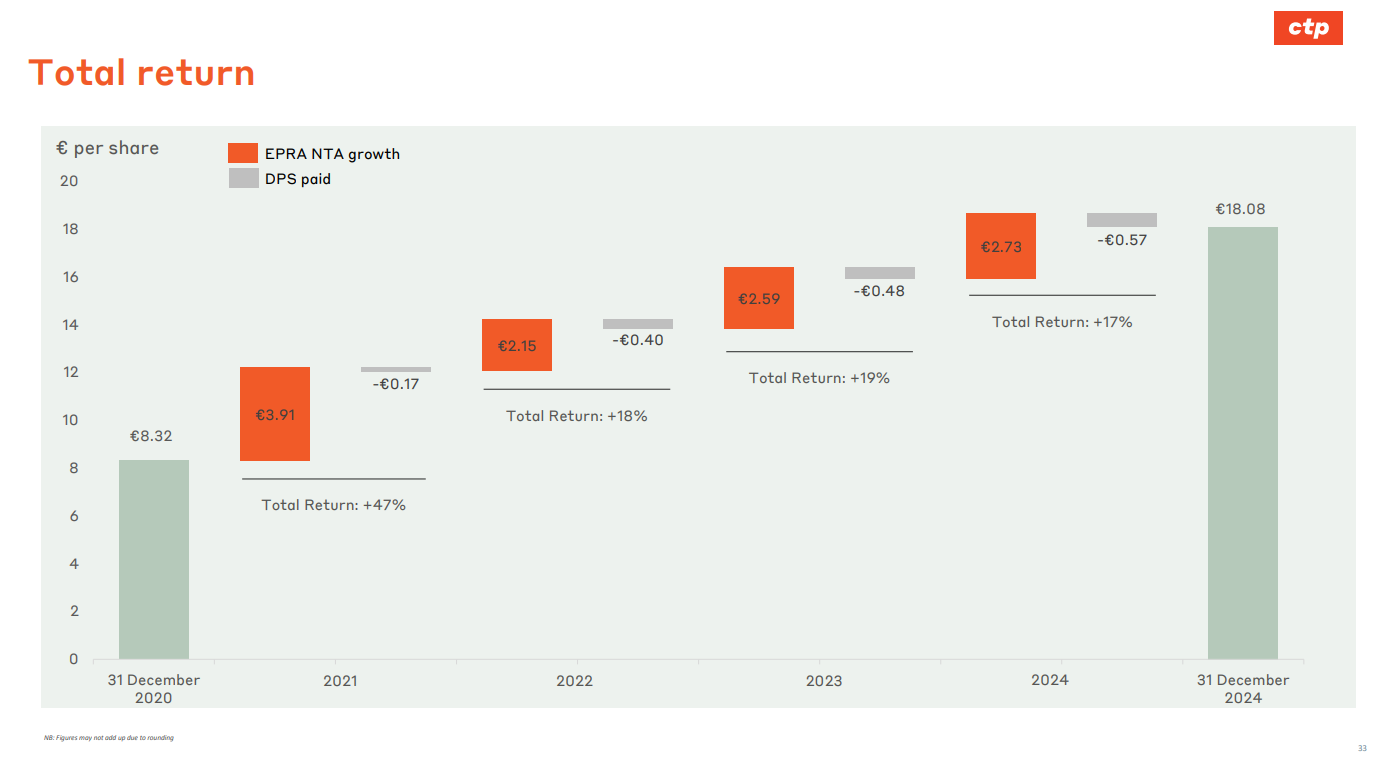

Net tangible assets per share increased by 13.6%, plus a dividend (3.4%) that was again increased. EPRA earnings of €0.80 are also quite decent compared to the €16.52 share price.

Last year I wrote already quite extensively on CTP. Operating results are good, but share price performance has been disappointing (flattish). This article goes into more detail about management and CTP’s strong market position. In my opinion, the results in 2024 only strengthened the arguments I made last year.

CTP NV: the earnings engine in this real estate company

Why do I like real estate owner and developer CTP NV when higher interest rates make investing in real estate less attractive?

Leverage a triple-edged sword

Leverage amplifies results. This is well known and can help greatly or lead to ruin. The cost of leverage is the interest rate paid on the debt. Real estate tends to use more leverage than other industries due to the assets being great collateral. There is a significant factor that is not often discussed. Loans do not increase with inflation. Debt holders are compensated for inflation with interest. This means that, rental growth is amplified by leverage.

3% rental growth with 50% leverage and stable cost means 6% earnings growth for shareholders.

Updated value of the developer

Deliveries in 2024 increased from 1.2M sqm to 1.3M sqm. Given the strong result in Q4 this was quite positive.

CTP aims to deliver between 1.2-1.7 million sqm in 2025. Using the 1.2M sqm means that CTP can generate €480M in potential revaluation gains. Using a multiple of 5, the development business is worth €2.4B. Roughly the same as I used last year but with some slight changes in the underlying numbers.

