Wilmar International: a cheap way to buy exposure to food production

Wilmar is a complex company. Low valuation, hidden strategic holdings & a good dividend means great potential returns for investors.

Investing in the food industry & farming has always held appeal to me. So far though I have never invested a significant part of my portfolio into the sector. The primary reason for this is that the forward returns usually do not look that attractive to me. My recent article on Gruma vs Herdez (both quite attractive led to my renewed interest in the industry. This interest was further increased by Sven Carlin’s YouTube videos on Nutrien & ADM. Having looked at the industry before I decided to look a bit deeper and found Wilmar International.

Why Wilmar International is interesting in a couple bullet points:

Wilmar International is a leading agribusiness with very strong positions in palm oils and sugar.

Listed subsidiary Yihai Kerry Arawana worth more than entire market cap of Wilmar International.

at 10 times earnings & a 5.2% dividend yield the valuation is not demanding.

Wilmar International return on equity and investment are mediocre but its asset base is strong and of high quality. It seems unlikely we are buying at a cyclical peak here.

A potential inflection of earnings can cause a strong rerating of the stock.

ADM as a large shareholder decreases some of the potential governance issues to acceptable levels. Other large shareholders are branches of the Kuok family.

1. Wilmar International a leading agribusiness

Wilmar International is active in 4 different segments plus some collaborations with other leading companies.

Food Products

Wilmar International is the largest producer of consumer pack edible oils in the world, with leading positions in China, Indonesia, India, Vietnam, Sri Lanka and several African countries. We also have growing sales of rice, flour, noodles and condiments under a diverse brand portfolio.

Sounds very much like commodity like products. Similar to the Tortillas of Gruma. I like the leading positions in growing markets. Difficult to assess normalized margins for this segment though. In 2023 the pre-tax result of S$295M was impacted with by higher input prices (especially for flour). At the end of 2023 this impact was already easing and volume increased 6%. In 2022 pre-tax profit was S$730M but helped by a divestment gain of S$176M on Adani Wilmar Limited. In China the market is quite optimistic about a recovery in margins on oils given the valuation of Yihai Kerry Arawana. (more on Adani Wilmar Limited & Yihai Kerry Arawana later).

Feed and Industrial Products

Wilmar International operates crushing plants in China, India, Vietnam, Malaysia, Pakistan, Zimbabwe, Zambia and South Africa. We crush a wide range of oilseeds including soybean, rapeseed, groundnut, sunflower seed, sesame seed, cotton seed, copra and palm kernel. We are one of the world’s largest copra and palm kernel crushers as well as the world’s largest producer of palm biodiesel and oleochemicals, offering a comprehensive range of products from basic oleochemicals, derivatives to biofuels. Sales volume increased by 10%.

In FY2023, the Feed and Industrial Products segment recorded lower pre-tax profit of US$926.7 million (FY2022: US$1.56 billion) mainly as the tropical oils business experienced weaker margins for its mid and downstream operations. The oilseeds division also saw weak crush margins in the first half of the year, arising from lower demand from the poultry and hog industries and elevated soybean prices in the second quarter. However, this was offset by better crush margins in the second half of the year.

This is the largest and most important segment for Wilmar International. This segment is cyclical but given the leading positions this segment in my opinion should be able to achieve a 10% return on capital. My thinking around this segment is somewhat similar to my successful investment in Fonterra. Dominant necessary infrastructure for well-located, good performing farms should over the cycle be able to earn at least fair returns on capital.

Plantation and Sugar milling

This segment comprises oil palm plantation and sugar milling activities, which include the cultivation and milling of palm oil and sugarcane, as well as the production of compound fertilisers.

