2 Quality Mexican food companies. Gruma vs Herdez

The Mexican stock exchange has quality companies with good exposure to the US. They benefit from favorable demographics & have reasonable valuations.

In part 10 of the Mexican stocks series, I cover among others 2 companies with strong brands & a reasonable valuation. This is what I like about the Mexican stock market. It is not dominated by oil/resource companies & banks. Yes there are banks & resource companies but there are large consumer facing companies as well.

Unfortunately, I found some less appealing companies as well. Those stocks I will cover briefly. Focus will be on Gruma & Herdez. Two strong food companies with better growth prospects than their developed market peers & lower valuations.

An overview:

Grupo Gigante: -

Hcity: -

Grupo Hotelero Santa Fe: -

Homex: -

Gruma: +

Herdez: +

Grupo Gigante: -

Market cap 24.5B MXN. Total assets 52.4B MXN, Equity 25.8B MXN, net debt 7.4B MXN & net income 1.9B MXN.

Grupo Gigante is a retail & restaurant company. With retail being the largest segment with 73% of revenue. Important brands are Office Depot & RadioShack de Mexico.

Valuation looks ok but not attractive. Businesses are very competitive, and those brands have performed poorly in the US. Have seen other retail brands with stronger brands and cheaper valuations in Mexico. Not at all interested. Pass

Hcity: -

Market cap 1.9B MXN. Total assets 13.8B MXN, Equity 6.1B MXN, net debt 5.1B MXN & net income 35M MXN.

Hoteles City Express is considered the leading and fastest-growing limited-service hotel chain in Mexico in terms of number of hotels, number of rooms, geographic presence, market share and revenues.

Not a fan of their limited operating profit. It looks like they are in the process of being acquired by Marriott for $100M (1.965B MXN). No premium left. Pass.

Grupo Hotelero Santa Fe: -

Market cap 2.5B MXN. Total assets 11.6B MXN, Equity 6.8B MXN, net debt 2.5B MXN & net income 593M MXN, operating income 380M MXN.

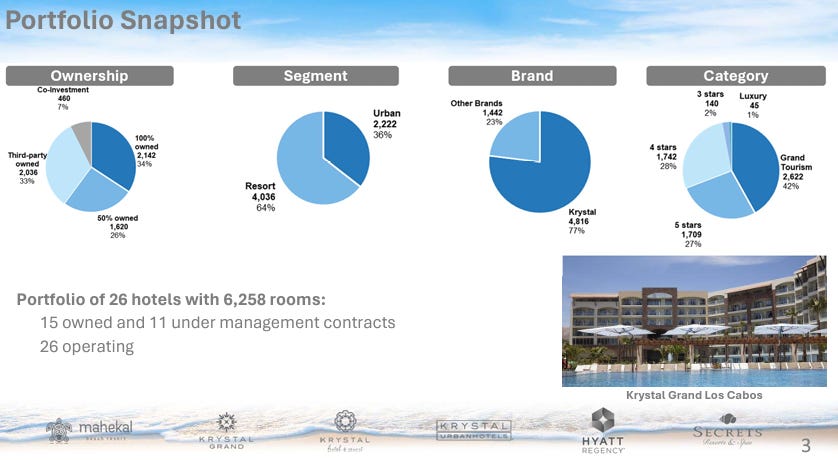

Grupo Hotelero Santa Fe is an owner and operator of 26 hotel properties.

Performance of Grupo Hotelero Santa Fe is ok. A 68% occupancy ratio in the first semester of 2024 is not great in my book. It is the best in 6 years but still I would have liked higher numbers.

Hotel operators are quite cyclical, and I am worried how the results can deteriorate in a downturn.

The main problem with these assets is the amount of competition. New hotels will compete and bring down occupancy levels.

Grupo Hotelero Santa Fe is partly responsible for all this growth. This growth is financed with a lack of shareholder distributions & issuance of new shares.

It is nice that you can buy the assets at a discount, but money is not returning to shareholders. Dilution makes longer term prospects even less appealing. Pass.

Homex: -

Mexican construction company that is struggling to stay afloat. Became the largest construction company in Mexico in 2005 after the merger with Casas Beta. Has gone bankrupt before. Interesting story in the LA Times if you are interested in Mexican construction. Its rise & its fall. Homex is in decline with the rest of the Mexican construction market. At some point the cycle for Mexican construction companies will turn. Homex is not the way to play this recovery though.

Now focus on higher quality companies.

