First Mexican special situation & buying emerging market subsidiary for hefty discount instead of premium

Servicios Javer is a profitable construction business at a cheap valuation and at a discount to the acquisition price. Kimberly-Clark de Mexico is trading at an attractive valuation.

In part 11 on my journey of covering all Mexican stocks. It this edition I found an interesting special situation with a company trading at cheap valuations & a buyout offer which seems realistic to get through.

Kimberly-Clark de Mexico is another interesting situation. I find it surprising how much cheaper it is than the US listed stock. When looking at companies with listed Indian subsidiaries I tend to find the opposite. This is quite amusing to me.

Can someone explain to me why Indian subsidiaries deserve a hefty premium while Mexican subsidiaries should trade at a big discount?

Other interesting stocks covered in part 11 are a well performing steel company, a growing over the counter medicine company and a growing supermarket chain that focuses on richer Mexicans.

Stocks covered:

Industrias CH: +-

Servicios Corporativos Javer: +

Kimberly-Clark de Mexico: +

Grupo Kuo: -

Genomma Lab Internacional SAB de CV: +-

La Comer: +-

Industrias CH

Market cap 80.7B Ps, equity 48.9B Ps, total assets 75.6B Ps and net income 2023 3.8B Ps. Industrias CH is an industrial conglomerate with a focus on steel. The most important asset is Grupo Simec of which Industrias CH owns 76.2%, Grupo Simec also owns 7.2% of its own shares.

Steel products is a very competitive industry. Products can be shipped around the world and the huge amount of fixed cost leads to poor returns on capital.

Paying 80.7B Ps for 48.9B Ps in equity is too much for me in this industry. I also do not like the expansion in Brazil. If you like to invest in Simec than buying it through Industrias CH is a good idea. For me it is a pass.

Servicios Corporativos Javer

Market cap 2.8B Ps, equity 3.3B Ps, total assets 9.7B Ps, net income in 2023: 671M Ps. Net income 9M 2024 513M Ps. The debt ratio has been trending downwards and is quite reasonable at 0.56 times net debt / EBITDA.

Javer is a Mexican construction company. The Mexican construction industry has been challenged for years. There are signs of hope though. The new presidente Claudia Sheinbaum of Mexico wants to build at least 1 million homes. This might stimulate new construction demand.

The land bank is also located in good states with significant economic growth. The valuation of Javer is attractive but compared to competitor Consorcio Ara it still looks expensive. Operationally Javer might have the upper hand, but it lacks the hidden value of retail real estate. More information on my view on the Mexican housing market can be found in the article which covers Consorcio Ara.

Servicios Javer = Special situation!

What makes Servicios Javer attractive is the pending acquisition. Shareholders holding 62.7% of the shares have agreed to sell their shares to Vinte Viviendas Integrales for 14.94 Ps a share. Recently the share price of Servicios Javer dropped 28.6%. To me it is not clear why this is the case. It might be a fat finger or a forced sale in a very illiquid position.

Not an expert but to me the deal is likely to get through. There are plenty of other construction companies in Mexico. This would be a nice 50% gain. Given the reasonable valuation you get if the deal does not go through this is a very interesting situation. Normally I think catalyst are quite often overrated but in this particular case I find it likely that Vinte Viviendas Integrales will take over Servicios Corporativos Javer for 14.94 Ps a share. Given the lack of attractive special situations in my portfolio I tried to open a small position in Servicios Corporativos Javer. This was not successful given the huge bid ask spread. Still interested so maybe I should not be sharing this.

Be aware that trading in the stock of Servicios Javer can be very illiquid.

Kimberly-Clark de Mexico

Market cap 93B Ps, equity 6.5B Ps, total assets 53.0B Ps, net income in 2023: 7.8B Ps. 9M 2024 net income 6.0B Ps up 19%. Kimberly-Clark de Mexico is a producer of diapers, tissues and paper towels.

Recently the share price of Kimberly-Clark de Mexico has seen a significant drop for such a stable company. This is somewhat surprising given that the share price of Kimberly-Clark Corp is up, and interest rates are down.

The valuation at 11.7 times earnings is reasonable. Net debt is reasonable as well at 12.3B Ps (0.9 times EBITDA). The dividend is quite attractive at 5.65%.

It is surprising to me that the Mexican subsidiary is a lot cheaper than Kimberly-Clark that is trading at 21.3 times earnings. Kimberly-Clark owns 47.9% of Kimberly-Clark de Mexico. I would say government issues are limited. Which is somewhat of an advantage compared to family-controlled companies like

Herdez & Gruma which I discussed recently.

