Ebro Foods: largest rice producer is a bargain

Lower prices for rice & wheat help Ebro Foods increase its margins. This leads to record profitability.

A lot of attention is given by investors to stocks which benefit from higher commodity prices. In this blog post I want to shine some light on a company that does benefit from lower commodity prices.

Ebro Foods is the worldwide leader in the sale of rice & a leader in the sale of fresh pasta.

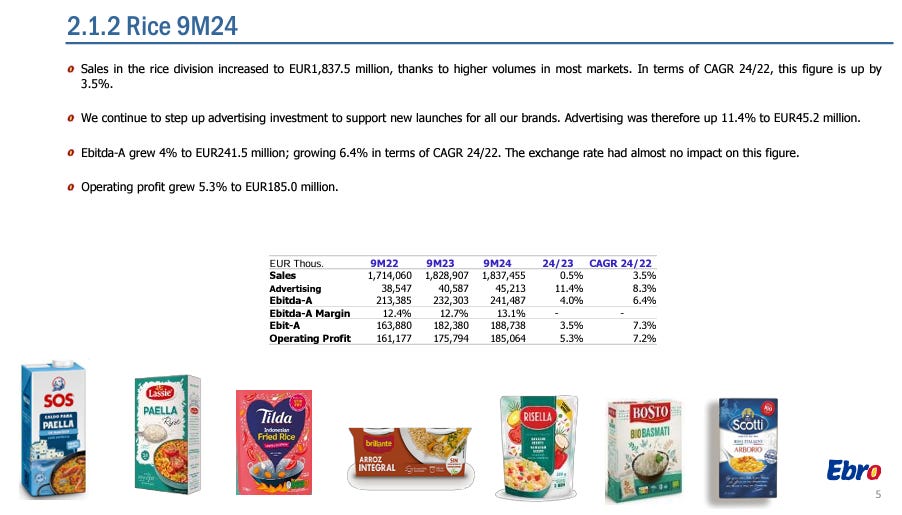

In Rice Ebro has 23% share in the US, 28% share in France, 26% share in the UK, 31% in Spain, 32% in Belgium, 28% in the Netherlands, 21% in Germany & 17% in Portugal.

In the pasta segment it has a strong growing presence in fresh pasta with 45% share in France & 55% in Canada.

The company used to be the second largest pasta seller behind barilla but divested from this business in a number of transactions. The latest was for the Panzani brand to CVC Capital partners for € 550M in 2021.

Geographically Europe is the most important market with 44% of the revenue. Americas (mostly US & Canada) is a close second with 34% share. Rest of the sales is exports to other markets. Ebro Foods is thus clearly an international company and not only focused on Europe.

Share price performance

The historic results of Ebro Foods has been disappointing. The dividend has a nice 4% yield but the share price has declined 15% in 5 years.

A picture of on Twitter sparked my interest. It is a graph with the Ebro foods stock price & EBITDA. It shows EBITDA clearly increasing making the stock historically cheap from a valuation perspective.

Not investing in higher commodity prices

For many investors it is popular to invest behind higher prices for commodities. The truth is that the prices of commodities are not performing well longer term. Technological innovation leads to higher productivity which leads to downward pressure on commodity prices. Yes, the prices of commodities benefit from inflation and shocks. Still in the long term it is better to invest in the users of commodities that sell a brand. The most famous example is Coca-Cola.

Ebro Foods has strong local brands. Not as great as Coca-Cola. Influence of commodity prices is much larger. Major inputs for Ebro Foods are rice & wheat.

Ebro Foods benefitting from lower rice & wheat prices

The price of rice has dropped significantly recently. Due to India allowing rice exports. This will definitely help Ebro given that the companies rice brands can more easily keep margins when the price of input drops.

The price of wheat, an important input for pasta has also dropped after a steep spike.

