Hornbach holding: Why I like the stock

Why investing in companies with lower returns on capital can deliver very good returns and deserve a position in your portfolio.

Why invest in Hornbach: Explanation to an eleven year old

Hornbach allows consumers to buy stuff cheaper and with great service

Hornbach has a strong market position that is increasing in strength.

Hornbach has grown revenue and earnings.

Trustworthy management

Real estate is worth significantly more than market capitalisation and debt.

Hornbach is one of Europe’s larger DIY chains with 172 stores. The company is growing and investing in underlying real estate. Below I will elaborate on the points made above and why I think the market is misjudging the company.

Hornbach allows consumers to buy stuff cheaper and with great service

Retail is usually hard to predict and quite fickle. However by focusing on things which do not change companies can create a strong position. Hornbach does this in the DIY retail space.

The company gives consumers every day low pricing and actually has a low price guarantee to customers. So consumers know they will consistently get a good deal and don’t have to wait for a special sale.

How does the company sell products at a lower price and still make money?

Hornbach is able to sell at a lower price, because the company focuses strongly on cost and sells only through big stores (and online deliveries) which can be run very efficiently. Hornbach has the highest sales density per m2 in its most competitive market (Germany) while having large stores.

You can imagine a self-reinforcing flywheel at work. Low prices attract customers willing to buy stuff, which leads to more sales, which allows for lower overhead per sales, which allows lower prices…

Hornbach is not saving on employees either. Buy paying a bit more than is normal in the sector the company is able to better retain employees and attract the best from the competition. In addition it helps that the growth of the company also gives enough opportunities for employees to grow within the organisation. This means that knowledge of employees and the level of service is usually higher at Hornbach than at competitors.

Another benefit of consistently offering lower prices is that this helps in an environment where consumers get more price conscious.

Hornbach has a strong market position that is increasing in strength

The European DIY market is a lot more competitive than the US market. The primary reason for this is the number of competitors and the market share they have. This is especially true in Germany. In this competitive market Hornbach is growing and has become the clear number 3 with a market share of 14.8% (from 13.2% in 2019). With Hornbach increasing its market share the market is likely to become more profitable.

Markets like the Netherlands 26.5% market share (from 20.7% in 2019) and Czech Republic 36.1% market share (from 33.2% in 2019) are already clearly more profitable. Share of the markets outside Germany is growing from in 46.8% in 2018 to 51.6% currently. This is kind of surprising given that 99 of the 172 stores are actually in Germany.

The company is growing its market share in 3 ways:

Winning customers to the stores by consistently offering lower prices.

Already discussedOpening new stores to increase coverage

Company is consistently opening new stores to increase sales. More stores lead to scale advantages as wellInvest heavily in a strong online offering

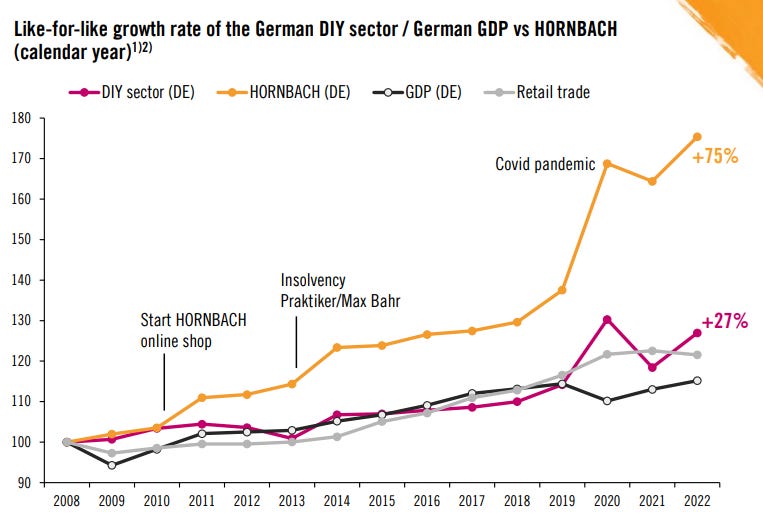

Hornbach opened its online shop in 2010 and has consistently invested significant sums into its online offering. Before the pandemic I had some serious doubts on the returns on those investments which do hurt profitability in the short term, but in hindsight it was a great decision. A significant part of the investment consist of the right logistics. These significant investments in the online offering leads to a leading 13% of online sales compared to 5% for the competition in Germany (my feeling is they are a leader in other markets as well).

Given the current situation I think it is likely that the growth of the company will persist.