The high 10.3% yield on cost creates significant value and acts like a cushion. If projects do not go as planned, they are more likely to remain profitable thanks to the higher yield on cost.

Value of real estate

The gross portfolio yield is 6.6% and the reversionary yield is an attractive 7.1%. Both are stable compared to last year. I see some opportunities with for this to compress a bit given the current interest rate environment. This means that I think the EPRA NTA is a reasonable proxy for the fair value of the portfolio.

Risk

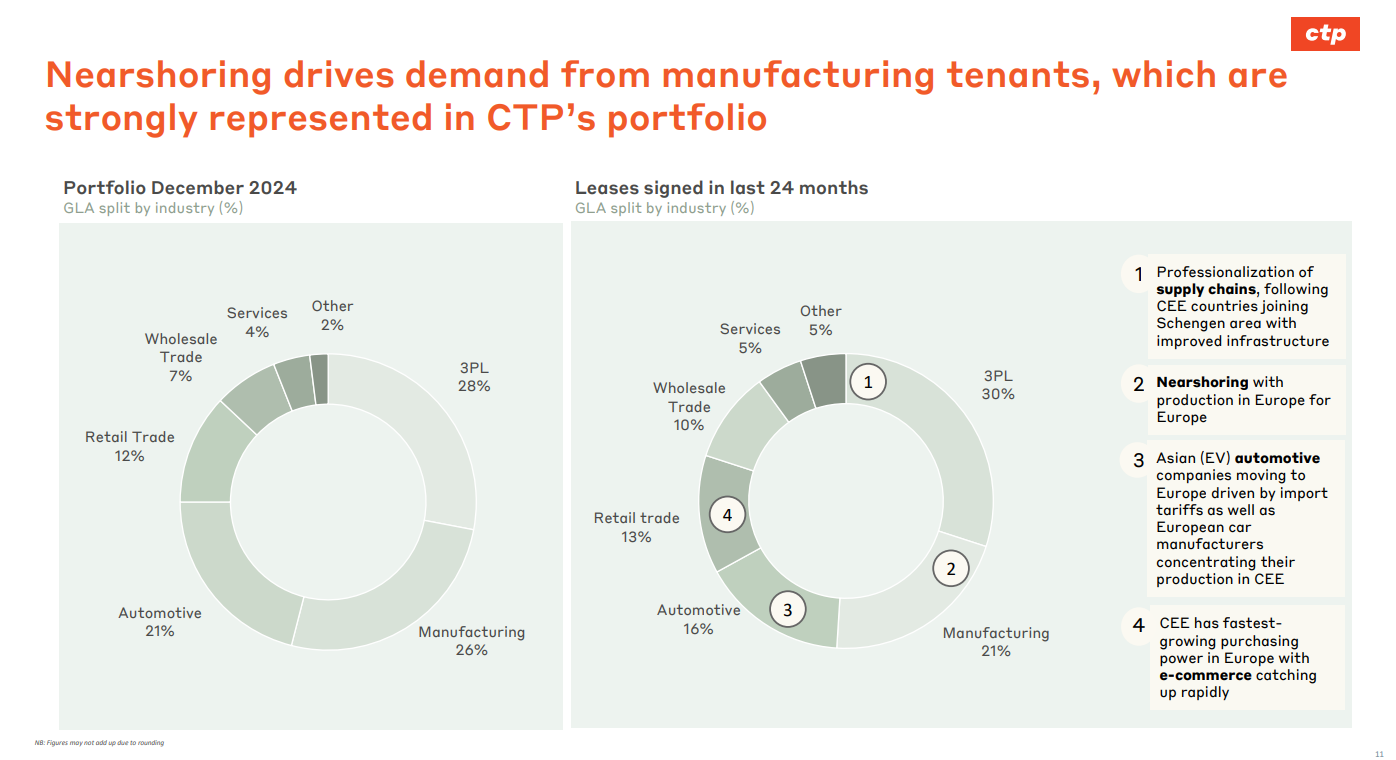

The biggest risk I see for CTP is a strong economic slowdown. The risk of high interest rates almost disappeared. A strong slowdown in economic activity though has become a bigger risk. The portfolio is well balanced, but has significant exposure to cyclical industries like automotive and manufacturing.

Looking at the signings over the last 24 months, you can already see that the more cyclical sectors are taking up less additional space.

The risk of an economic slowdown is why I used 1.2M sqm for space to be developed in the future.

Conclusion

CTP is a real estate company that manages to deliver a yield on cost of 10.3%. This exceptional level of profitability means that development at CTP adds value. In addition to this value-adding development, CTP has great logistical real estate, which can benefit from rental growth. Together, this can lead to satisfying value generation for shareholders. Share price performance for investors who paid too much around the IPO has been disappointing. Happy to hold a small position.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Hopefully it's European value's time to shine if the war is ending and sentiment looking up.

Thanks for sharing, looks very interesting! Now I'll have to reread it to understand it LOL