Buying ABN AMRO shares: Mediocre quality is attractive

Strong capital base & wealth management make ABN AMRO in interesting bank. Clearer focus in segments where the company has some advantages is a good thing.

ABN AMRO is a Dutch universal banking group & clear number 3 behind ING & Rabobank. It is the leading wealth management bank in the Netherlands & has a strong number 3 position in Germany. The current price creates a potential opportunity for investors.

I previously covered ING Groep & have been a shareholder for quite some time. The stock price of ING has performed well over that period. The same cannot be said for the shares of ABN AMRO.

The share price performance of ABN AMRO has been lacking and still has not recovered its pre covid high.

Under the hood the company has made some necessary strategic decisions. ABN AMRO is not trying to serve the world anymore, but just focuses on Western Europe. Which I think is still too broad of a scope, but at least it is a start (Personally I think ABN AMRO is (should be) a Dutch bank with wealth management activities in Germany/Belgium).

The share price performance is somewhat surprising though. Since ABN AMRO is a main beneficiary from higher interest rates & high stock market prices.

The cheaper valuation & strong wealth management position let me to buy some shares in ABN AMRO instead of more ING. These purchases are financed by new contribution to the stock portfolio.

Why I like the shares of ABN AMRO

Decent position in the stable Dutch banking market with opportunities for higher returns on equity.

Mortgage risks are acceptable again. Corporate loans a manageable risk.

Equity of 25.2B euros for a market cap of 14.7B euros (Google Finance is wrong).

Trading for 5.2 times earnings.

Reasons for the low price

Conclusion

Top 3 player in personal banking. Not the best position but given that there are only 3 large Dutch banks being the number 3 is actually still pretty good.

Do not like the significant position in mortgages. Really do not like that they do not seem to see the most significant risk of mortgages (really high interest rates). Given that inflation has cooled down, interest rates on new loans are higher & house prices are rising again. The mortgages risk is acceptable to me.

Wealth management. Clear number 1 position in the Dutch market with many smaller players. Wealth management always has a relatively high efficiency ratio, which partly explains the poor performance of ABN AMRO on this front. An issue I see is that they charge their customers too much (the segment I know at least, not sure how it is for the really rich clients). Fee pressure is a real threat. I do see plenty of scope for cost cutting as well.

Investors in wealth management products are probably still fairly happy given the strong returns in the stock market. This will limit outflows to cheaper products and increase fees that are based on AUM.

Corporate. This segment is the least attractive for banks & ABN AMRO is quite big in it. Has some synergies with their large wealth management business. Problem is that large corporates have options to shop around & ABN AMRO has not the scale of the specific skills to provide truly unique solutions (BNP Paribas is my favorite bank in Europe when looking at its capabilities to serve large corporates). ABN AMRO will likely generate mediocre returns in this segment, but benefit from higher interest rates.

ABN AMRO targets

Targets do not look very ambitious to me. Given the 12% return on equity achieved in 2023. The Dutch market only has 3 large banks. With a normal interest rate environment & lower bank tax, I think returns will return to the 15-20% return on equity range (with 15% for number 3 ABN AMRO). This would be a nice boost to profits & is the main thesis behind me investing in ABN AMRO (in combination with the juicy capital returns).

Still quite far away from the excellent 25% return on equity Banco del Bajio achieves.

Yes, if you think interest rates will go down below 2% again you should definitely not invest in banks.

Capital returns

Given the relatively poor return on equity I’m happy that the company is not investing too much in growth. ABN has a strong capital return policy in the form of dividends & a share buyback program. ABN AMRO currently yields 9.3% & has bought back 500M worth of shares between and May for the last 3 years (total buyback 1.5B euros). ABN AMRO bought back stock when it was cheap which benefits current shareholders.

The effect of higher interest rates is clearly visible. Net interest income got a nice bump up. I expect NII to stay around this level.

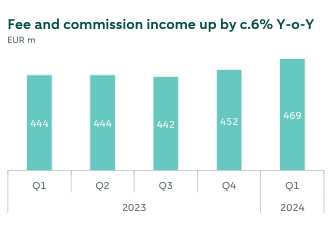

Good to see that ABN AMRO manages to get some more fee income. Still relatively modest compared to NII.