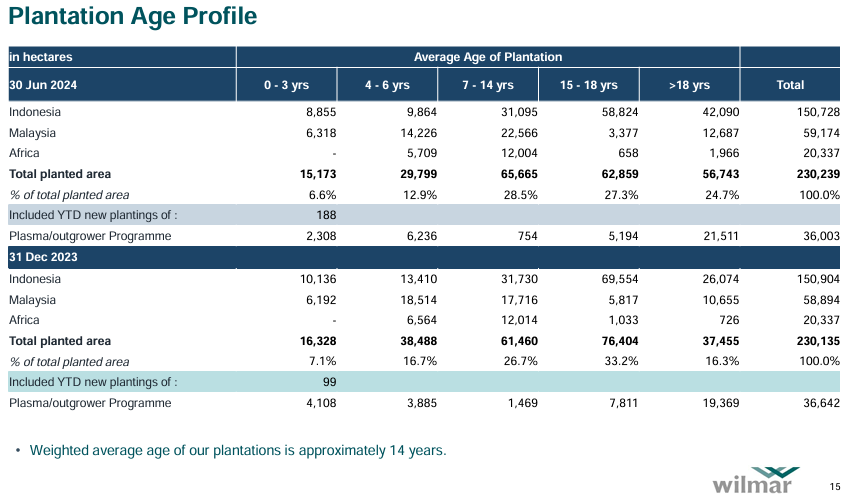

The plantations of Wilmar International are 237k ha of which 230k ha palm oil. Through joint ventures Wilmar controls another 60k ha in Africa.

In recent years, we stepped up our re-planting programme and thus maintaining the average age of our plantations at a relatively young 13 years. This will support the medium to long-term growth of our plantation operations. Around 60% of the plantations are at the prime production age of seven to 18 years and 24% are at age six years and below.

This quote is quite revealing. Wilmar Has significantly invested in its plantations. This means that in the coming years the production of the plantations will increase due to the aging of the plantations. These investments in combination with the investments at the other divisions also explain the muted free cash flow & relatively high asset base.

In FY2023, the Plantation and Sugar Milling segment’s pre-tax profit decreased by 12% to US$500.1 million mainly due to lower profit from the oil palm plantation business as palm oil prices were lower during the year. However, this was offset by a US$231.0 million gain on disposal of Cosumar (stake in Moroccan Sugar company).

In the longer term, we see oil palm production plateauing as new plantings across the industry decrease, stemming from stricter sustainability criteria and limited availability of suitable land. However, we will continue exploring methods to increase FFB yields, without the need for further land expansion.

I really like this sentence. I do not want Wilmar International to invest more in new greenfield palm oil plantations since I do not think the returns on investment are high enough for my liking. Lower investments will likely lead to higher return on assets given the time it takes for these investments to return capital.

Production of Palm oil is still mainly done in Indonesia and Malaysia. Yields in Indonesia and Malaysia were stable at around 3.8 tons/ha in the last decade, well above the global average of 2.9 tons/ha (2014, FAO).

Given that growth in Indonesia and Malaysia seems limited going forward this might make the plantations already in use more attractive.

The graph of palm oil looks interesting. After a spike in 2022 the prices are still reasonably high and even look to break out on the upside again. Higher palm oil prices are good for Wilmar International.

Other

The other segment is small. Most noteworthy are the food parks investments of Wilmar International in China. This is an interesting segment with clear growth potential.

Strategic investments

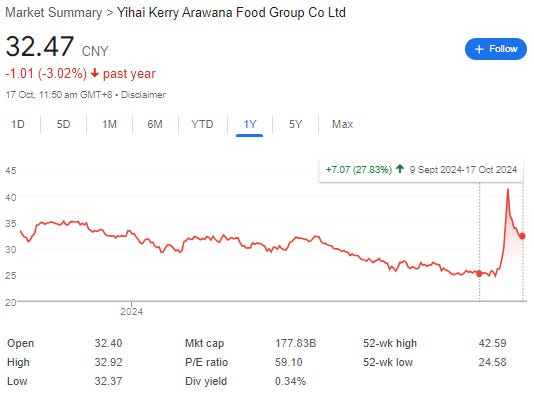

Yihai Kerry Arawana Food Group is the largest cooking oil processing company in China. Listed with a market cap of 178B CNY (S$32.8B). Wilmar owns 89.99% leading to a valuation of S$29.5B. This is more than the current market cap of Wilmar International of S$21.13B.

