CTP NV: the earnings engine in this real estate company

Building real estate and keeping it can be a good business model.

Why do I like real estate owner and developer CTP NV when higher interest rates make investing in real estate less attractive?

CTP NV is founder let & has great management.

Proven track record in execution and acquisition.CTP has a strong position in an attractive niche.

Long growth runway in developing logistical and industrial parks in CEE.Bought below NAV and get the real estate development engine for free.

NAV is reasonable and the development engine might be worth 2.5B at 5x annual value creation.Higher inflation also has its benefits.

Higher inflation leads to higher rent growth.

Interest rates are to asset prices like gravity to the apple.

Warren Buffett

I want to add that this gravitational pull is even stronger for highly leveraged assets. This in combination with lower demand is the reason why the office and retail real estate markets show significant problems.

Even markets that looked very safe like multifamily saw significant declines.

CTP develops and owns logistical parks in Eastern Europe and was pulled down by worries about higher interest rates and the war in Ukraine. This decline allowed me the opportunity to initiate a position.

The stock has rebounded while the problems for other real estate companies are far from over. How is it possible that CTP is performing well in this environment?

1. CTP is founder let & has great management

Founder let companies tend to be better managed and have higher stock returns. Remco Vos is a great founder who built his wealth in this company. This means that the business can create significant value. Before I initiated a position in CTP, CTP did an acquisition in Germany of Deutsche Industrie REIT AG for 800 mln. euro in November 2021. These assets did not look cheap at first glance, but it turned out to be a smart acquisition in Germany. The reasons CTP gave were the following:

Increasing rent

Increasing occupancy

buying below replacement cost

I liked the reasoning, but the first two points can only be done through superior management. I was a bit sceptical at first, but the results in Germany have been very good. Net rental income in Germany increased from 41.9 mln—euro in 2022 to 57.9 mln euro in 2023. In conjunction, CTP Germany realized a positive revaluation of its assets of 123.4 mln. euro (with a gross portfolio yield in Germany of 8.7%).

Remember these results are realized in a tough market environment.

The execution of this acquisition increased my confidence in CTP management.

Another great example of management quality is the aggressive push into solar energy on top of their parks. From 6 MWp in 2021 to 38 MWp in 2022 and 100 MWp in 2023. The yield on cost target is 15%. This could become an attractive additional pillar under CTP which is not reflected in the current market value.

2. CTP has a strong position in an attractive niche

CTP develops and owns logistical/industrial parks with a clear focus on Eastern Europe. The Czech Republic is its core market with 44.9% of the value located there. The second market is Romania with 14.3%, third is Germany with 8.9%, and fourth is Hungary with 8.2%. Currently, CTP is the market leader in the Czech Republic, Romania, Hungary, Serbia and Bulgaria.

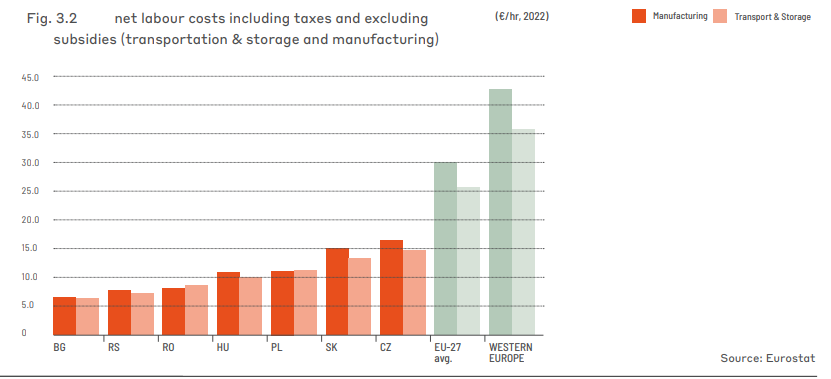

These strong positions help CTP to be the company of choice to provide real estate to companies that want to expand in Eastern Europe. Given the trend of nearshoring, the low wages, and relatively low real estate prices this is still the region of choice for most expanding production companies.

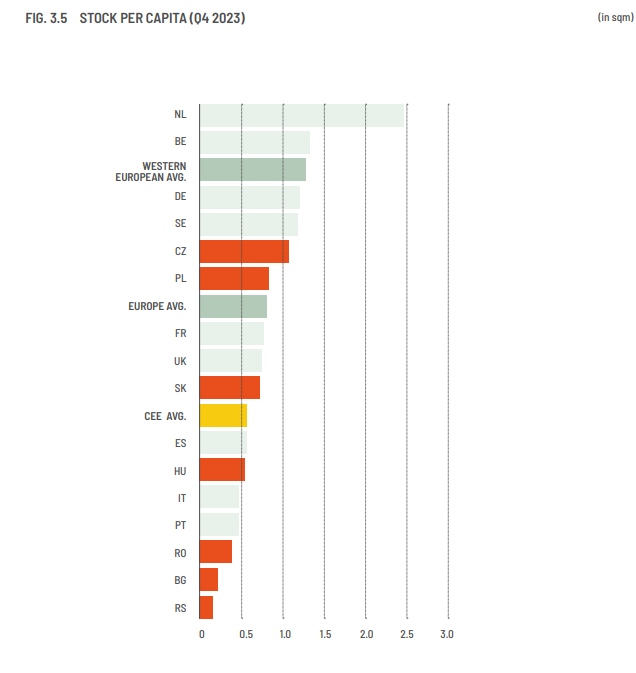

Luckily for CTP the amount of standing logistical real estate in Central Eastern Europe is also a fraction of the Western European average.