Gruma: +

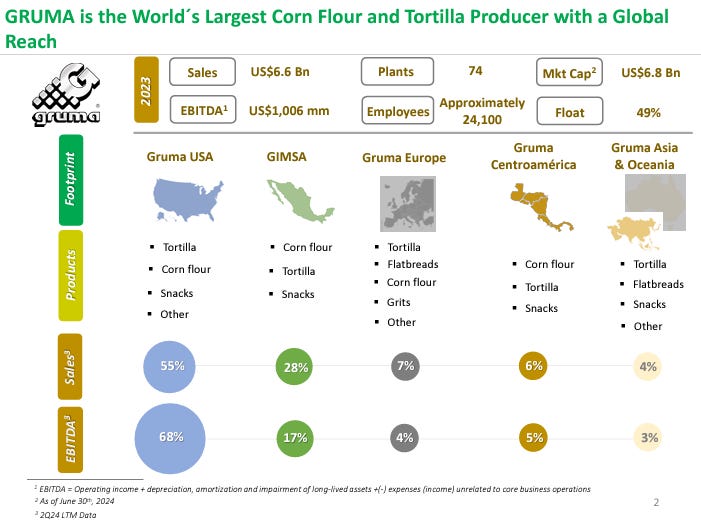

Market cap 136.8B MXN ($6.95B). Total assets $4.7B, equity $1.8B, net debt $1.2B & net income $430M.

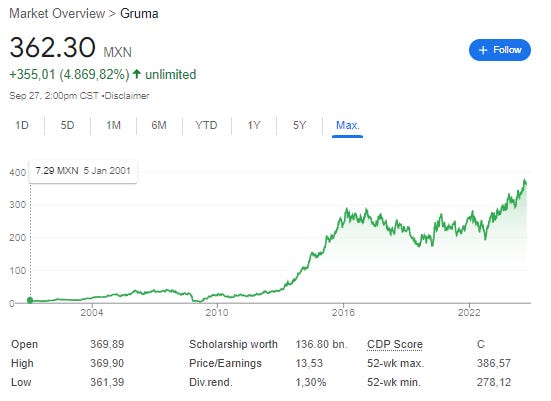

Gruma is the world leader in corn flour & tortillas. With the majority of sales & earnings coming out of the USA. Gruma has a number one market position in most markets it operates in. Given the premium valuations in the US market I find Gruma not expensive for a food company

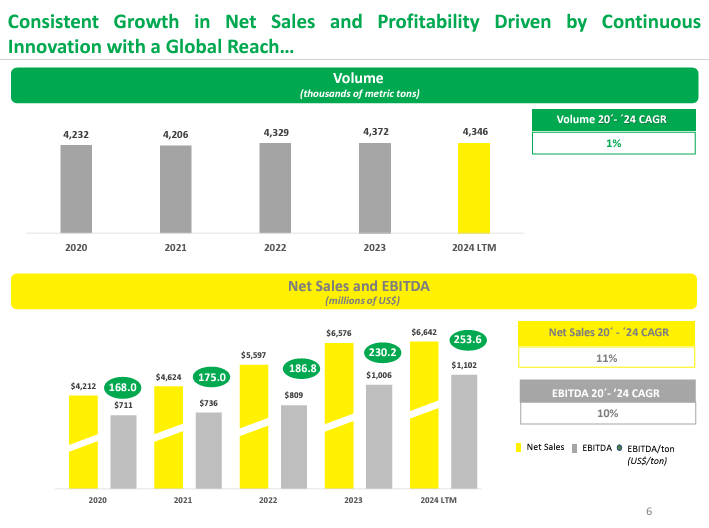

Volumes are roughly stable, but sales and earnings are clearly marching higher. Can the company keep this growth in earnings up or is this a cyclical high? Is a 7.6% margin low or high? difficult to say for me but the trend is positive.

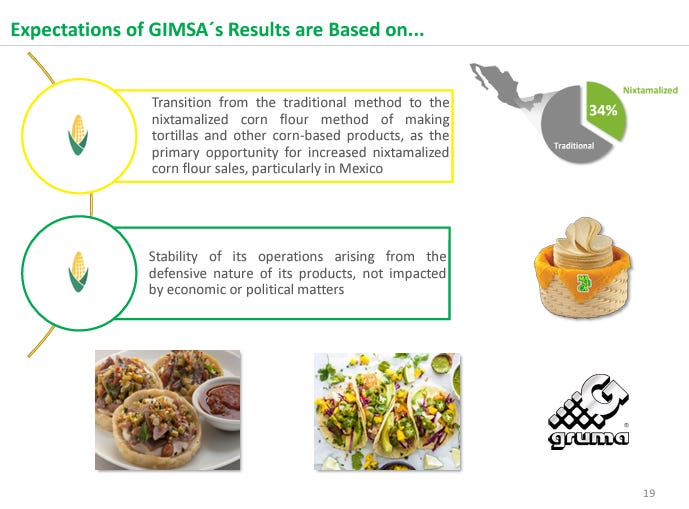

Gruma sees more growth in Mexico. In The US the company is also positive due to demographics and the growing popularity of Mexican food. Both reasonable assumptions.