Hornbach has historically grown revenue and earnings

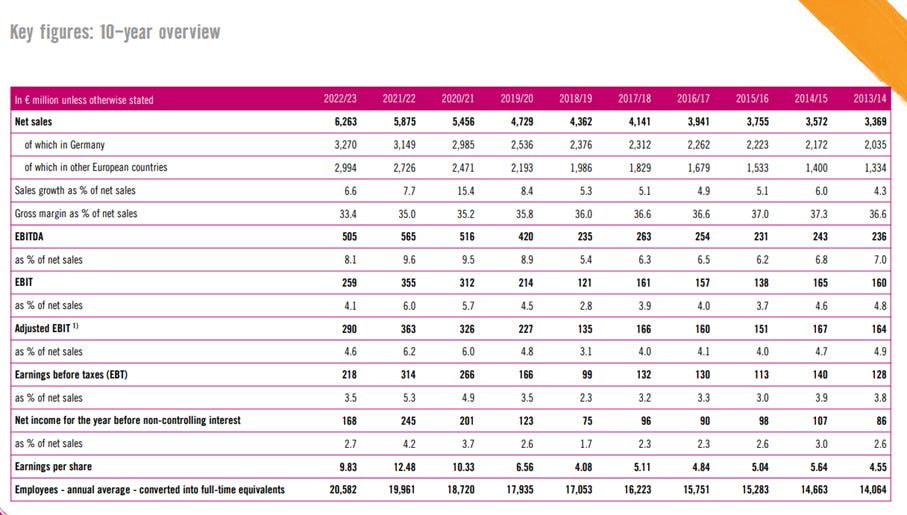

Looking at the last 10 years Hornbach has grown the company almost doubling revenue and doubling earnings from €86M to €168M. Investors however in my opinion are focusing too much on the last couple years and see a decline from €245M to €168M. However the results during COVID-19 are an exception. Net income margins are roughly back at their historic norms.

Given these historic results and the investments the company has made in new stores and online continued growth in the medium term is likely.

In the short term however growth might be a bit subdued. However Even when looking further back the company has always produced good earnings. Even during the financial crisis, which severely hurt the housing market the company produced decent results. One of the reasons is that customers become more cost conscious in a recession.

EPS:

2012/13: €4.06

2011/12: €4.77

2010/11: €5.07*

2009/10: €4.16*

2008/09: €5.71*

2007/08: €3.00*

Since the financial crisis the company has produced satisfactory results at current share price for the entire period.

Company earns on average €5.95 per year and thus trades at an average p/e ratio of roughly 10. This does not take into account that the company grew its store base (from 155 in 2017 to 172 2nd half 2023), bought back a store, started selling online and bought out minority shareholders in Hornbach Baumarkt AG. Yes the company over earned in the last three years, but using €5.95 is very conservative. Personally I think a more normalised EPS number is between €7 and €9, with continued growth going forward due to additional investments.

Cost of growth

In addition to these earnings I think that the companies’ earnings are suppressed by the cost associated with growth. Only pre-opening expenses already are 0,22% of sales on average. Personally I think the pre-opening expenses are only part of the cost of growth. Just the 0,22% of sales however is another €12M on a yearly basis. More than enough to pay out an additional 1% in dividend.

Don’t get me wrong. I don’t think the company should stop growing. However these hidden cost of growth are part of the reason why under investing companies can look cheaper than they actually are.

Trustworthy management

Hornbach is a family controlled company. Family owned companies come with their pro’s and cons. On average however stocks of family controlled companies outperform. Currently the fifth generation is in control. Family companies tend to be a bit more conservative and this is definitely the case with Hornbach and the financing of the company.

Hornbach has €349M in cash and €868M of debt. Given the real estate value of €2,203M (see real estate) I think it is fair to say the company is conservatively financed.

Something I think is important is that management is not enriching themselves too much. Given that there is no stock dilution. This is something I really like. Chairman and CEO Albrecht Hornbach earns €947k and CFO Roland Pelka receives €1,106k. This is a nice salary, but an acceptable amount.

Management seems honest and even a bit conservative. The company is quick with issuing profit warnings, which sometimes due to improving circumstances proved unnecessary. I like this conservative nature.

Dividend

Company has a policy of a stable dividend. As is common in Europe the company is reluctant to cut the dividend and has never done this in its history. Company currently aims to pay out roughly 30% of its earnings, but historically has paid out less. If earnings will decline the most likely scenario is that the payout ratio increases. Dividend is currently €2.40 per share which gives the stock a yield of 3.90%.

Real estate

What separates Hornbach from most other retail companies is its real estate. I like companies that have real estate, but are not directly active in the sector. This because there are opportunities for hidden value.

