Investing in Mexico: A start on all Mexican stocks

Opportunities in a market with significant tailwinds.

Mexico benefits from nearshoring and high interest rates that might decrease. This combination makes it a potentially interesting country to invest in. I went over all the stocks on the Mexbol. Below the noteworthy things that I found.

I got interested in doing a country series because of three reasons:

Buffett recommends starting with company A and continuing till Z. In this way, you will see a lot and the chances of learning are higher.

Value and Opportunity is a great blog that has done series on European countries. I did enjoy them. Recommend having a look over at his blog. Hopefully, the readers enjoy this series as well.

I previously did some country research on certain markets without writing it down. This might have been good content and good for record keeping. Just went through all Mexican stocks and decided to write something about them.

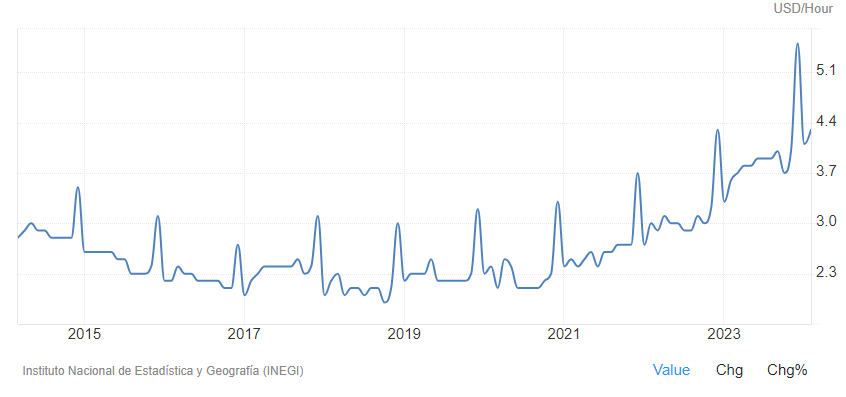

Before I start on the list another interesting graph I came across.

Mexican manufacturing wages are increasing rapidly, are still low and have a long runway ahead. This might have multiple good implications for Mexico. Given this graph, I’m most interested in companies that benefit from a wealthier Mexican consumer.

Mexican stocks: A-Z

Arca Continental SAB. Botler of Coca-Cola (298B market cap): 16.4 times profit. Modest debt (19.2B), modest earnings growth, 3% dividend and 1.5% share buyback. Book value of shareholders is 105B. Interesting, but not cheap enough for me with the Mexican 10y at 10.2%, but decent value.

Accel SAB. Provides manufacturing and logistics services in Mexico and the United States. (4.3B Market cap): Share price is flat, which is surprising. Too hard for me with just information in Spanish. You pay slightly over book, 14 times earnings, and 1.9B net debt.

Corporcacion Actinver. Mexican holding company primarily engaged in the financial sector (8B Market cap): 7 times profit, a low dividend of 1.3% and trades roughly at book value. Not an expert in the Mexican financial sector. Mexican banking sector has room for growth, but not sure I find it so attractive. More confidence in European banks

Agro Industrial Exportadora SA. Mexican holding company which is engaged in the food processing sector (13.3M market cap). No profit, market cap is very small, industry does not sound attractive.

Grupo Rotoplas, S.A.B. de C.V. or simply Rotoplas is a Mexican multinational company dedicated to the manufacture of water storage and filtration tanks (13.6B market cap). 20.6 times profit (45 times seems wrong). 2.3 times book. 3.3B net debt. Not sure I believe this is such an attractive growth industry that it warrants such a premium valuation.

After writing 5 of these stocks down I don’t think there is much value in me covering stocks this way. I do think there is great value in just starting at A or Z and just look at all the stocks in an index. It gives a great perspective. If you don’t want to take my word for it, it is something Buffett recommends as well.

Looking at the first stocks I see more reasonable valuations than in the US.

If people like me to continue this series please let me know.

I think a shorter series with just the stocks I found interesting might add more value. In addition, I do not see the benefit of talking down to stocks I don’t like.

The first stock of interest I want to discuss is Corporacion Ara (no position).

This company will be discussed in the next article. Potentially with more short descriptions of other companies.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

I'm in for just the interesting ones!

I would like the series a-z