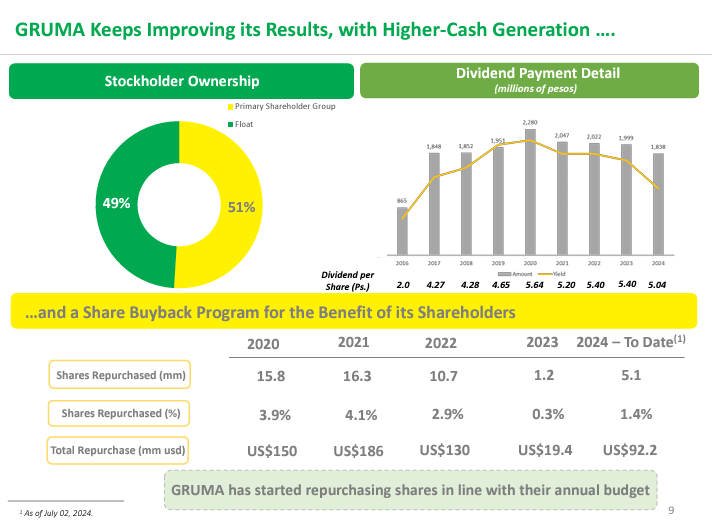

The company is controlled by the family of the founder Roberto Gonzalez Barrera. With the help of the share buyback program the family now owns over 50% of the shares.

The share buyback was not only good for the family to get control but was also smart financially. The shares in the company continue to march up. Dividend is rather low at 1.3%.

Valuation of the company is reasonable at 13.5 times earnings. The margins on the product are moving in the right direction. Volume growth is somewhat disappointing to me given the growth drivers they are talking about. The devaluation of the Mexican peso will help with the results measured in pesos. If you are confident that margins will move up this can be a great investment. Not sure though what the margins could be on tortillas but would be surprised if they would reach double digits. Interesting company to follow.