3. Attractive valuation

EPRA NTA increased by 15.2% to 15.92 euro (7.1B euro compared to a market value of 7.2B euro). The gross portfolio yield is 6.7% and the reversionary yield is 7.2% (when rent is adjusted to market rates). I think those yields are fairly reasonable, given the high and growing demand for this type of real estate. CTP expects 5% rent growth in 2024 after 7.4% growth in 2023.

You can argue that a gross portfolio yield on real estate of 6.7% is too low with the current interest rate environment. I think this yield is still fine because real estate has the potential to increase rent (more on this in the chapter on the benefits of higher inflation).

For comparison Warehouses De Pouw (WDP), a Belgian company logistic real estate company with a more Western European focus (43% the Netherlands, 35% Belgium, and 18% Romania) is valued at a gross portfolio yield of 6.3% and trades at a significant premium EPRA NTA (20.1 vs share price of 26.14).

Historically the yield is higher in CEE than in Western Europe. They increased above historic averages due to the war in Ukraine, but are now again at the historic average. In my opinion the difference in yield between CEE and WE will decrease. The reasons for this convergence are higher growth in CEE, better governance in CEE, and higher standards of living in the CEE that are more comparable to Western Europe.

Valuation of the developer

CTP developed 2.0 mln. sqm in 2023 and aims to develop 2.0 mln sqm again in 2024, while in 2022 1.7 mln. sqm was developed. The yield on the cost of this development was 10.3%. Given the 6.7% gross portfolio yield, this means the company can deliver 55% revaluation potential on development completion.

Just to be conservative and make the math a little easier and more intuitive I use a revaluation potential of 50% (yield on cost of 10.05%).

Development costs are estimated to be 500 euros per sqm in 2024. This means 250 euro profit per sqm x 2.0 mln. sqm = 500 mln in created value. Multiplying by 5 leads to a valuation of 2.5B. Why 5? It is low, but the quality of earnings coming from this kind of development is fairly low. CTP has a great track record and might even develop more in the future, but a revaluation of 50% is high and might be difficult to sustain.

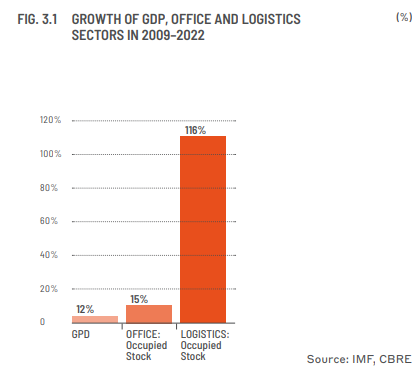

CTP sees a long-run rate for continued growth and new development with the majority of the growth coming from existing parks and from existing clients. This might be true, historic growth in the market is impressive.

So I might be, conservative on this front. Still, 2.5B on top of the valuation of the real estate is a significant amount on a market value of 7.2 B.

4. Benefits of higher inflation

I already disclosed that CTP managed to get 7.4% in like-for-like rental growth in 2023. The primary reason for this high rental growth is inflation. Historically most rental contracts had fixed 1.5-2.5% growth, but now 66% of the contracts are also linked to CPI (consumer price index). CTP aims to increase that to 80% in 2024. With most of your contracts linked to CPI, higher inflation leads to faster rent growth. While interest rates do work like gravity on asset prices I think the interest rates that matters is the real interest rates. Real interest rates have been negative for quite a while and only recently turned positive. I don’t know what interest rates will do. There is a lot of talk about a decline and this is almost a certainty if you believe the yield curve. I’m not so certain, but both lower interest rates and higher inflation are not bad for CTP. What would be the worst is an environment with low inflation, economic stagnation, and high interest rates. Given the current political landscape, I do not find this combination very likely.

Conclusion

While the current environment is not ideal for the real estate market I think CTP is in a good position to benefit from continued growth in CEE. A positive real interest rate is a headwind for all assets, but CTP has the tailwinds to overcome this, potentially thrive, and deliver very satisfactory shareholder returns. Especially if you just pay for the real estate and get the development engine for free.

CTP delivered a good Q3 result. NTA per share up 10.1% to €17.52 and EPRA earnings per share up 11.7%. The market does not like the results. It probably has something to do with the continued investments in the landbank and economic worries. Lot of worries on the call on potentially lower demand going forward. I'm looking at increasing my investment. Anyone a different take on CTP?

That is certainly the case, but if someone is paying full price for the development potential I will most likely take some money of the table (40% above current market cap). Good thing is the price target is rather quickly in the right direction. Last year the value of the real estate increased 15%.