Hornbach has significant ownership in the store real estate. Store ownership has grown in recent years. Given that the company is primarily a retailer and does not regularly value its real estate this leads to hidden assets in the company. The company states in its annual report on page 71 that the hidden assets amount to €884M. This is when the real estate is valued at a conservative rent multiplier of 13 and an age discount of 0,6% p.a. Total real estate value when this method is used is €2,203M. Personally I think this still might be conservative, but given current interest rates it is a somewhat fair multiple to use. €2,203M of real estate value compares favourably to €519M of net debt and €976M of market capitalisation.

Quality of real estate

The real estate consist for the overwhelming majority of big box retail stores. Real estate is located near large catchment areas. From my experience the real estate is generally well maintained and have good access to main roads. This kind of retail locations are still fairly popular and do not face the same challenges as malls.

Alternative use case of real estate

The big boxes are suitable for a host of other use cases. The most obvious one is logistics. Actually logistics real estate has a lot of similarities to this real estate, but is currently more popular as an investment.

For certain locations densification is also an option. Some of the older locations are actually fairly close to the city centre and might be turned into residential real estate when the urban sprawl continues to grow.

Owned vs leased

61% owned (target of at least 50%, historically the company was close to 50%, but in recent years there has been strong growth in the % of owned stores). This is achieved by developing new real estate themselves and not selling any real estate. Actually the company used funds to buy back a store in Chemnitz. Given the strong cash flow the company is able to grow and keep the real estate. Nothing wrong with this, but the returns from under levered real estate is not something to get jealous about.

This is actually one of the major risks for investors that a significant part of your money is delivering lower than benchmark returns. However the good thing is that the risk is fairly low and it increases the optionality in the business.

What analyst might think

Short term earnings pressure due too cooling housing market. I think pressure is overstated. People might move less, but would in those cases often renovate a home. Naturally earnings decline a bit after a couple of boom years, but future underlying earnings are very likely to be good. Earnings have been good during the financial crisis and company is significantly stronger than 15 years ago.

Returns on capital are low. This seems to be the case. However there are three mitigating factors:

one significant reason is the low leverage and significant real estate holdings. I do not have an issue with this. However I hope they do not increase the percentage of owned real estate much further. Best case would be that they use this financial power at an opportune time. Given the company I think this is unlikely, but the financial fortress does protect them in more difficult circumstances and allows management to focus on the long term.

Second reason is that Hornbach is investing in growth. This is done through investments in price, logistics for online and new stores. These investments cannot be fully capitalised, but will enhance the position of Hornbach in the future. These investments are also quite flexible and can be scaled down when necessary.

Given the significant discounts you pay for the assets a lower, but acceptable return on capital is not a deal killer in my opinion. High returns attract more competition, while lower returns might lead to less competition and higher future returns.

Ways to win:

Family take over. Unlikely, but not impossible

Family sale. Unlikely, but huge upside.

Smart acquisition. Company has not a history of acquisition, but is experimenting with growth outside the core DIY store with Bodenhaus (flooring). Potential to put some capital to use, but more risky given the lack of a track record.

Real estate spin off. You can always hope, but not very likely in my opinion.

Rerating. Companies to in and out of favour. A look at the stock shows you that the stock can have strong moves. This plus the returns of business is why I like the stock. Halving the position after a double might make sense.

Continued growth plus dividend. Company is likely to continue to grow. If rate of grows slows. Company might increase the payout ratio a bit. Given the returns the company generates I’m sort of indifferent. I think it is unlikely the company cuts the dividend and growth while not smooth is likely.

Expected return

Earnings growth of 7% from a mixture of inflation, store expansion, rent growth and online is likely in my opinion. This plus a dividend yield just below 4% gives a total return of 11%. Which is still attractive even in this higher rate environment. In addition this growth I think the valuation of the company can double. In 10 years total return with decent timing can come from earnings growth 100%, dividend 50% and rerating 100% with a timely sale.

Q1 results for Hornbach are above expectations. Sales up only 1.8%, with 2.6% growth for Hornbach Baumarkt. Higher gross margins and successful cost management leads to 33.8% growth of EBIT and EPS up 43.6%. Company as always is conservative with their projections and only see a slight increase in results this year.

Hidden real estate reserves showed up in last investor presentation and are now 934M euros.

New annual report for Hornbach is out.

page 11 of the factbook shows a nice graph with share price, revenue and ebit.

Hornbach found a way to lower earnings a bit by doing some impairments. In addition to this my favorite part of the Annual report is missing. No explanation anymore on the hidden value of the real estate assets.

I'm confident that Hornbach big stores are still worth 13 times rent - 0,5% age factor. Using this calculation last year the hidden value was 884M euros. This would have crossed the 900M mark this year. Fairly significant given a market cap of 1.25B euros.