Herdez: +

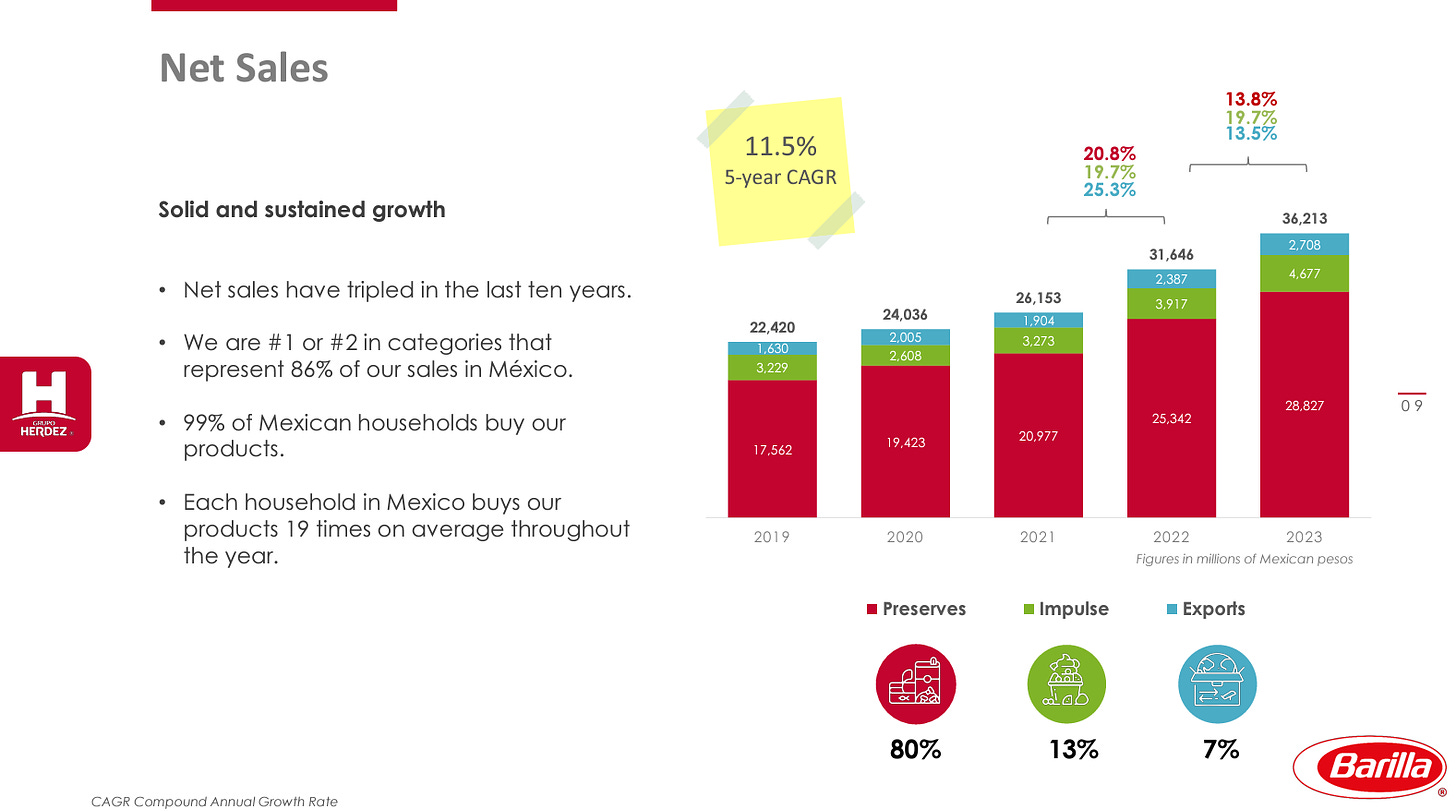

Market cap 18.2B MXN. Total assets 37.9B MXN, equity to shareholders 7.1B MXN, net debt 7.1B MXN & net income 1.3B MXN. High minority shareholdings making debt look like a problem. Debt is not a problem at only 1.2 times EBITDA. Herdez was covered in March by Alluvial Capital.

