Regeneron: Investing in a better mouse trap

My first investment in the healthcare sector. Why I liked Regeneron and still hold the stock after good returns.

The goal is to make money, not to know everything. This is true for all investments, but more clearly true in this situation. I’m not a healthcare expert. However, I think this does not disqualify me from investing in the sector. I like the idea of having some exposure to this growing sector. Biotechnology has performed poorly, but returns for Regeneron have been good. So I’m outperforming the sector. Still holding the position and have not sold anything after the increase in the stock price. I even increased the position somewhat, but not at current prices. Buying more at a higher price is something I try to get more comfortable with. In the case of Regeneron with good results (so far).

If anyone has any good ideas in the sector please share the ideas in the comments. I have been working on another idea and will share it in due time.

Explanation to an 11-year-old

Serious about inventing medicine

No serious patent cliffs

Good capital allocation

Attractive valuation

1. Serious about inventing medicine

I found it to be true: Most large medicine companies invest surprisingly little in research of new medicine and focus mostly on buying smaller medicine companies. The R&D they do spend is mostly in the later stages on promising medicines they acquired.

The main reason companies do this is to present better results. Investing in early-stage R&D with a high chance of failure depresses net income and earnings per share. Management wants to hit analyst targets and thus decides to reduce R&D investments.

Regeneron invested $3.6B in R&D in 2022 (30% of revenues). In 2023 Regeneron spent $4.4B, a staggering 33.8% of revenue.

The largest investor in R&D in 2022 were the following companies:

Roche: $14.7B (22% of revenue)

Johnson & Johnson: $14.6B (15% of revenue)

Merck & Co: $13.6B (23% of revenue)

Pfizer: $11.4B (11% of revenue)

Novartis: $10B (20% of revenue)

AstraZeneca: $9.8B (22% of revenue)

Bristol Myers Squibb: $9.5B (21% of revenue)

Eli Lilly: $7.2B (25% of revenue)

Sanofi: $6.7B (16% of revenue)

Abbvie: $6.5B (11% of revenue)

The most popular stock in medicine is currently without a doubt Novo Nordisk. This company increased its R&D budget in 2023 with 35%, but still only invested $4.7B which amounted to 14% of revenue.

The biggest difference however is the way that Regeneron is trying to find new medicines.

Regeneron: a better mouse trap

Investing more in research is great, but not what I’m after. My feeling after reading a bit about Regeneron is that they are better at research. If that is the case the company might deliver higher returns from their investments as well.

Regeneron was founded in 1988 and focused on mouse genetics. This allowed Regeneron scientists to determine the best targets for therapeutic intervention and more quickly generate human antibodies as drug candidates.

The company added to this capability by developing fusion proteins and in 2014 started to work on the human genome.

This combination helps the company to find new drugs with less effort.

I’m still not sure how confident I am that Regeneron has developed a better mouse trap, but the results so far keep pointing in that direction. For this reason, I’m comfortable with Regeneron rapidly increasing their Research & Development budget.

2. No serious patent cliffs

Most medical companies have long histories, meaning they have old drugs that go off-patent. Regeneron is only 35 years old and its first blockbuster drug Eylea was approved in 2011.

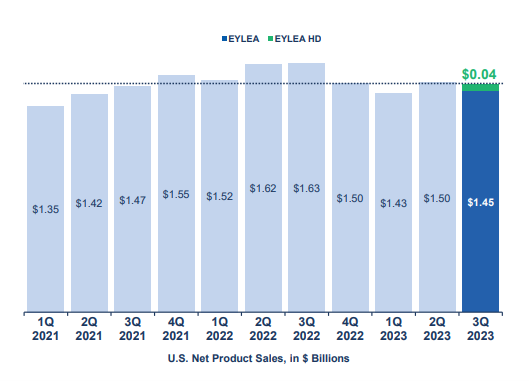

This anti-VEGF drug is now facing competition from drugs like Vabysmo from Roche, but sales of this market-leading drug are still holding up well at $1.5B a quarter. Given the introduction and approval of a higher dose variant, I think Eylea can hold its ground for a couple more years with manageable declines..

The largest drug of Regeneron is Dupixent with $3.1B a quarter and still growing 33%. This drug is developed in collaboration with Sanofi.

The Dupixent drug was first approved in 2017, but the use cases of this drug are still growing. In my opinion, the full potential of this drug is still not reached for the most important drug of Regeneron.

Another drug with significant potential is Libtayo. Libtayo was FDA-approved in 2018 and is still growing rapidly.

Other upcoming medicines that show growing revenues are Praluent, Evkeeza, and Inmazeb.

Results for Q4 are out and continue this picture with strong performance for both Dupixent and Libayo.

3. Capital allocation

Regeneron pays no dividend. I find this to be refreshing in the field of large medical companies that usually have a consistent dividend policy. Regeneron is willing to reward shareholders though. They have aggressively bought back shares when it makes sense.

The company bought back over $12B worth of shares since 2019. Including a $5B pack of shares from Sanofi at roughly 1/3 of the current market cap ($100B). This was 15% of the company at the time. In 2023 the company bought back stock worth of $2.2B. In hindsight an even more aggressive share buyback program would have been better, but I still give them good marks on this front.

A slight minus is the rewards management got. Management got paid too much using options. The CEO got paid $453M in 2021. This was very excessive. In 2022 however, it dropped back to a more reasonable $9M. Given the great performance of the company I swallow this, but it is something to be aware of.

4. Attractive valuation

Given the growing revenues from Dupixent in particular and a promising pipeline, I would argue that the valuation of Regeneron is still attractive even given the run-up in the share price.

The p/e ratio seems high at 26.9. Especially given revenue growth of only 8%. Growth would have been 12% when revenues from Ronapreve were excluded. Ronapreve is an antibody cocktail against COVID-19. I view these COVID-related incomes as a bonus and a sign of Regeneron’s strong research capabilities.

The most shocking thing might be EPS. Earnings per share declined year over year by 9%. Again some of it was caused by Ronepreve, but most by something else. Research and development increased 24% to $4.4B (33.8% of revenue). Regeneron could post significantly higher earnings if it decided to cut R&D. A more normal 23.8% of revenue would lead to an increase in profits of $1.3B, an increase in earnings of 33.2%. Reducing the p/e to a more manageable 20.2 times earnings.

The balance sheet is a fortress. Cash is with $16.2B considerably larger than the debt of $1.9B.

All in all, I think the valuation at first glance looks expensive, but when you give the company credit for its R&D and fortress balance sheet the stock looks reasonably priced. If you believe the company has found a better mouse trap, the share price might go a lot higher in the future.

I still have some doubts about how much weight I have to put on the above-par ability of Regeneron to find new drugs. I’m willing to invest though with the idea that this is at least partly true. This does not mean that new blockbuster medicines by Regeneron are guaranteed, but I think the odds might be slightly in the investor’s favour.

Disclaimer: These are my ideas and not personal investment advice. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Healthcare / healthtech investing explained for dummies which I appreaciate.

Regeneron stock is in my opinion better that most competitiors. I like the buy back scheme and focus on research itself. Such companies are hard to replace en likely to grow.

Would like to get some tips about more of these healthcare / healthtech companies.