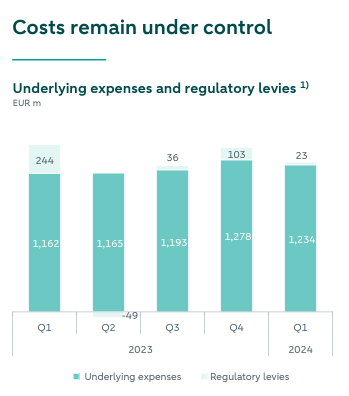

Stable at a high level is not the same as under control. In recent years there have been very significant investments into anti money laundering capabilities. there is some clear room for more efficiencies in that space in the coming years. Banking taxes (Regulatory levies) will decline now that both the SRF & DGS funds are fully loaded. This means that contributions to these funds will decrease.

Coverage ratio & CET1

ABN AMRO has been consistently overcapitalized & have brought this overcapitalization down by strong capital returns to the current CET1 level of 13.8%. This is still fairly conservative.

The coverage ratios tell a different story. ABN AMRO has low coverage ratios, which are also declining. Given the low loan to value & recent increases in home prices I’m not too worried about the residential mortgages from a non-payment perspective.

What does worry me somewhat is the low coverage of the corporate loans in stage 3 at 25.6%. The total coverage of the corporate loans at 1.2B with 92.6B of loans outstanding seems also quite low to me.

In a downturn the coverage ratio looks fairly vulnerable to me. That being said doubling the coverage of the corporate loans does cost 1.2B (full coverage of stage 3 would be 2.4B). This is manageable from a percentage of equity and as a percentage of profit perspective.

Bringing the coverage ratio up to the level of ING (similar conservative lending practices) would cost:

189M for residential mortgages (0,25%)

171M for consumer loans (3.89%)

-78M for corporate loans (ING loans are slightly more conservative with 3.0% stage 3 rating vs ABN AMRO at 3.5%) so 0 is probably fair.

On an absolute basis and a comparative basis, the coverage ratio is an acceptable risk. Low coverage or reserving does not break the thesis that ABN AMRO shares are undervalued.

Valuation

Buying 25.2B of equity for 14.7B is a good deal. Especially if the return on equity itself are decent (in the 10-12% range) and have a good chance to move to 15%. You might be a bit negative on the value of the loan book or even think the bank is overearning in this environment. I do think that return on equity in the 10-12% range should not be a great challenge in a normal rate environment.

If you buy a company at a discount to its equity and the company has a decent return on the equity the price earnings ratio will be really low. In this case 5.2 times earnings. This means ABN AMRO can pay out juicy dividends and still has money left over to grow equity and buy back shares.

Reasons for low valuation

ABN AMRO was taken over by 3 banks just before the financial crisis. Two got hit terribly (Fortis & Bank of Scotland), while Banco Santander got away with relatively little damage. The Dutch part of Fortis plus ABN AMRO was saved by the Dutch government.

The Dutch government has been steadily selling its stake and currently owns 49.5% but continues to sell more shares. This puts some pressure on the share price (alleviates the upward pressure of the share buyback program).

In my view it is likely that the new current government will sell the entire stake and potentially the whole company. Most likely candidate is Nordea, just speculating here.

State banks have a tendency to be less efficient. ABN AMRO has an even longer history of being inefficient, as this was the reason for the failed takeover.

Part of the lower efficiency ratio is explained by the larger wealth management business though.

A slightly lower efficiency ratio means ABN AMRO is likely to stay behind ING in terms of return on equity.

Conclusion

ABN AMRO is a mediocre bank. The banking environment has been very tough on banks in eurozone since the financial crisis. The future looks better for banks especially when located in markets with limited competition. Just look at Australian, Canadian and Scandinavian banks. I think a similar banking environment might be created in the Netherlands.

This combined with lower contributions to DGS & SRF funds will push return on equity up. A rising tide lifts all boats. In mining it is well known that the share price of the best operators moves the least with an increase in the underlying commodity. Given the current prices I expect something similar for banks. The exceptional situation & valuation makes it acceptable to buy a mediocre business at what I think is a fantastic price.

If you want to know more about my thinking on banks: please read my article on ING or Banco del Bajio.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.