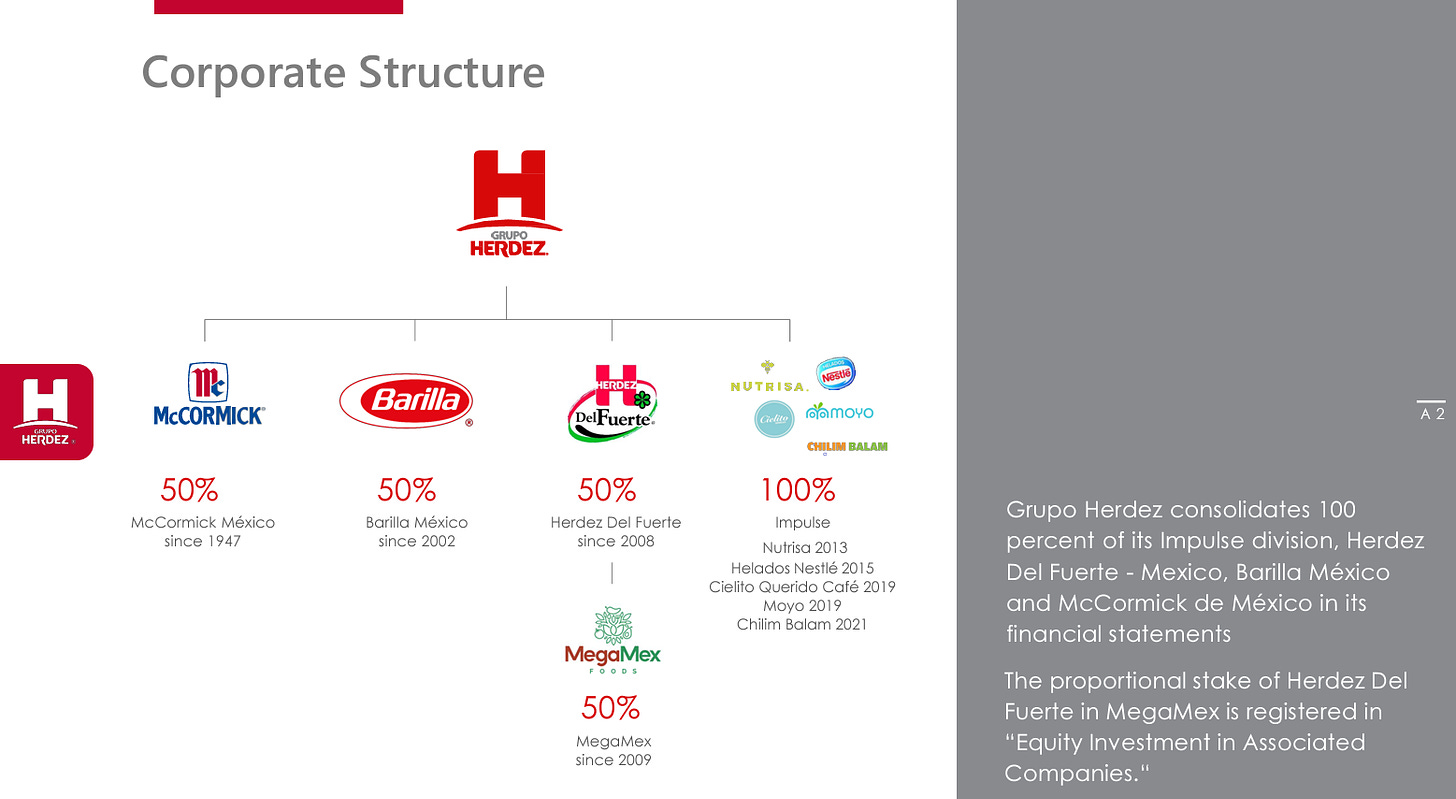

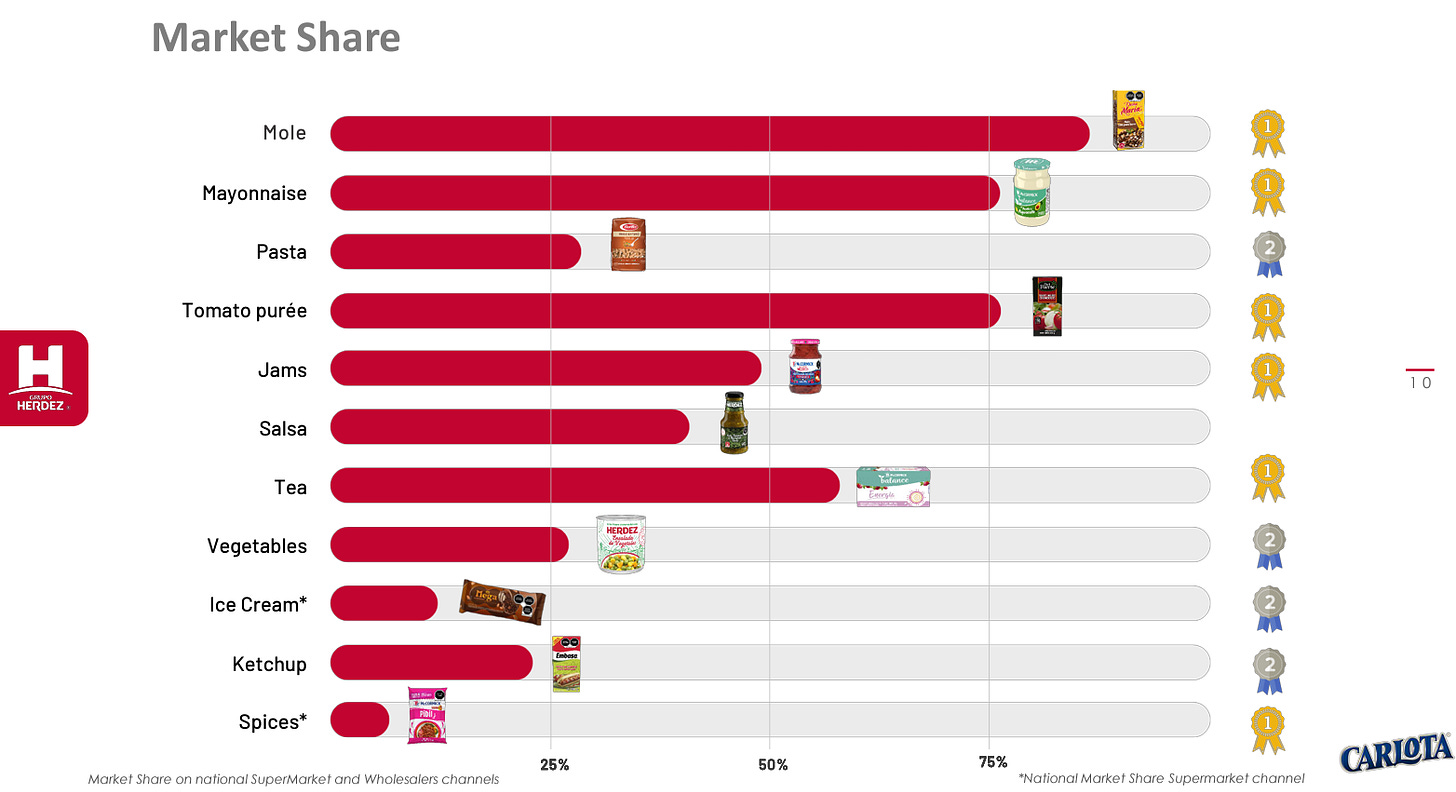

Grupo Herdez has collaborations with famous international food companies like McCormick, Hormel & Barilla. Herdez holds a dominant market share in various segments.