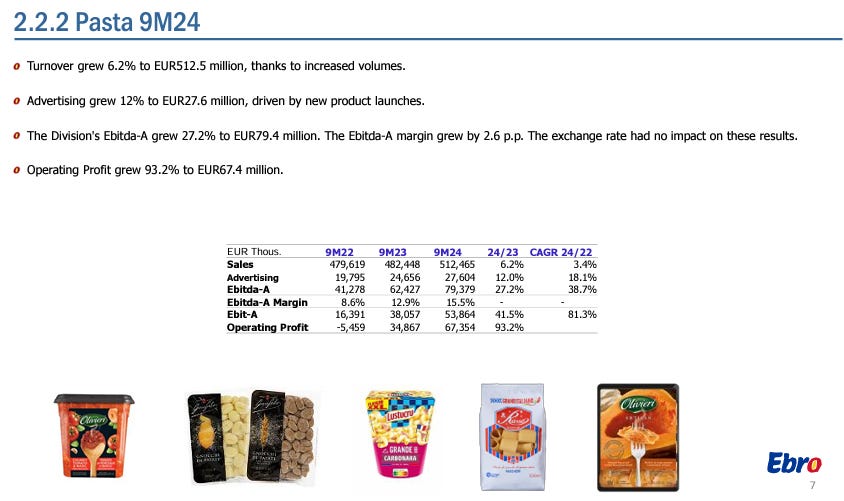

The effect of lower wheat prices on pasta margins are quite clear. Profits in the 9 months of 2024 increased 93.2% to € 67M and the EBITDA-A Margin increased from 12.9% to 15.5%. Looking further back we even see an operating loss of € 5.4M in the 9 months of 2022 when wheat prices were very high.

The steep drop in rice prices will thus likely benefit the results of Ebro Foods in the coming quarters. An increase in the margin of 2% point will increase profits with € 37 on a 9 month basis or € 49M annually. This would mean a 26% increase in profits.

So I do quite like the setup. The company is trading at 13.5 times earnings. Earnings are increasing and I think it is likely to keep doing so in the short term due to lower rice prices.

Balance sheet

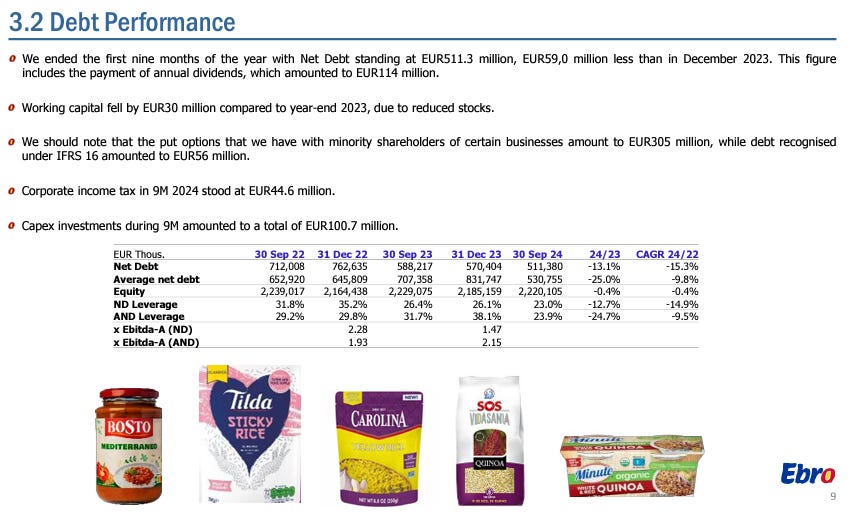

A strong balance sheet is something which is quite often underrated. Ebro Foods has €511M in net debt but the balance has been moving in the right direction. Declining from € 653M two years ago.

The debt is mostly used to finance inventory. Given the lower commodity prices it is likely that the net debt position will decrease going forward. This means that the debt levels are ok and manageable. No hidden net cash on the balance sheet though.

Quality of the business

My worries on Ebro Foods are more on the quality of the business side. Ebro Foods is a commodity processor. The brands have some value but not nearly on the level of Coca-Cola. Ebro Foods due to its size has some advantages of scale. Another positive is that the sale of rice in most developed market is not cyclical and quite price inelastic.

Future growth is limited though. I think it is quite difficult to differentiate with branding in a commodity category like rice. Not sure how much good advertising can do to differentiate rice.

The strong market position is worth something. Supermarkets have space for a limited number of brands. A plus is that selling rice is not a sexy industry. Not a market which will attract crazy competitors. Which allows Ebro Foods to keep its competitive position.

Valuation

Given the stability of the business and the competitive position I think15 times earnings is probably reasonable, while 10 times earnings feels really cheap. Given that the stock is now trading at 13.5 times earnings and earnings might improve there is clearly some upside.

Conclusion

At 13.5 times earnings Ebro Foods is clearly cheap for a food company. The company is a leader in its field and has a decent balance sheet and a fair dividend of 4%. In the short term I see a potential boost in earnings from a lower rice price. Longer term I think competition from supermarket brands might limit the upside of Ebro Foods. I think it is hard to differentiate in rice and while the company might have some advantages through scale I’m afraid that longer term there will be pressure on the margins. While interesting the stock is currently not attractively enough for me. I do like the current set up with lower rice prices providing a tailwind and will follow the company to see how the share price will develop.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Grupo nutresa might be interesting in this category also

Not sure i understand.

Is rice not a commodity?

What value adds ebro rice product to this rice input (packing /distribution?)

I guess that price ebro rice output is significantly affected and determined by price rice input, in order to compete.

Prefer indofoods anyway.