P&G and Kimberly-Clark dominate the diaper market worldwide. Which does look like an interesting profitable business to be in. Kimberly-Clark de Mexico might be a good cheap way to get exposure to increasing wealth of the Mexican consumer. If you have more money to spend more luxurious diapers seems like an obvious spot to look. Not sure though how strong the market position of Kimberly Clark is in Mexico. If someone knows more about this than please let me know.

Interesting company to follow.

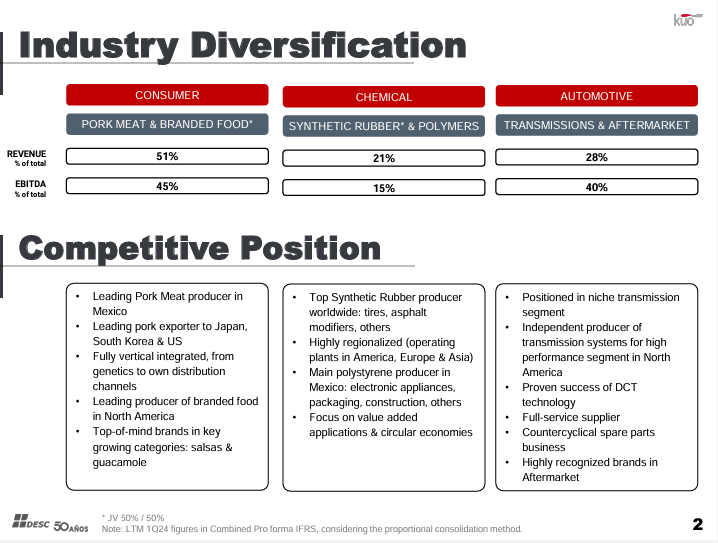

Grupo Kuo

Market cap 19.3B Ps, equity 16.5B Ps, total assets 44B Ps, net income in 2023: 736M Ps. Grupo Kuo is a mixed financial holding company with fluctuating profitability. I do not see clear synergies between pork meat, rubber and automotive transmissions.

All those industries are cyclical and or challenged competitive industries. Pass

Genomma Lab Internacional

Market cap 25.3B Ps, equity 9.4B Ps, assets 20.7B Ps, net income in 2023: 1.1B Ps.

Genomma is selling over the counter medicines and has an personal care and beverage business. The company sells predominantly in Mexico and Latam but has some exposure to the US.

I like how the company is focused on reducing the number of brands and SKU’s. Not so great is that the company is still active in many categories as a number 3 or lower player. Only in Derma OTC the company is leading.

The stock performance recently has been very strong. Recent operational results have been good but I’m somewhat puzzled by the YTD performance. This means the valuation is now a bit high for my liking. Given my lack of company specific knowledge I’m hesitant to pay 17.8 times TTM earnings.

Interesting company to follow and clearly cheaper than OTC medicine companies from developed markets. So is Kenvue the split off OTC business of Johnson & Johnson trading at 39 times earnings and is Haleon in the UK trading for 32.5 times earnings.

La Comer

Market cap 29.7B Ps, equity 30B, total assets 41.2B Ps and net income in 2023 2.1B Ps.

La Comer runs 84 food stores in Mexico. The company focuses on more affluent Mexican consumers and has been growing from 54 stores in 2016. Operating income in that timeframe has increased from 416M Ps to 2,579M Ps in 2023.

La Comer has significant real estate holdings of 44 units which are good for 62% of the sales area. Property plant & equipment right of use assets and lease liabilities is 21B Ps and might be undervalued.

The company wants to benefit from a richer Mexican consumer. In this way the company fits nicely in the thesis that the Mexican consumer will get richer. Not 100% convinced though that La Comer will win additional market share. In rich countries a low price strategy still holds a lot of appeal.

Historically the results have been good for La Comer. I do like the real estate, which might be undervalued but not 100% convinced that their strategy is a winning one. In addition, I find over 17 times TTM earnings quite expensive for a retailer. If you like La Comer, I recommend looking at Grupo Comercial Chedraui which I wrote about as well.

Conclusion

Special situation investing remains a very interesting field to look at. In the US and to a lesser extent in Europe that kind of situation seems to be too crowded to deliver exceptional returns. In emerging markets, it feels different to me. Might start looking specifically for those kind of situations in the future. If anyone has any tips let me know.

For more long-term oriented investors I think Kimberly-Clark de Mexico is an interesting situation deserving more attention. If someone can get a better grasp of the competitive situation in Mexico I’m all ears.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Worth looking into