These strong dominant positions increase the negotiating power of Herdez in Mexico.

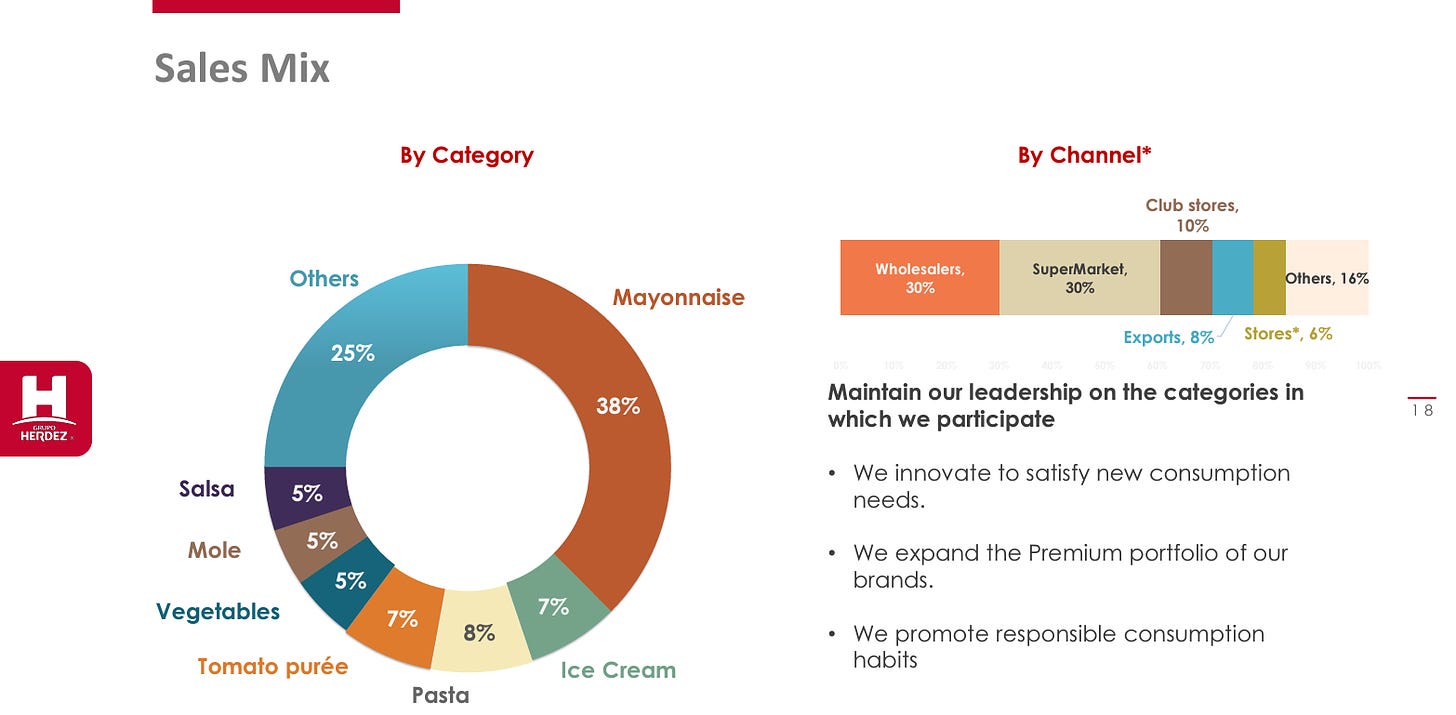

Looking at the business it becomes clear that Herdez is has a clear focus on condiments and more specifically Mayonnaise. I like these segments more than the tortillas of Gruma given that they are more differentiated, and brands play a more significant role. The downside is that many segments like vegetables, pasta & Ice Cream are very different and probably do not have too many synergies.

In the US Herdez is more focused on avocado based products. I like that Herdez has a more focused niche strategy. With potential growth in the mayonnaise segment.