Yihai Kerry clearly benefitted from the news around the new Chinese stimulus package.

Profits at Yihai Kerry Arawana Food Group have been declining since 2020 from 6B CNY to 2.8B CNY. Net debt is significant at 40B CNY. So personally, I would not be interested in Yihai Kerry at the current valuation. Still, it is a positive to have highly valued subsidiaries. Potentially Wilmar will divest some of its holdings at an attractive price.

Shree Renuka Sugars is India's largest sugar refiner and ethanol producer. Listed in Mumbai with a market value of 101.23B INR (S$1.55B) Wilmar owns 62.5% for a value of S$0.97B. Company is not generating any profits but is growing.

Adani Wilmar is an Indian food and beverage conglomerate and is India's largest processor of palm oil. Listed with a market value of 454B INR (S$6.97B). Wilmar owns 43.93% leading to a valuation of 3.06B. This asset looks even more overvalued at first glance with a profit in 2023 of 1.5B INR. Profit in between 2022 and 2019 have been between 4.6B INR and 8.0B INR. Still very expensive.

Highly valued subsidiaries are a nice bonus on the undervaluation thesis. Similar to my investment in KSB.

Profits

Wilmar International is consistently profitable and is rewarding shareholders. Net profit was S$1.8B in 2019, S$2.1B in 2020, S$2.5B in 2021, S$3.3B in 2022 & S$2.0B in 2023. Shares outstanding declined in this timeframe from 6.34B to 6.24B. In my opinion the profitability of Wilmar International might be somewhat understated due to the growth investments that cannot be fully capitalized.

H1 2024 net profit was up 6% per share. Cash flow was also great with inventory down 10% due to a mix of less days and lower prices. This strengthens the financial profile of Wilmar International.

Strong asset base

The net asset value per share is S$4.16 vs a share price of S$3.29. Net tangible assets per share is S$3.06. This means you are roughly paying net tangible assets for Wilmar International.

Since 2019 total assets increased from S$63.3B to S$81.5B in 2023. Intangibles decreased in this timeframe from S$7.2B to S$7.0B. Shareholders equity in this timeframe increased from S$22.5B to S$26.6B.

Return on equity

Return on equity was 7.8% & return on invested capital 6.1%. A fair return but in my view something that in a slightly more favorable environment could easily move closer to 10% on average. This is not too much of a stretch given the 12.0% return on equity achieved in 2022.

An inflection based on more moderate investment & higher palm oil prices could in my view easily change investor expectations and value the company at roughly 1.5 times book value S$6.24. This is almost double the current share price of S$3.29 and still a reasonable earnings multiple of 15.

Shareholders

Largest shareholder is the Kuok group with 27%. This family is historically not known for the best corporate governance. Since the merger of Wilmar & Kerry in 2006 (both controlled by different parts of the family) I have not seen activities which could be classified as harmful to smaller investors.

This makes sense given that since that time ADM, the largest agricultural supply chain manager and processor in the world, has a 22.5% share.

This gives me confidence that the Wilmar businesses are run with a clear profit motive and with the interests of minority shareholders in mind.

Wilmar is willing to share the profits of the enterprise with all shareholders through its dividend which yields 5.17% & sporadic share buybacks.

Conclusion

Wilmar International is an integrated agribusiness with strong leading positions in sugar and palm oil. The company combines strong consumer brands with plantation & milling activities. 2023 was not a great year for Wilmar International but the future is looking better. The listed investments are clearly worth more than the current market cap of Wilmar International. Shareholders are paid to wait with a dividend above 5% plus irregular share buybacks. My price target is 1.5 times book and 90% above the current share price.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Isn't the Chinese subsidiary consolidated in Wilmar's earnings?

Very interesting idea. I would love it to be a little cheaper given the valuation of many Asian holdcos competing to get into the portfolio.