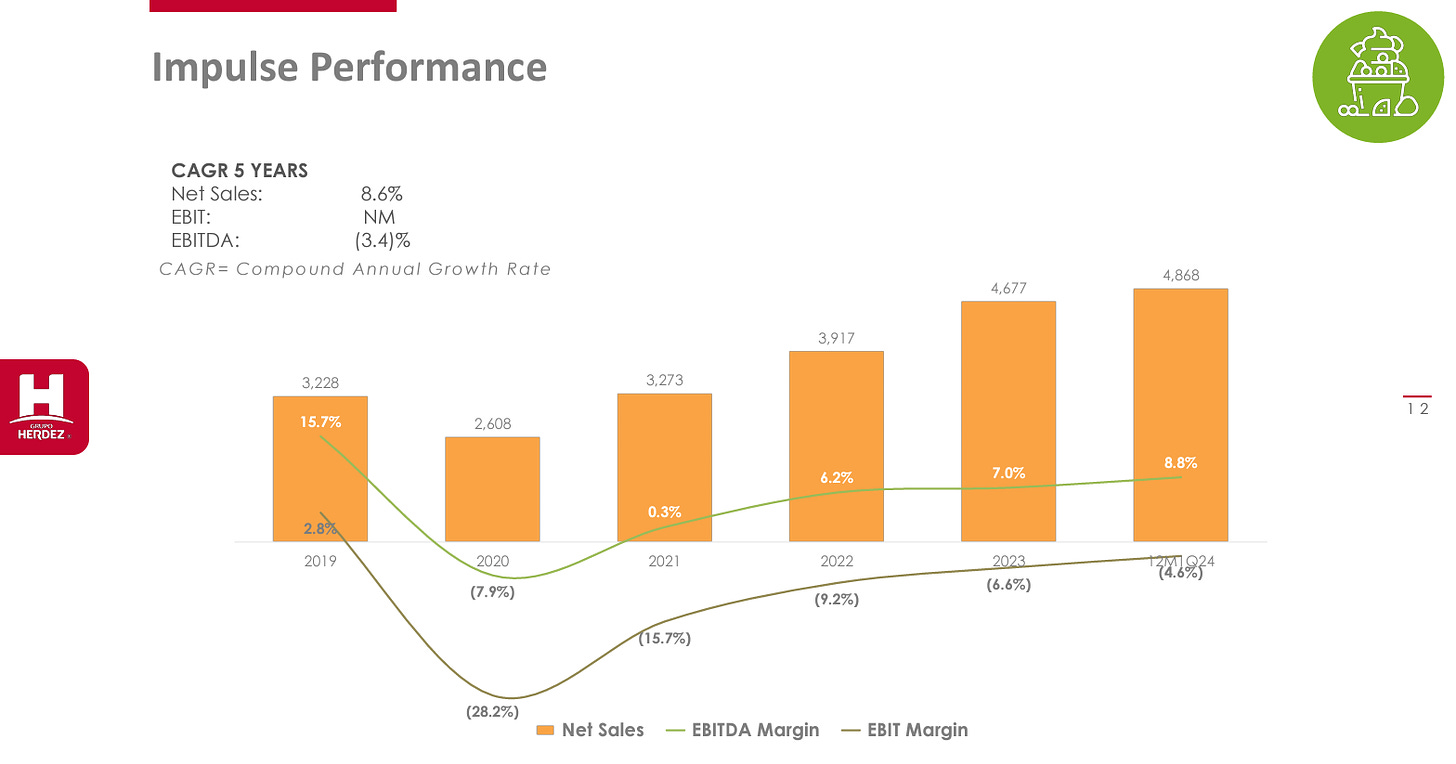

Impulse has had poor performance. Nestle Helados (25%) in Mexico is dominated in Mexico by Helados Holanda (48% market share) (owned by Unilever). Still the performance of other Impulse brands like Nutrisa is even worse. Herdez has also been active in this space acquiring more. This has been a poor strategy.

Hopefully the situation at Impulse can be turned around. This would make Herdez very attractive. Even modest additional investments in this segment do not break the investment case.

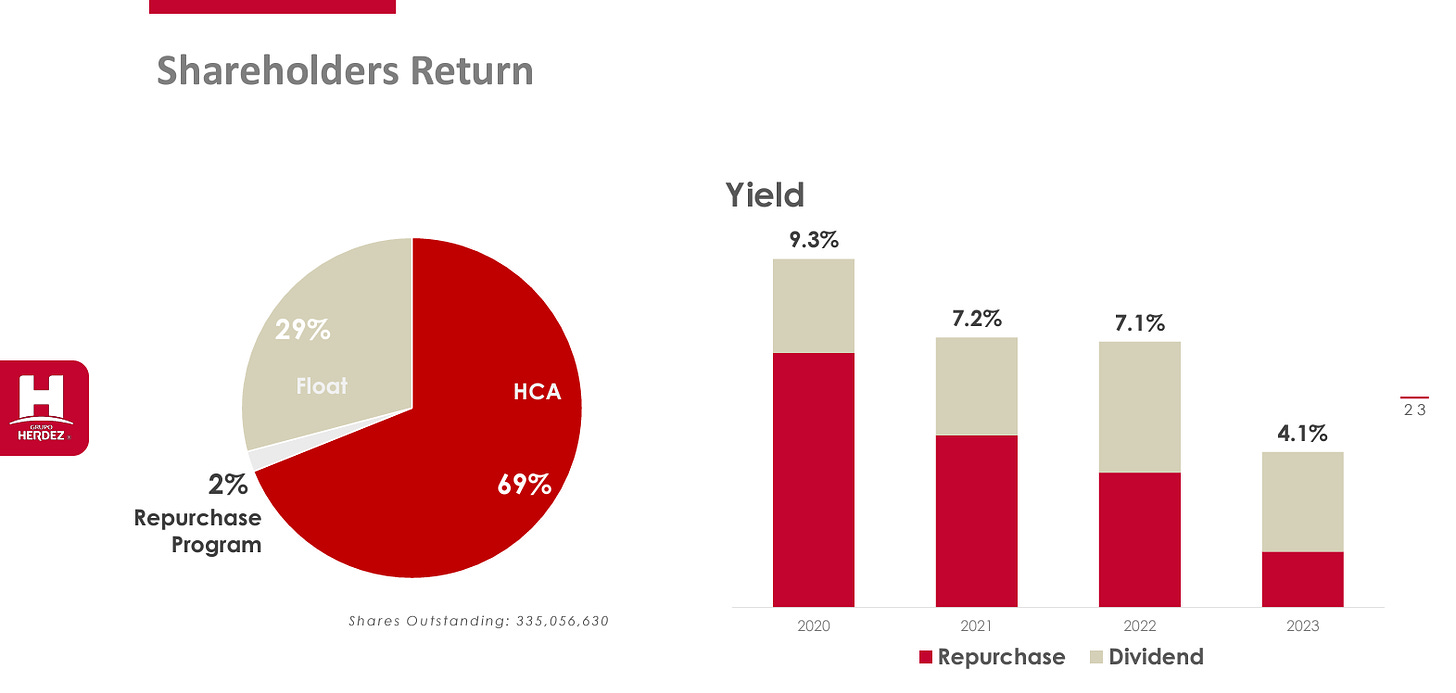

Herdez is controlled by the Hernández-Pons family. Herdez has delivered good shareholder returns & decent capital allocation. Buying shares at attractive prices. At 12.5 times earnings (LTM & 14x 2023) the share price is quite attractive to highly valued international peers like McCormick (28x), Hormel (22x) & Unilever (22x).

This is even more surprising given that growth prospects in Mexico with its rising middle class are likely to be higher than in the developed world.

Low valuation for a steady business. Mexican food in my opinion has much better growth prospects than most other food categories. Condiments is a nice sector to be focused on which have the potential for strong brands. Exposure to the US and relatively low debt levels are other positive things. A major downside are the investments in the Impulse segment. These have not been bearing fruit and it does not seem that management has learned its lesson. A turnaround in this segment can be icing on the cake but I think additional investments in this poor performing segment are more likely.

Given the low valuation and that the majority of the business and all the earnings come from great assets I find Herdez a very interesting company.

Conclusion

Mexico has quality food companies flying below the radar. The valuations on them are very reasonable considering the stability of their business and the growth prospects compared to international food companies. Favorable demographic trends plus richer Mexican consumers are helping both Gruma & Herdez. The share prices of Gruma & Herdez can also benefit from a lower interest rate environment in Mexico. Their bond like stability plus growth would be more highly valued and it would allow the companies to increase their debt position without additional interest cost.

Gruma & Herdez are both interesting. If I had to choose, I probably favor Herdez. Just because I’m more confident in the strength of condiment brands vs a tortilla manufacturer which in my view is closer to a commodity.

Disclaimer: These are my ideas and not personal investment advice. I might own shares discussed and can sell those shares at all times. I don’t know your financial situation. Do your due diligence and do not blindly follow an article on the internet.

Herdez makes this absolutely addictive "HERDEZ® Guacamole Salsa" - Mexican supermarkets and I think Wal-Mart (at least in California) sells it: https://www.youtube.com/watch?v=AIBwvMIBIvM / https://www.youtube.com/watch?v=nb1MeD-RCaM - I linked to your post in my links collection post today and the previous parts in other Monday posts...: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-14-2024